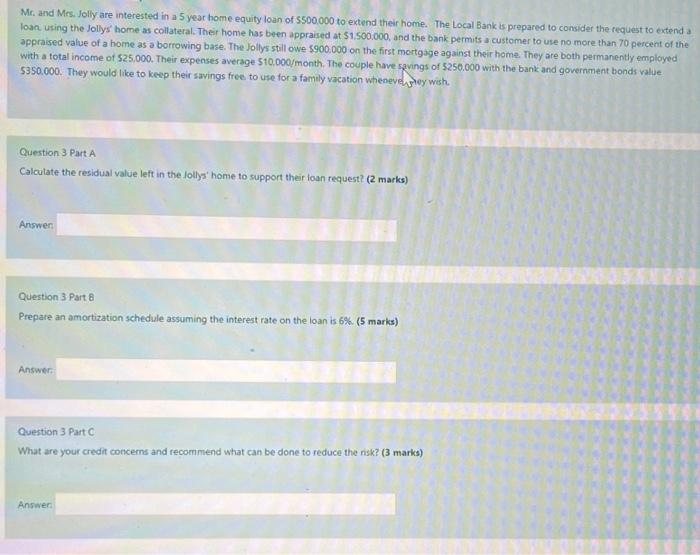

Mr. and Mrs. Jolly are interested in a 5 year home equity loan of 5500.000 to extend their home. The Local Bank is prepared to consider the request to extend a loan. using the Jollys' home as collateral. Their home has been appraised at 51.500.000, and the bank permits a customer to use no more than 70 percent of the appraised value of a home as a borrowing base. The Jollys still owe $900.000 on the first mortgage against their home. They are both permanently employed with a fotal income of 525.000. Their expenses average $10.000. month. The couple have savings of $250.000 with the bank and government bonds value $350.000. They would like to keep their savings free to use for a family vacation whenevearrey wish. Question 3 Part A Calculate the residual value left in the lollys' home to support their foan request? (2 marks) Answ Question 3 Part 8 Prepare an amortization schedule assuming the interest rate on the loan is 6% ( 5 marks) Question 3 Part C What are your credit concerns and recommend what can be done to reduce the risk? (3 marks) Mr. and Mrs. Jolly are interested in a 5 year home equity loan of 5500.000 to extend their home. The Local Bank is prepared to consider the request to extend a loan. using the Jollys' home as collateral. Their home has been appraised at 51.500.000, and the bank permits a customer to use no more than 70 percent of the appraised value of a home as a borrowing base. The Jollys still owe $900.000 on the first mortgage against their home. They are both permanently employed with a fotal income of 525.000. Their expenses average $10.000. month. The couple have savings of $250.000 with the bank and government bonds value $350.000. They would like to keep their savings free to use for a family vacation whenevearrey wish. Question 3 Part A Calculate the residual value left in the lollys' home to support their foan request? (2 marks) Answ Question 3 Part 8 Prepare an amortization schedule assuming the interest rate on the loan is 6% ( 5 marks) Question 3 Part C What are your credit concerns and recommend what can be done to reduce the risk