Question

Mr. and Mrs. Kent contacted us (the financial advice firm you work for) because they need some help with investing in fixed income. They own

Mr. and Mrs. Kent contacted us (the financial advice firm you work for) because they need some help with investing in fixed income. They own their own house; they already have equity investments, and they are considering investing $300,000 in fixed income. They tell us that they are interested in an investing horizon of about 20 years. We must respond to these questions:

1.A) Find a suitable corporate bond highest possible grade, not callable, not convertible, about 20 years maturity.

1.B) Prepare a table of cash flows for the bond you have selected, and the Kents $300,000 investing budget.

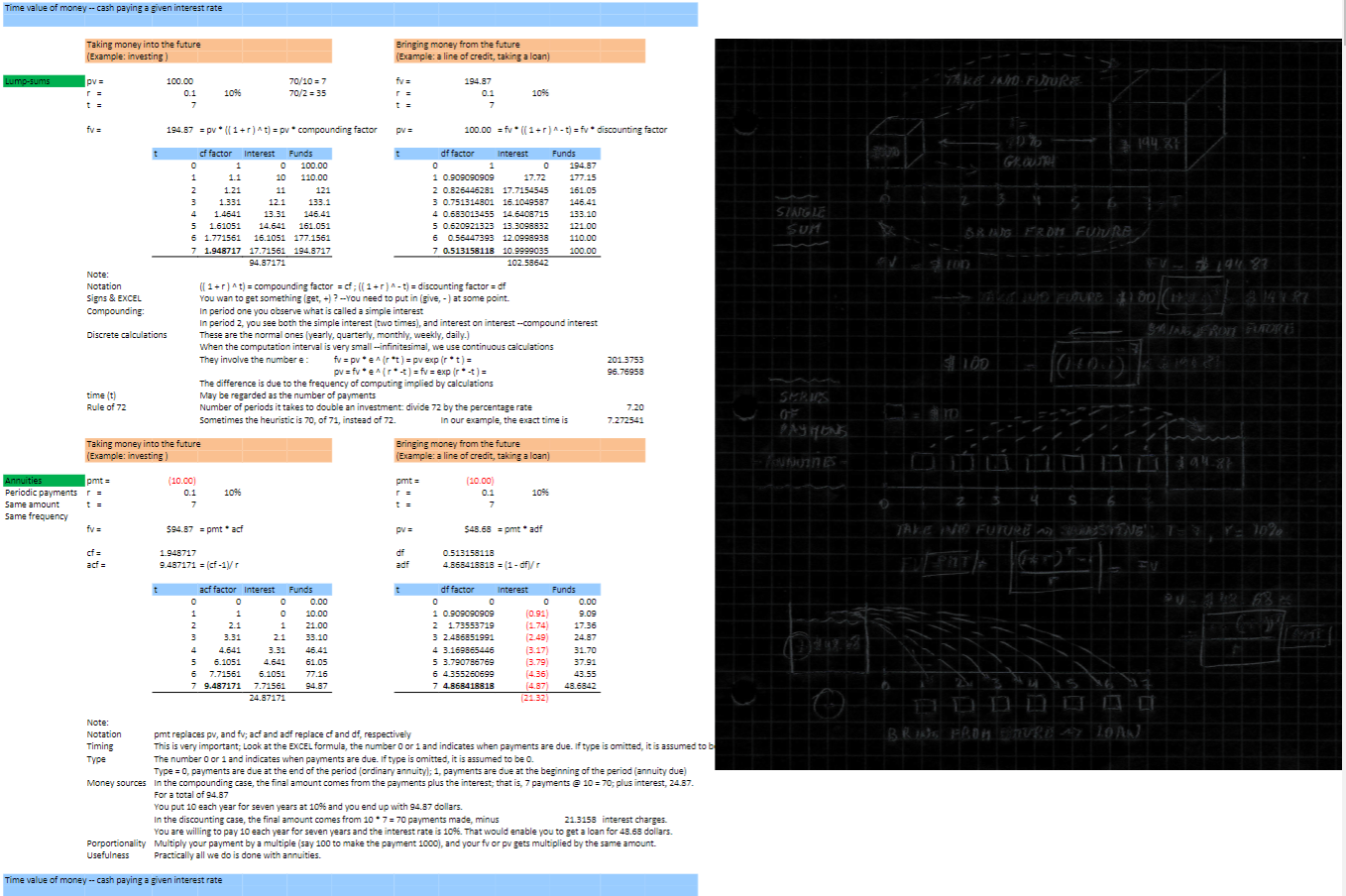

(Note 1: picture-example given. please make sure you are using the price quote properly)

3. A) Are annual cash-flows over $15,000 for the bond investment you have selected? (Hint: simply answer Yes, or No.)

B) What could we do if the cash flows were less than $15,000 per year?

C) What are the pluses and minuses of going for a high-coupon bond?

4. What about immediate annuities? Should we use the single corporate bond or the insurance annuities? We are both 65 years old. (Hint: go to immediateannuities.com, input our data, copy & paste the data in your report, and briefly explain the relevant numbers.)

Time value of money - cash paying a given interest rate Taking money into the future (Example: investing ) Lump-sums pv= r= 100.00 0.1 10% 70/10=7 t= fv= pv= 100.00 =fv((1+r)nt)=fv discounting factor Note: Notation Signs \& EXCEL Compounding: Discrete calculations time (t) Rule of 72 ([1+r]t)= compounding factor =cf;((1+r]t)= discounting factor =df You wan to get something (get, + ) ? -You need to put in (give, - ] at some point. In period one you observe what is called a simple interest In period 2, you see both the simple interest (two times), and interest on interest -compound interest These are the normal ones (yearly, quarterly, monthly, weekly, daily.) When the computation interval is very small -infinitesimal, we use continuous calculations They involve the numbere : fv=pv(rt)=pvexp(rt)= pv=fve(rt]=fv=exp(rt)= 201.3753 96.76958 The difference is due to the frequency of computing implied by calculations May be regarded as the number of payments Number of periods it takes to double an investment: divide 72 by the percentage rate 7.20 Sometimes the heuristic is 70 , of 71, instead of 72 . In our example, the exact time is 7.272541 Taking money into the future (Example: investing ) Annuities Periodic payments same amount Same frequency pmt = r= t= fv= cf = acf = (10.00) 0.110% 7 594.87=pmt acf 1. 948717 9.487171=( cf -1)/r Note: Notation pmt replaces pv, and fv; acf and adf replace of and df, respectively Timing This is very important; Look at the EXCEL formula, the number 0 or 1 and indicates when payments are due. If type is omitted, it is assumed to b Type The number 0 or 1 and indicates when payments are due. If type is omitted, it is assumed to be 0 . Type =0, payments are due at the end of the period (ordinary annuity); 1 , payments are due at the beginning of the period (annuity due) Money sources In the compounding case, the final amount comes from the payments plus the interest; that is, 7 payments @10=70; plus interest, 24.87 . For a total of 94.87 You put 10 each year for seven years at 10% and you end up with 94.87 dollars. In the discounting case, the final amount comes from 107=70 payments made, minus 21.3158 interest charges. You are willing to pay 10 each year for seven years and the interest rate is 10%. That would enable you to get a loan for 48.68 dollars. Porportionality Multiply your payment by a multiple (say 100 to make the payment 1000), and your fv or pv gets multiplied by the same amount. Usefulness Practically all we do is done with annuities. Time value of money - cash paying a given interest rate Taking money into the future (Example: investing ) Lump-sums pv= r= 100.00 0.1 10% 70/10=7 t= fv= pv= 100.00 =fv((1+r)nt)=fv discounting factor Note: Notation Signs \& EXCEL Compounding: Discrete calculations time (t) Rule of 72 ([1+r]t)= compounding factor =cf;((1+r]t)= discounting factor =df You wan to get something (get, + ) ? -You need to put in (give, - ] at some point. In period one you observe what is called a simple interest In period 2, you see both the simple interest (two times), and interest on interest -compound interest These are the normal ones (yearly, quarterly, monthly, weekly, daily.) When the computation interval is very small -infinitesimal, we use continuous calculations They involve the numbere : fv=pv(rt)=pvexp(rt)= pv=fve(rt]=fv=exp(rt)= 201.3753 96.76958 The difference is due to the frequency of computing implied by calculations May be regarded as the number of payments Number of periods it takes to double an investment: divide 72 by the percentage rate 7.20 Sometimes the heuristic is 70 , of 71, instead of 72 . In our example, the exact time is 7.272541 Taking money into the future (Example: investing ) Annuities Periodic payments same amount Same frequency pmt = r= t= fv= cf = acf = (10.00) 0.110% 7 594.87=pmt acf 1. 948717 9.487171=( cf -1)/r Note: Notation pmt replaces pv, and fv; acf and adf replace of and df, respectively Timing This is very important; Look at the EXCEL formula, the number 0 or 1 and indicates when payments are due. If type is omitted, it is assumed to b Type The number 0 or 1 and indicates when payments are due. If type is omitted, it is assumed to be 0 . Type =0, payments are due at the end of the period (ordinary annuity); 1 , payments are due at the beginning of the period (annuity due) Money sources In the compounding case, the final amount comes from the payments plus the interest; that is, 7 payments @10=70; plus interest, 24.87 . For a total of 94.87 You put 10 each year for seven years at 10% and you end up with 94.87 dollars. In the discounting case, the final amount comes from 107=70 payments made, minus 21.3158 interest charges. You are willing to pay 10 each year for seven years and the interest rate is 10%. That would enable you to get a loan for 48.68 dollars. Porportionality Multiply your payment by a multiple (say 100 to make the payment 1000), and your fv or pv gets multiplied by the same amount. Usefulness Practically all we do is done with annuitiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started