Question

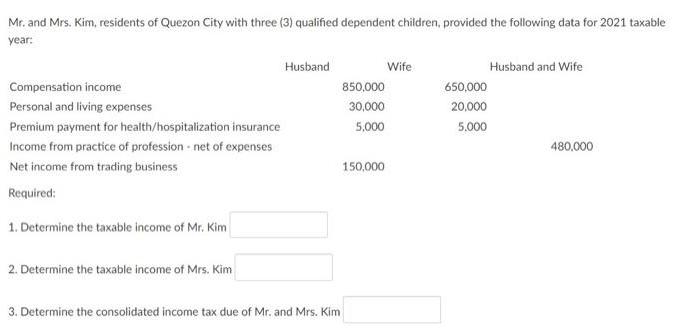

Mr. and Mrs. Kim, residents of Quezon City with three (3) qualified dependent children, provided the following data for 2021 taxable year: Compensation income

Mr. and Mrs. Kim, residents of Quezon City with three (3) qualified dependent children, provided the following data for 2021 taxable year: Compensation income Personal and living expenses Premium payment for health/hospitalization insurance Income from practice of profession-net of expenses Net income from trading business Required: 1. Determine the taxable income of Mr. Kim 2. Determine the taxable income of Mrs. Kim Husband 3. Determine the consolidated income tax due of Mr. and Mrs. Kim 850,000 30,000 5,000 150,000 Wife 650,000 20,000 5.000 Husband and Wife 480,000

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Taxable Income of Mr Kim Mr Kims taxable income is calculated as follows Compensation Income 85000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App