Answered step by step

Verified Expert Solution

Question

1 Approved Answer

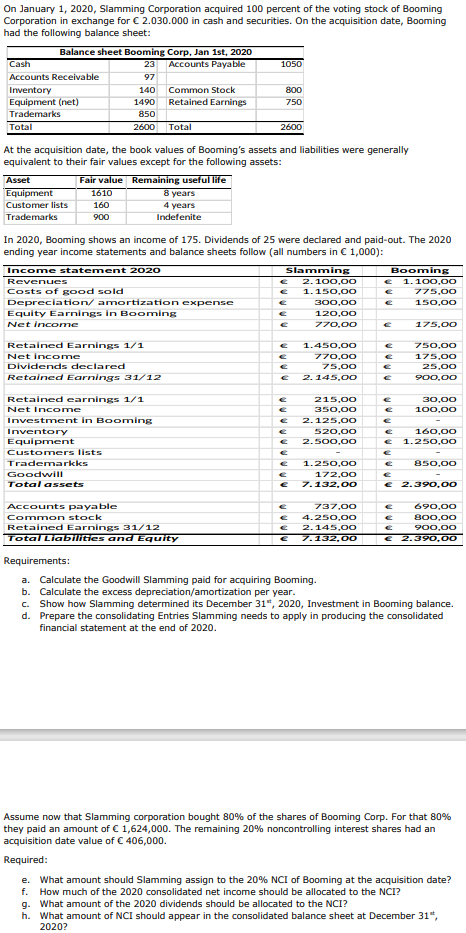

On January 1, 2020, Slamming Corporation acquired 100 percent of the voting stock of Booming Corporation in exchange for 2.030.000 in cash and securities.

On January 1, 2020, Slamming Corporation acquired 100 percent of the voting stock of Booming Corporation in exchange for 2.030.000 in cash and securities. On the acquisition date, Booming had the following balance sheet: Balance sheet Booming Corp, Jan 1st, 2020 23 Accounts Payable 97 Cash Accounts Receivable Inventory Equipment (net) Trademarks Total 140 1490 850 2600 Asset Equipment Customer lists Trademarks Income statement 2020 Revenues Common Stock Retained Earnings Total At the acquisition date, the book values of Booming's assets and liabilities were generally equivalent to their fair values except for the following assets: Fair value Remaining useful life 1610 8 years 160 4 years 900 Indefenite Retained Earnings 1/1 Net income Dividends declared Retained Earnings 31/12 Costs of good sold Depreciation/ amortization expense Equity Earnings in Booming Net income Retained earnings 1/1 Net Income Investment in Booming Inventory Equipment Customers lists Trademarkks Goodwill Total assets In 2020, Booming shows an income of 175. Dividends of 25 were declared and paid-out. The 2020 ending year income statements and balance sheets follow (all numbers in 1,000): 1050 800 750 Accounts payable Common stock Retained Earnings 31/12 Total Liabilities and Equity 2600 Slamming 2.100,00 1.150,00 300,00 120,00 770,00 Good Codeded 1.450,00 770,00 75,00 2.145,00 215,00 350,00 2.125,00 520,00 2.500,00 1.250,00 172,00 7.132,00 737,00 4.250,00 2.145,00 7.132,00 Booming 1.100,00 775,00 150,00 175,00 750,00 175,00 25,00 900,00 30,00 100,00 160,00 1.250,00 850,00 2.390,00 690,00 800,00 900,00 2.390,00 Requirements: a. Calculate the Goodwill Slamming paid for acquiring Booming. b. Calculate the excess depreciation/amortization per year. c. Show how Slamming determined its December 31, 2020, Investment in Booming balance. Prepare the consolidating Entries Slamming needs to apply in producing the consolidated financial statement at the end of 2020. d. Assume now that Slamming corporation bought 80% of the shares of Booming Corp. For that 80% they paid an amount of 1,624,000. The remaining 20% noncontrolling interest shares had an acquisition date value of 406,000. Required: e. What amount should Slamming assign to the 20% NCI of Booming at the acquisition date? f. How much of the 2020 consolidated net income should be allocated to the NCI? g. What amount of the 2020 dividends should be allocated to the NCI? h. What amount of NCI should appear in the consolidated balance sheet at December 31*, 2020?

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the Goodwill Slamming paid for acquiring Booming we need to subtract the fair value of identifiable net assets from the consideration paid Consideration paid 2030000 Fair value of ident...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started