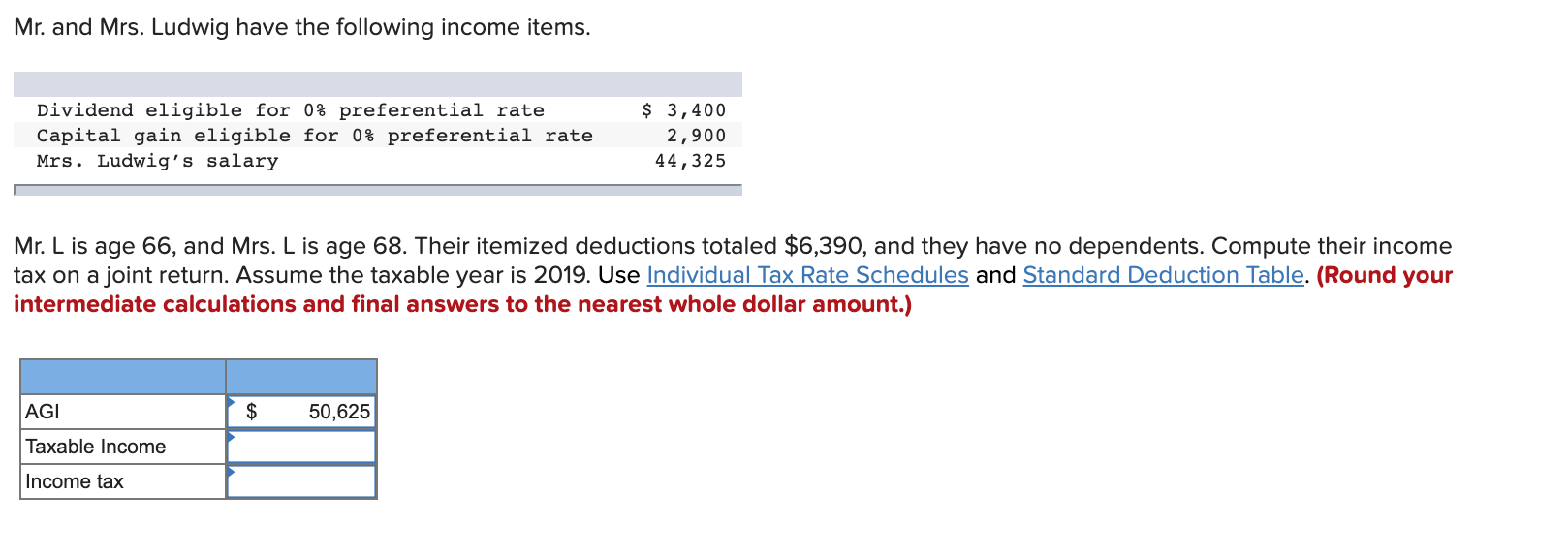

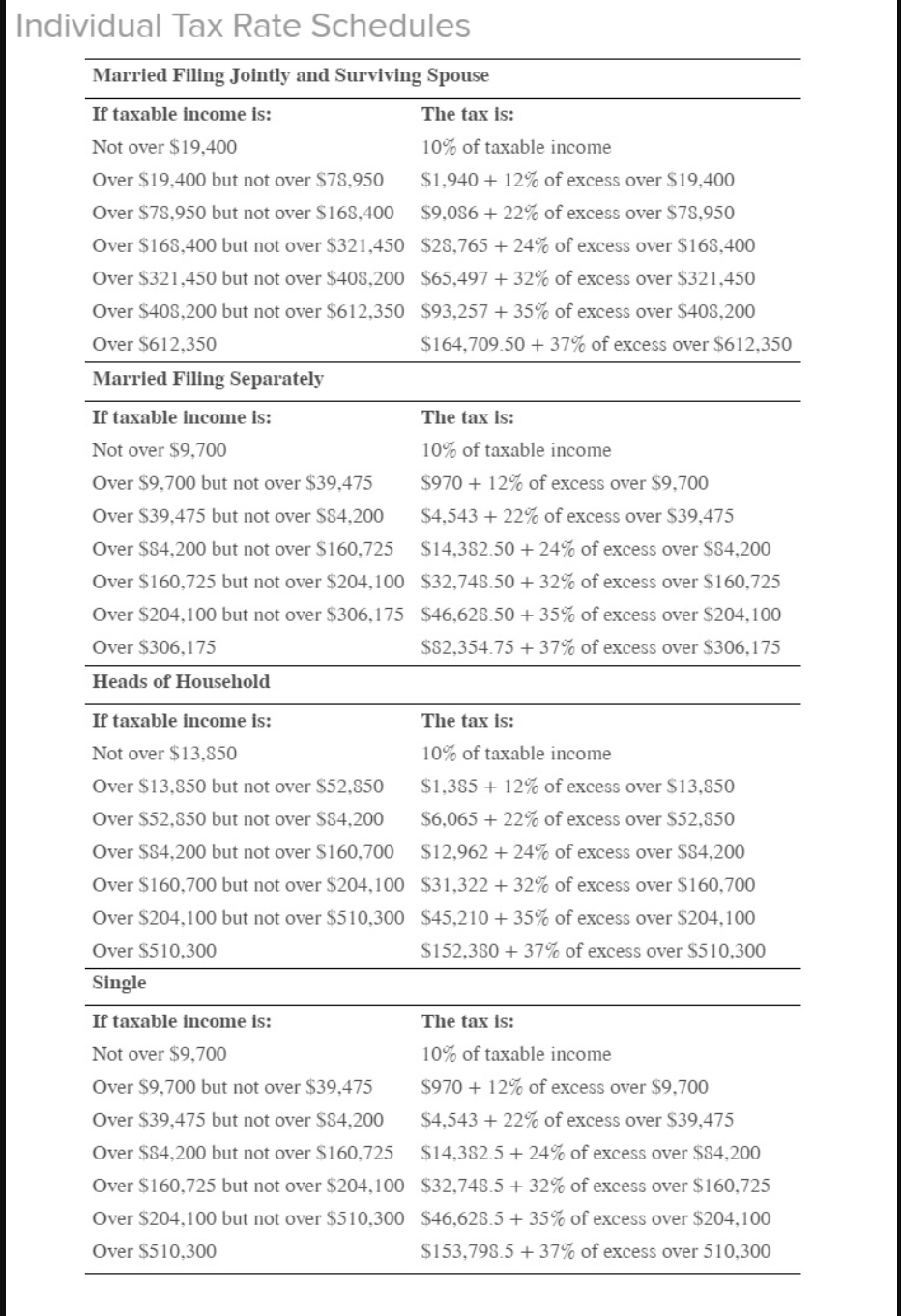

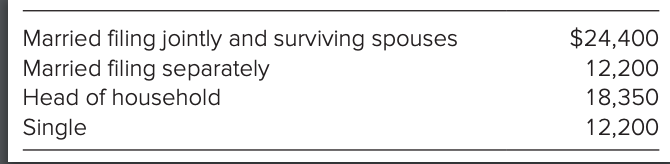

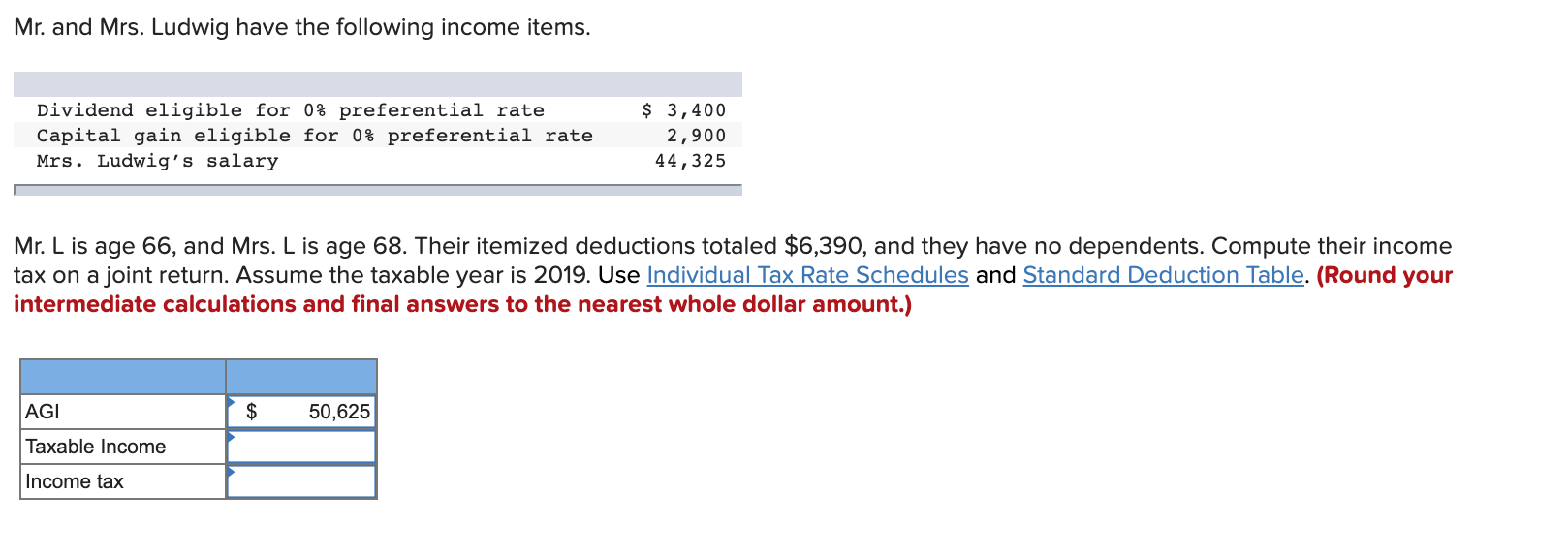

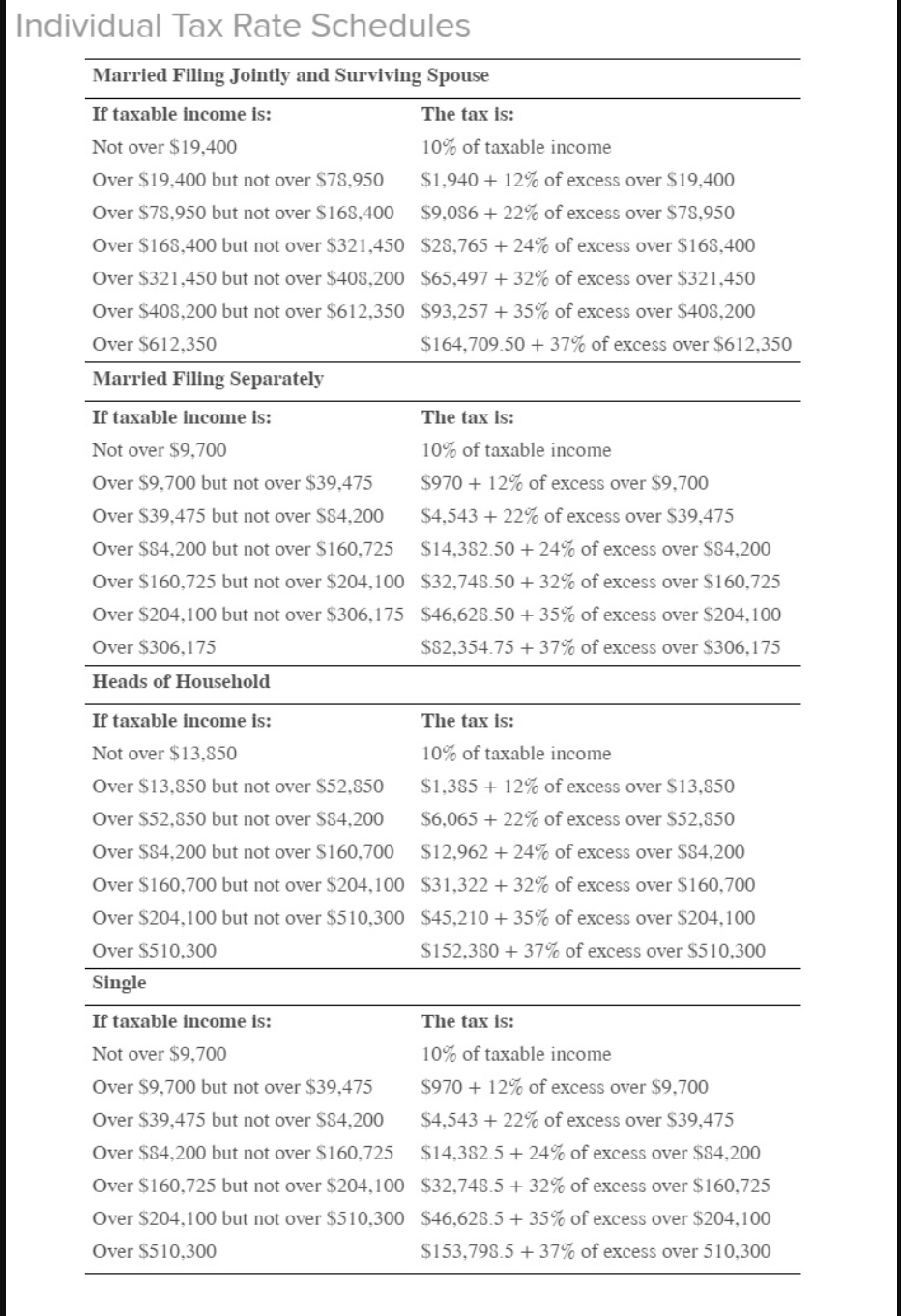

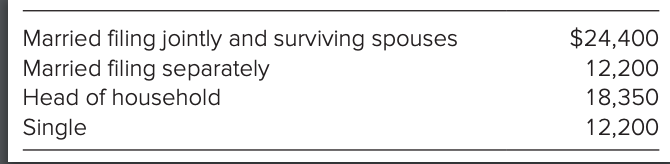

Mr. and Mrs. Ludwig have the following income items. Dividend eligible for 0% preferential rate Capital gain eligible for 0% preferential rate Mrs. Ludwig's salary $ 3,400 2,900 44,325 Mr. L is age 66, and Mrs. L is age 68. Their itemized deductions totaled $6,390, and they have no dependents. Compute their income tax on a joint return. Assume the taxable year is 2019. Use Individual Tax Rate Schedules and Standard Deduction Table. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) AGI $ 50,625 Taxable Income Income tax Individual Tax Rate Schedules Married Filing Jointly and Surviving Spouse If taxable income is: The tax is: Not over $19,400 10% of taxable income Over $19,400 but not over $78,950 $1,940 + 12% of excess over $19,400 Over $78,950 but not over $168,400 $9,086 + 22% of excess over $78,950 Over $168,400 but not over $321,450 $28,765 + 24% of excess over $168,400 Over $321,450 but not over $408,200 $65,497 + 32% of excess over $321,450 Over $408.200 but not over $612,350 $93,257 + 35% of excess over $408,200 Over $612,350 $164,709.50 + 37% of excess over $612,350 Married Filing Separately If taxable income is: The tax is: Not over $9,700 10% of taxable income Over $9,700 but not over $39,475 $970 + 12% of excess over $9,700 Over $39,475 but not over $84,200 $4,543 + 22% of excess over $39,475 Over $84,200 but not over $160,725 $14.382.50 +24% of excess over $84.200 Over $160,725 but not over $204,100 $32,748.50 + 32% of excess over $160,725 Over $204,100 but not over $306,175 $46,628.50 + 35% of excess over $204,100 Over $306,175 $82,354.75 + 37% of excess over $306,175 Heads of Household If taxable income is: The tax is: Not over $13,850 10% of taxable income Over $13,850 but not over $52,850 $1,385 + 12% of excess over $13,850 Over $52,850 but not over $84,200 $6,065 + 22% of excess over $52,850 Over $84,200 but not over $160,700 $12,962 +24% of excess over $84,200 Over $160,700 but not over $204,100 $31,322 + 32% of excess over $160,700 Over $204,100 but not over $510,300 $45,210 + 35% of excess over $204,100 Over $510,300 $152,380 + 37% of excess over $510,300 Single If taxable income is: The tax is: Not over $9,700 10% of taxable income Over $9,700 but not over $39,475 $970 + 12% of excess over $9.700 Over $39,475 but not over $84,200 $4,543 + 22% of excess over $39,475 Over $84.200 but not over $160,725 $14,382.5 + 24% of excess over $54,200 Over $160,725 but not over $204,100 $32,748.5+ 32% of excess over $160,725 Over $204,100 but not over $510,300 $46,628.5 + 35% of excess over $204,100 Over $510,300 $153,798.5 + 37% of excess over 510,300 Married filing jointly and surviving spouses Married filing separately Head of household Single $24,400 12,200 18,350 12,200