Answered step by step

Verified Expert Solution

Question

1 Approved Answer

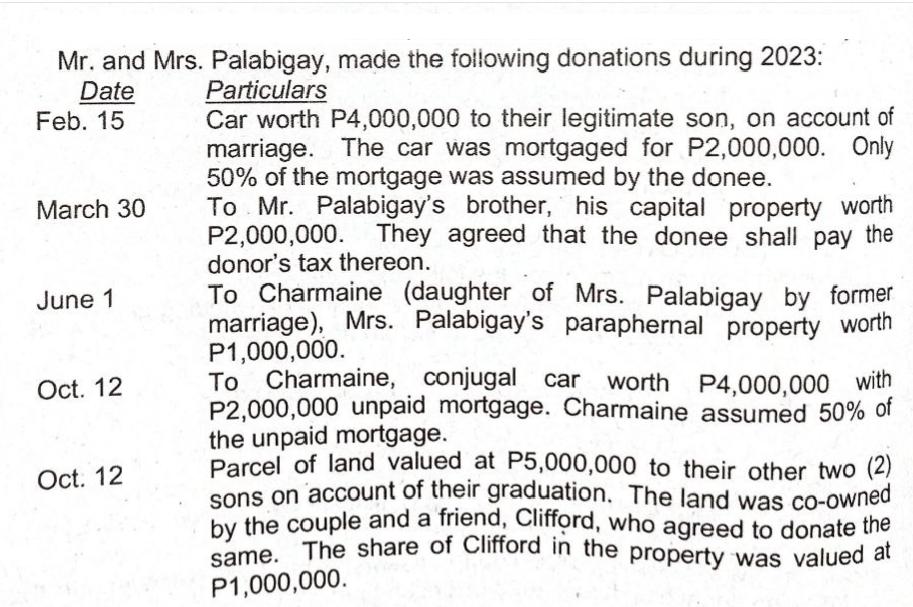

Mr. and Mrs. Palabigay, made the following donations during 2023: Date Particulars Feb. 15 March 30 June 1 Oct. 12 Oct. 12 Car worth

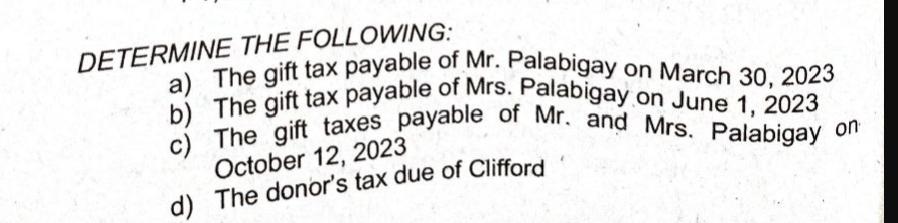

Mr. and Mrs. Palabigay, made the following donations during 2023: Date Particulars Feb. 15 March 30 June 1 Oct. 12 Oct. 12 Car worth P4,000,000 to their legitimate son, on account of marriage. The car was mortgaged for P2,000,000. Only 50% of the mortgage was assumed by the donee. To Mr. Palabigay's brother, his capital property worth P2,000,000. They agreed that the donee shall pay the donor's tax thereon. To Charmaine (daughter of Mrs. Palabigay by former marriage), Mrs. Palabigay's paraphernal property worth P1,000,000. To Charmaine, conjugal car car worth worth P4,000,000 with P2,000,000 unpaid mortgage. Charmaine assumed 50% of the unpaid mortgage. Parcel of land valued at P5,000,000 to their other two (2) sons on account of their graduation. The land was co-owned by the couple and a friend, Clifford, who agreed to donate the same. The share of Clifford in the property was valued at P1,000,000. DETERMINE THE FOLLOWING: a) The gift tax payable of Mr. Palabigay on March 30, 2023 b) The gift tax payable of Mrs. Palabigay on June 1, 2023 The gift taxes payable of Mr. and Mrs. Palabigay on c) October 12, 2023 The donor's tax due of Clifford d)

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Gift Tax Calculations for Mr and Mrs Palabigay and Clifford a Gift tax payable by Mr Palabigay on March 30 2023 Net taxable gift P2000000 original pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started