Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr and Mrs . Peter and Carol O'Connor are clients at the tax firm where you are employed. The partner you report to has asked

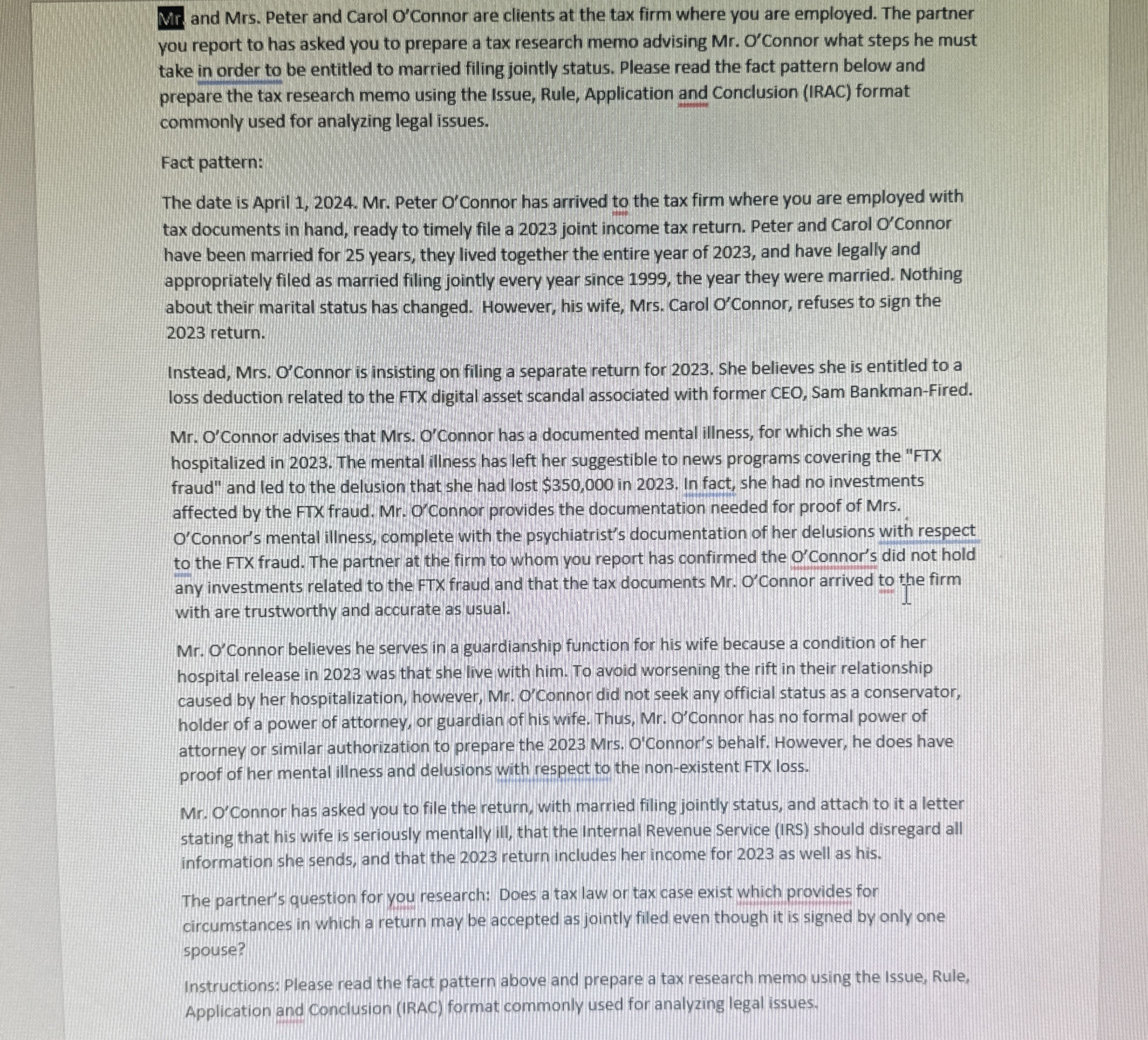

Mr and Mrs Peter and Carol O'Connor are clients at the tax firm where you are employed. The partner you report to has asked you to prepare a tax research memo advising Mr O'Connor what steps he must take in order to be entitled to married filing jointly status. Please read the fact pattern below and prepare the tax research memo using the Issue, Rule, Application and Conclusion IRAC format commonly used for analyzing legal issues.

Fact pattern:

The date is April Mr Peter O'Connor has arrived to the tax firm where you are employed with tax documents in hand, ready to timely file a joint income tax return. Peter and Carol O'Connor have been married for years, they lived together the entire year of and have legally and appropriately filed as married filing jointly every year since the year they were married. Nothing about their marital status has changed. However, his wife, Mrs Carol O'Connor, refuses to sign the return.

Instead, Mrs O Connor is insisting on filing a separate return for She believes she is entitled to a loss deduction related to the FTX digital asset scandal associated with former CEO, Sam BankmanFired.

Mr O'Connor advises that Mrs O'Connor has a documented mental illness, for which she was hospitalized in The mental illness has left her suggestible to news programs covering the FTX fraud" and led to the delusion that she had lost $ in In fact, she had no investments affected by the FTX fraud. Mr O'Connor provides the documentation needed for proof of Mrs O'Connor's mental illness, complete with the psychiatrist's documentation of her delusions with respect to the FTX fraud. The partner at the firm to whom you report has confirmed the O'Connor's did not hold any investments related to the FTX fraud and that the tax documents Mr O'Connor arrived to the firm with are trustworthy and accurate as usual.

Mr O'Connor believes he serves in a guardianship function for his wife because a condition of her hospital release in was that she live with him. To avoid worsening the rift in their relationship caused by her hospitalization, however, Mr O'Connor did not seek any official status as a conservator, holder of a power of attorney, or guardian of his wife. Thus, Mr O'Connor has no formal power of attorney or similar authorization to prepare the Mrs O'Connor's behalf. However, he does have proof of her mental illness and delusions with respect to the nonexistent FTX loss.

Mr O'Connor has asked you to file the return, with married filing jointly status, and attach to it a letter stating that his wife is seriously mentally ill, that the Internal Revenue Service IRS should disregard all information she sends, and that the return includes her income for as well as his.

The partner's question for you research: Does a tax law or tax case exist which provides for circumstances in which a return may be accepted as jointly filed even though it is signed by only one spouse?

Instructions: Please read the fact pattern above and prepare a tax research memo using the issue, Rule, Application and Conclusion IRAC format commonly used for analyzing legal issue. How to write a tax memo for this need this done by today

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started