Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. and Mrs. Ruiz operate a hardware store in a jurisdiction that levies both a sales tax on retail sales of tangible personalty and an

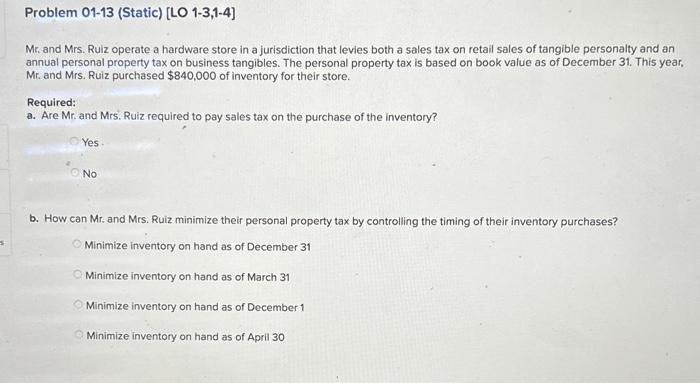

Mr. and Mrs. Ruiz operate a hardware store in a jurisdiction that levies both a sales tax on retail sales of tangible personalty and an annual personal property tax on business tangibles. The personal property tax is based on book value as of December 31 . This year, Mr. and Mrs. Ruiz purchased $840,000 of inventory for their store. Required: a. Are Mr. and Mrs. Ruiz required to pay sales tax on the purchase of the inventory? Yes. No b. How can Mr. and Mrs. Ruiz minimize their personal property tax by controlling the timing of their inventory purchases? Minimize inventory on hand as of December 31 Minimize inventory on hand as of March 31 Minimize inventory on hand as of December 1 Minimize inventory on hand as of April 30

Mr. and Mrs. Ruiz operate a hardware store in a jurisdiction that levies both a sales tax on retail sales of tangible personalty and an annual personal property tax on business tangibles. The personal property tax is based on book value as of December 31 . This year, Mr. and Mrs. Ruiz purchased $840,000 of inventory for their store. Required: a. Are Mr. and Mrs. Ruiz required to pay sales tax on the purchase of the inventory? Yes. No b. How can Mr. and Mrs. Ruiz minimize their personal property tax by controlling the timing of their inventory purchases? Minimize inventory on hand as of December 31 Minimize inventory on hand as of March 31 Minimize inventory on hand as of December 1 Minimize inventory on hand as of April 30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started