Answered step by step

Verified Expert Solution

Question

1 Approved Answer

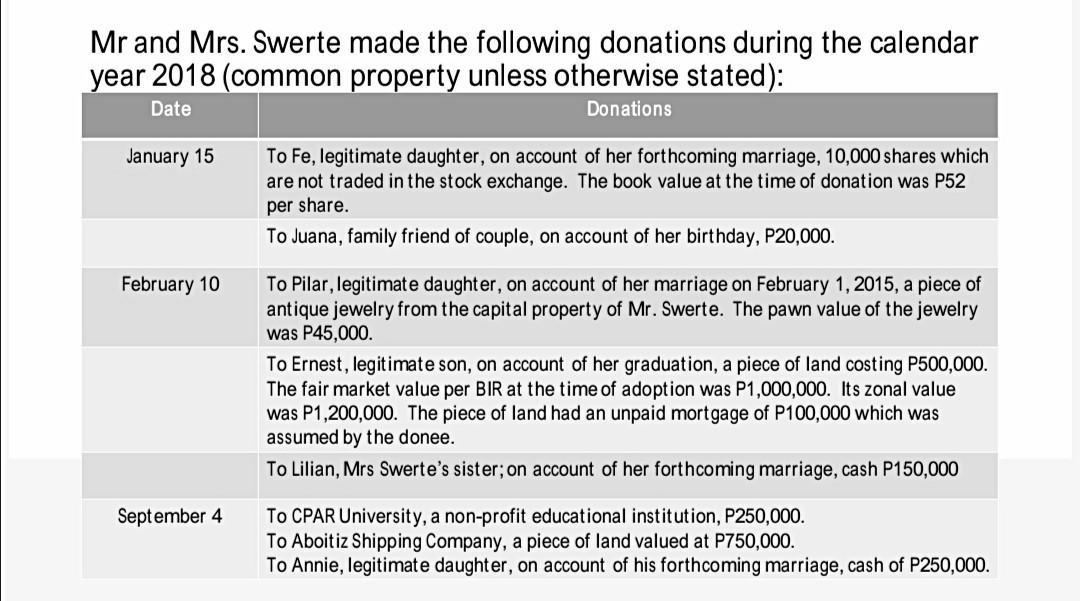

Mr and Mrs. Swerte made the following donations during the calendar year 2018 (common property unless otherwise stated): Date Donations January 15 February 10

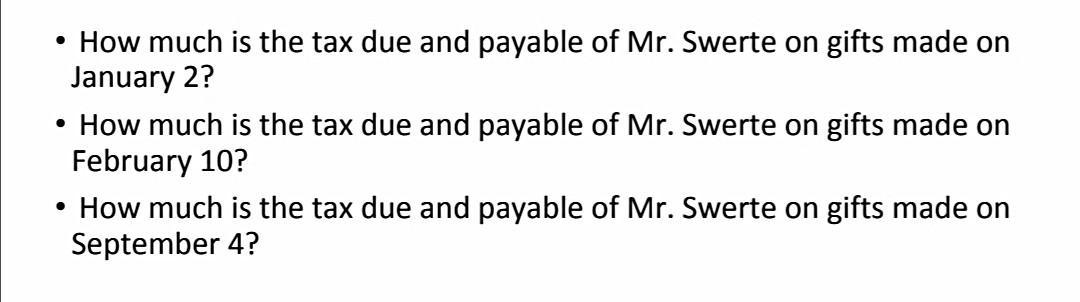

Mr and Mrs. Swerte made the following donations during the calendar year 2018 (common property unless otherwise stated): Date Donations January 15 February 10 September 4 To Fe, legitimate daughter, on account of her forthcoming marriage, 10,000 shares which are not traded in the stock exchange. The book value at the time of donation was P52 per share. To Juana, family friend of couple, on account of her birthday, P20,000. To Pilar, legitimate daughter, on account of her marriage on February 1, 2015, a piece of antique jewelry from the capital property of Mr. Swerte. The pawn value of the jewelry was P45,000. To Ernest, legitimate son, on account of her graduation, a piece of land costing P500,000. The fair market value per BIR at the time of adoption was P1,000,000. Its zonal value was P1,200,000. The piece of land had an unpaid mortgage of P100,000 which was assumed by the donee. To Lilian, Mrs Swerte's sister; on account of her forthcoming marriage, cash P150,000 To CPAR University, a non-profit educational institution, P250,000. To Aboitiz Shipping Company, a piece of land valued at P750,000. To Annie, legitimate daughter, on account of his forthcoming marriage, cash of P250,000. How much is the tax due and payable of Mr. Swerte on gifts made on January 2? How much is the tax due and payable of Mr. Swerte on gifts made on February 10? How much is the tax due and payable of Mr. Swerte on gifts made on September 4?

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

To determine the tax due and payable on the gifts made by Mr Swerte we need to consider the applicable tax rules and rates for gift taxes in the Philippines the following rules and rates apply 1 Donat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started