Answered step by step

Verified Expert Solution

Question

1 Approved Answer

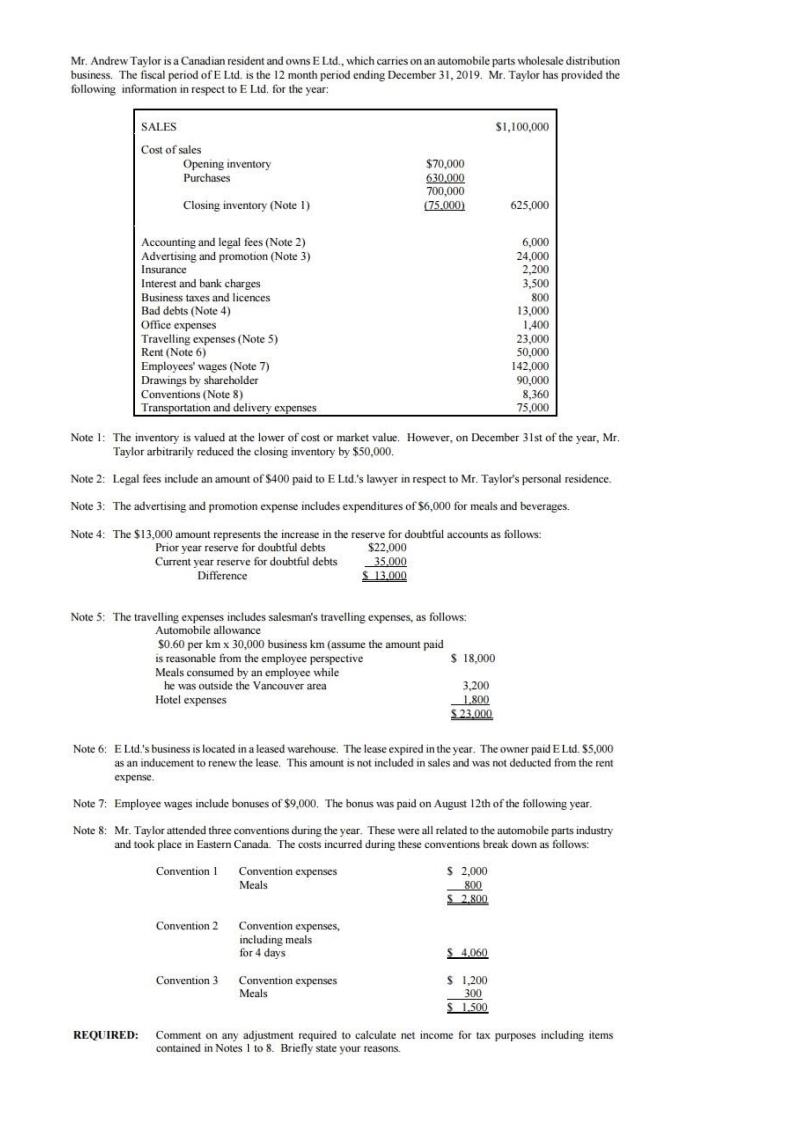

Mr. Andrew Taylor is a Canadian resident and owns E Ltd., which carries on an automobile parts wholesale distribution business. The fiscal period of

Mr. Andrew Taylor is a Canadian resident and owns E Ltd., which carries on an automobile parts wholesale distribution business. The fiscal period of E Ltd. is the 12 month period ending December 31, 2019. Mr. Taylor has provided the following information in respect to E Ltd. for the year: SALES Cost of sales Opening inventory Purchases Closing inventory (Note 1) Accounting and legal fees (Note 2) Advertising and promotion (Note 3) Insurance REQUIRED: Interest and bank charges Business taxes and licences Bad debts (Note 4) Office expenses Travelling expenses (Note 5) Rent (Note 6) Employees' wages (Note 7) Drawings by shareholder Conventions (Note 8) Transportation and delivery expenses Note 5: The travelling expenses includes salesman's travelling expenses, as follows: Automobile allowance i $70,000 630.000 700,000 (75.000) Note 1: The inventory is valued at the lower of cost or market value. However, on December 31st of the year, Mr. Taylor arbitrarily reduced the closing inventory by $50,000. Note 2: Legal fees include an amount of $400 paid to E Ltd.'s lawyer in respect to Mr. Taylor's personal residence. Note 3: The advertising and promotion expense includes expenditures of $6,000 for meals and beverages. Note 4: The $13,000 amount represents the increase in the reserve for doubtful accounts as follows: Prior year reserve for doubtful debts Current year reserve for doubtful debts $22,000 35,000 $13.000 Difference $0.60 per km x 30,000 business km (assume the amount paid is reasonable from the employee perspective Meals consumed by an employee while he was outside the Vancouver area Hotel expenses Convention 1 Convention expenses Meals. Convention 2 Convention expenses, including meals for 4 days Convention 3 Convention expenses Meals $ 18,000 3,200 1.800 $23.000 Note 6: ELtd.'s business is located in a leased warehouse. The lease expired in the year. The owner paid E Ltd. $5,000 as an inducement to renew the lease. This amount is not included in sales and was not deducted from the rent expense. Note 7: Employee wages include bonuses of $9,000. The bonus was paid on August 12th of the following year. Note 8: Mr. Taylor attended three conventions during the year. These were all related to the automobile parts industry and took place in Eastern Canada. The costs incurred during these conventions break down as follows: $1,100,000 $ 2,000 800 $ 2.800 $ 4,060 625,000 $ 1,200 300 $ 1.500 6,000 24,000 2,200 3,500 800 13,000 1,400 23.000 50,000 142,000 90,000 8,360 75,000 Comment on any adjustment required to calculate net income for tax purposes including items contained in Notes 1 to 8. Briefly state your reasons.

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Profit Loss Statement of E Ltd for year ended 31122019 Less A Less B PARTICULARS Sales Cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started