Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Antonio Mitras, a citizen and resident of the Philippines, died on January 1, 2018. He was married and the property relationship during the

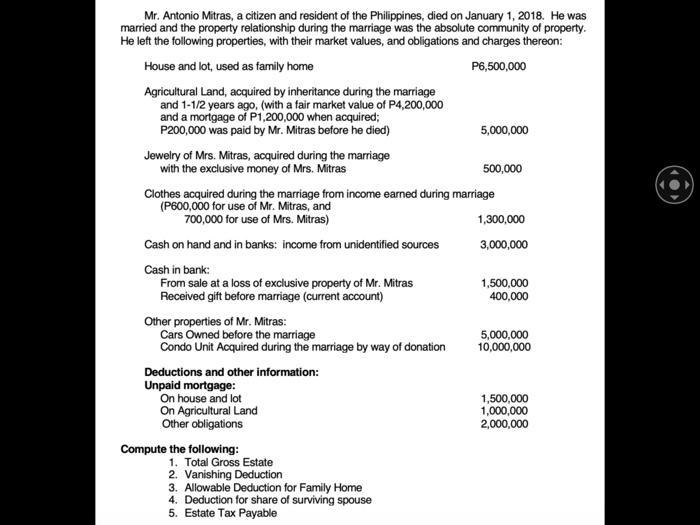

Mr. Antonio Mitras, a citizen and resident of the Philippines, died on January 1, 2018. He was married and the property relationship during the marriage was the absolute community of property. He left the following properties, with their market values, and obligations and charges thereon: House and lot, used as family home P6,500,000 Agricultural Land, acquired by inheritance during the marriage and 1-1/2 years ago, (with a fair market value of P4,200,000 and a mortgage of P1,200,000 when acquired; P200,000 was paid by Mr. Mitras before he died) 5,000,000 Jewelry of Mrs. Mitras, acquired during the marriage with the exclusive money of Mrs. Mitras 500,000 Clothes acquired during the marriage from income earned during marriage (P600,000 for use of Mr. Mitras, and 700,000 for use of Mrs. Mitras) 1,300,000 Cash on hand and in banks: income from unidentified sources 3,000,000 Cash in bank: 1,500,000 From sale at a loss of exclusive property of Mr. Mitras Received gift before marriage (current account) 400,000 Other properties of Mr. Mitras: Cars Owned before the marriage Condo Unit Acquired during the marriage by way of donation 5,000,000 10,000,000 Deductions and other information: Unpaid mortgage: 1,500,000 On house and lot On Agricultural Land Other obligations 1,000,000 2,000,000 Compute the following: 1. Total Gross Estate 2. Vanishing Deduction 3. Allowable Deduction for Family Home 4. Deduction for share of surviving spouse 5. Estate Tax Payable

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ANSWERS 1 Total Gross Estate P6500000 P4200000 P1300000 P3000000 P1500000 P400000 P5000000 P10000000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started