Assume the same information as in Exercise 2-5 except that instead of paying a cash earnout, Pritano

Question:

Assume the same information as in Exercise 2-5 except that instead of paying a cash earnout, Pritano Company agreed to issue 10,000 additional shares of its $10 par value common stock to the stockholders of Succo if the average post- combination earnings over the next three years equaled or exceeded $2,500,000. The fair value of the contingent consideration on the date of acquisition was estimated to be $200,000. The contingent consideration (earnout) was classified as equity rather than as a liability.

Data from in Exercise 2-5

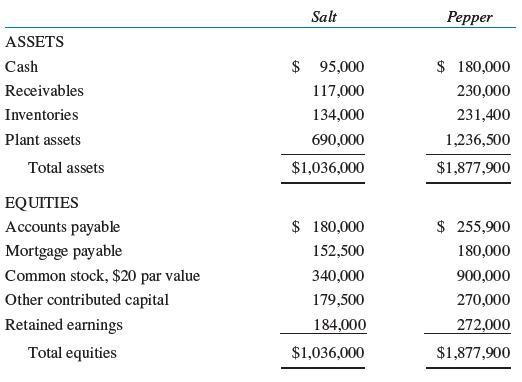

Balance sheets for Salt Company and Pepper Company on December 31, 2023, follow:

Pepper Company tentatively plans to issue 30,000 shares of its $20 par value stock, which has a current market value of $37 per share net of commissions and other issue costs. Pepper Company then plans to acquire the assets and assume the liabilities of Salt Company for a cash payment of $800,000 and $300,000 in long-term 8% notes payable. Pepper Company’s receivables include $60,000 owed by Salt Company. Pepper Company is willing to pay more than the book value of Salt Company assets because plant assets are undervalued by $215,000 and Salt Company has historically earned above- normal profits.

Required:

A. Prepare the journal entries on the books of Pritano to record the acquisition on December 31, 2023.

B. On January 1, 2027, the additional 10,000 shares of Pritano’s stock were issued because the earnout targets were met. On this date, Pritano’s stock price was $50 per share. Prepare the journal entry to record the issuance of the shares of stock.

Step by Step Answer: