Question

Mr Apricot Angelfish is an Australian, born in Melbourne. Apricot is a one of the top Michelin Star chefs in the world and has been

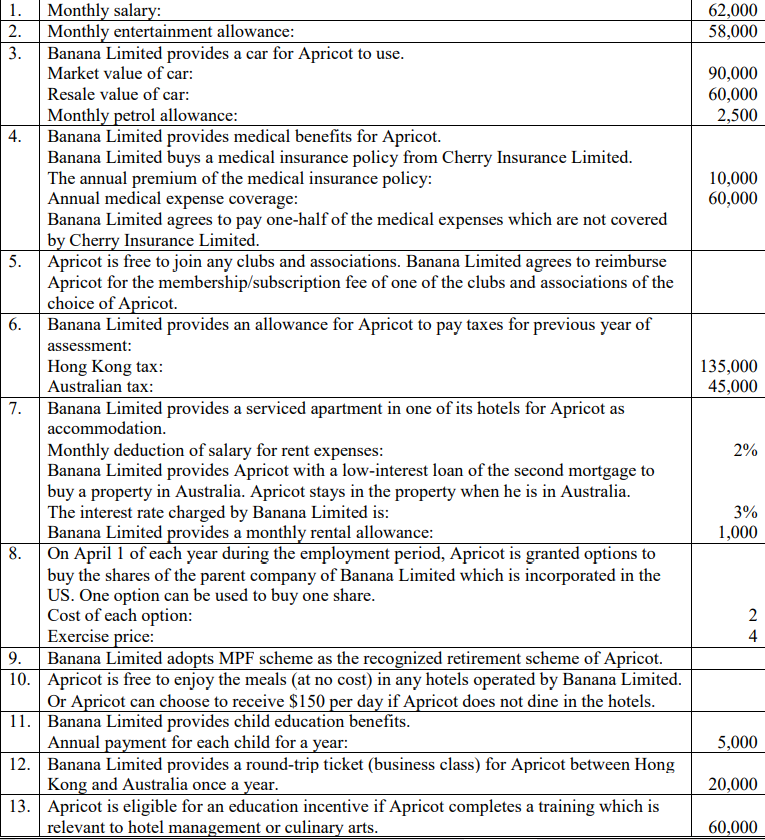

Mr Apricot Angelfish is an Australian, born in Melbourne. Apricot is a one of the top Michelin Star chefs in the world and has been working in Hong Kong for 20 years. He is a permanent resident in Hong Kong. Apricot is now employed by Banana Limited, a company incorporated in Hong Kong, as the executive chef for a term of three years starting from April 2019 to March 2022. Banana Limited operates a number of hotels in Asia-Pacific region. Below is the summary of the terms in the employment contract:

The emergency mission is the question (a), you can answer the question (a) only!!!!!!!!!!

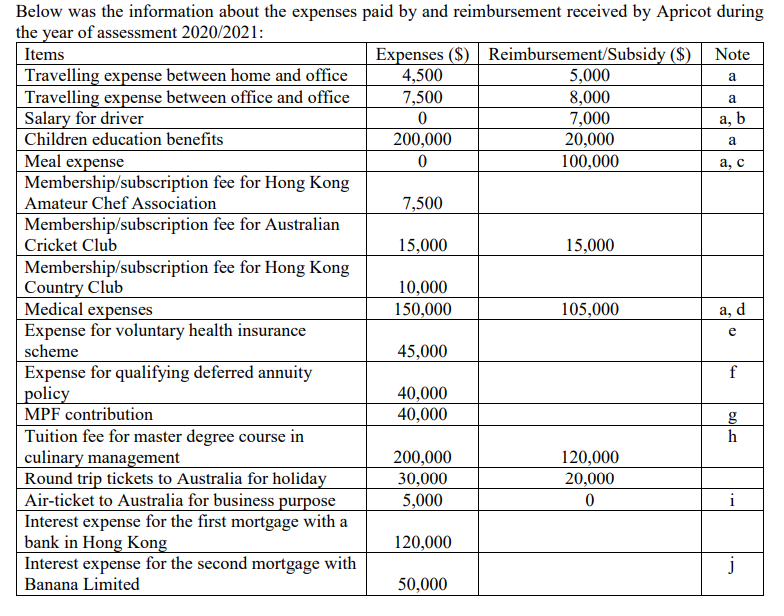

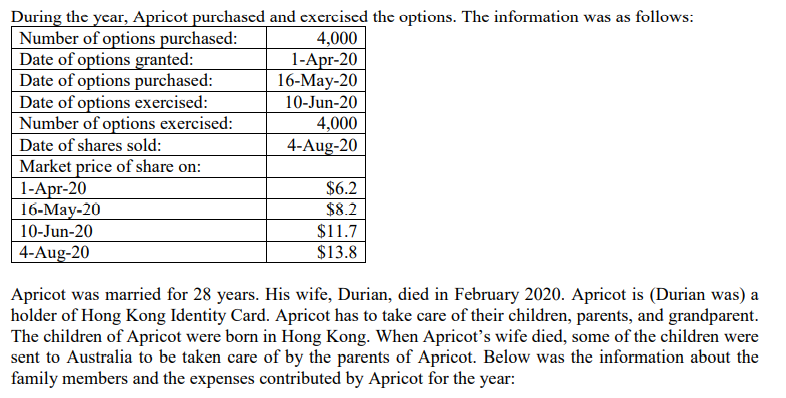

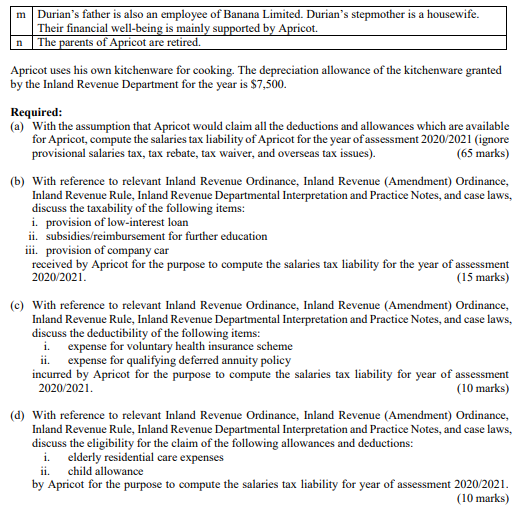

a a a, b a Below was the information about the expenses paid by and reimbursement received by Apricot during the year of assessment 2020/2021: Items Expenses ($) Reimbursement/Subsidy ($) Note Travelling expense between home and office 4,500 5,000 Travelling expense between office and office 7,500 8,000 Salary for driver 0 7,000 Children education benefits 200,000 20,000 Meal expense 0 100,000 a, c Membership/subscription fee for Hong Kong Amateur Chef Association 7,500 Membership/subscription fee for Australian Cricket Club 15,000 15,000 Membership/subscription fee for Hong Kong Country Club 10,000 Medical expenses 150,000 105,000 Expense for voluntary health insurance scheme 45,000 Expense for qualifying deferred annuity f policy 40,000 MPF contribution 40,000 g Tuition fee for master degree course in h culinary management 200,000 120,000 Round trip tickets to Australia for holiday 30,000 20,000 Air-ticket to Australia for business purpose 5,000 0 i Interest expense for the first mortgage with a bank in Hong Kong 120,000 Interest expense for the second mortgage with j Banana Limited 50,000 a, d e During the year, Apricot purchased and exercised the options. The information was as follows: Number of options purchased: 4,000 Date of options granted: 1-Apr-20 Date of options purchased: 16-May-20 Date of options exercised: 10-Jun-20 Number of options exercised: 4,000 Date of shares sold: 4-Aug-20 Market price of share on: 1-Apr-20 $6.2 16-May-20 $8.2 10-Jun-20 $11.7 4-Aug-20 $13.8 Apricot was married for 28 years. His wife, Durian, died in February 2020. Apricot is (Durian was) a holder of Hong Kong Identity Card. Apricot has to take care of their children, parents, and grandparent. The children of Apricot were born in Hong Kong. When Apricot's wife died, some of the children were sent to Australia to be taken care of by the parents of Apricot. Below was the information about the family members and the expenses contributed by Apricot for the year: Relations Age Place of residence Note Expenses paid by Apricot ($) 90,000 50,000 50,000 89 68 58 70 67 k, 1 Durian's grandmother Durian's father Durian's stepmother Apricot's father Apricot's mother Eldest son Eldest daughter Youngest son Youngest daughter n 1. n i 150,000 50,000 22 Hong Kong Hong Kong Hong Kong Melbourne Melbourne Hong Kong as full time university student Melbourne as full time university student Melbourne as full time secondary school student Melbourne as full time primary school student 18 50,000 50,000 13 6 50,000 d e Note: a The reimbursement/subsidy was paid by Banana Limited. b The driver is hired by Banana Limited for Apricot to use for any purpose. c During the year, Apricot had meals (200 days for breakfast, 200 days for lunch, and 150 days for dinner) in the hotels operated by Banana Limited. The costs for breakfast, lunch, and dinners were $20, $50, and $80, respectively. The total cost of the meal in the hotels operated by Banana Limited was $26,000. However, Apricot is free to enjoy the meals (at no cost) in any hotels operated by Banana Limited. For the days when Apricot did not have the meal in the hotels operated by Banana Limited, Apricot received $150 per day. In addition, Apricot received additional subsidies of $100,000 for dining outside. The reimbursement was paid by Cherry Insurance Limited. The voluntary health insurance scheme policy was for Apricot and his children, one scheme policy for each. The insurance scheme qualifying premium is $9,000 per person. f The qualifying annuity policy was for Apricot as sole holder and annuitant. & Of the total contribution to MPF scheme, $18,000 is for the mandatory contribution, the remaining is for tax deductible MPF voluntary contribution. h The master degree course was a course provided by an approved institution. Apricot completed the course on December 31, 2020. The eldest son stays in Hong Kong with Apricot. During the year, Apricot was asked to go back to Australia for a business visit for 3 days. Banana Limited purchased a business class flight ticket for Apricot ($35,000). Apricot used the ticket to exchange for two tickets for economy class (one for Apricot and one for eldest son). The extra cost for the two tickets for economy class was $5,000 Banana Limited provides Apricot with a low-interest loan of the second mortgage. If Apricot has to pay interest at market interest rate, the annual interest expense for the second mortgage should be $80,000 The grandmother of Durian stayed in a registered residential care home. The residential fee ($40,000) was paid by Apricot. In addition to the payment for the registered residential care home, Apricot contributed $50,000 towards her maintenance. The grandmother of Durian and mother of Apricot are eligible to claim the government disability allowance of Hong Kong and Australia. i j k 1 n m Durian's father is also an employee of Banana Limited. Durian's stepmother is a housewife. Their financial well-being is mainly supported by Apricot. The parents of Apricot are retired. Apricot uses his own kitchenware for cooking. The depreciation allowance of the kitchenware granted by the Inland Revenue Department for the year is $7,500. Required: (a) With the assumption that Apricot would claim all the deductions and allowances which are available for Apricot, compute the salaries tax liability of Apricot for the year of assessment 2020/2021 (ignore provisional salaries tax, tax rebate, tax waiver, and overseas tax issues). (65 marks) (b) With reference to relevant Inland Revenue Ordinance, Inland Revenue (Amendment) Ordinance, Inland Revenue Rule, Inland Revenue Departmental Interpretation and Practice Notes, and case laws, discuss the taxability of the following items: i. provision of low-interest loan ii. subsidies/reimbursement for further education iii. provision of company car received by Apricot for the purpose to compute the salaries tax liability for the year of assessment 2020/2021. (15 marks) (C) With reference to relevant Inland Revenue Ordinance, Inland Revenue (Amendment) Ordinance, Inland Revenue Rule, Inland Revenue Departmental Interpretation and Practice Notes, and case laws, discuss the deductibility of the following items: i. expense for voluntary health insurance scheme ii. expense for qualifying deferred annuity policy incurred by Apricot for the purpose to compute the salaries tax liability for year of assessment 2020/2021. (10 marks) (d) With reference to relevant Inland Revenue Ordinance, Inland Revenue (Amendment) Ordinance, Inland Revenue Rule, Inland Revenue Departmental Interpretation and Practice Notes, and case laws, discuss the eligibility for the claim of the following allowances and deductions: i. elderly residential care expenses ii. child allowance by Apricot for the purpose to compute the salaries tax liability for year of assessment 2020/2021. (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started