Question

Mr. Avinash has bought 1000 shares of MUL (with beta value of 1.25) at 7,550 each on 20th July 2017. He wants to hold

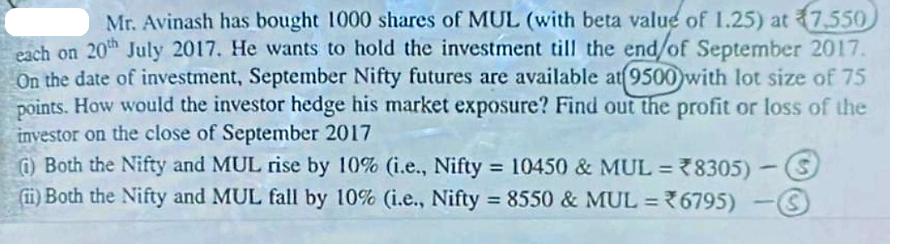

Mr. Avinash has bought 1000 shares of MUL (with beta value of 1.25) at 7,550 each on 20th July 2017. He wants to hold the investment till the end/of September 2017. On the date of investment, September Nifty futures are available at 9500) with lot size of 75 points. How would the investor hedge his market exposure? Find out the profit or loss of the investor on the close of September 2017 (1) Both the Nifty and MUL rise by 10% (i.e., Nifty = 10450 & MUL = 8305) - S (ii) Both the Nifty and MUL fall by 10% (i.e., Nifty = 8550 & MUL = 6795) -

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The image provided contains a question that involves calculating the profit or loss from hedging a stock market position using Nifty futures Heres the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Financial Planning

Authors: Randy Billingsley, Lawrence J. Gitman, Michael D. Joehnk

15th Edition

978-0357438480, 0357438485

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App