Answered step by step

Verified Expert Solution

Question

1 Approved Answer

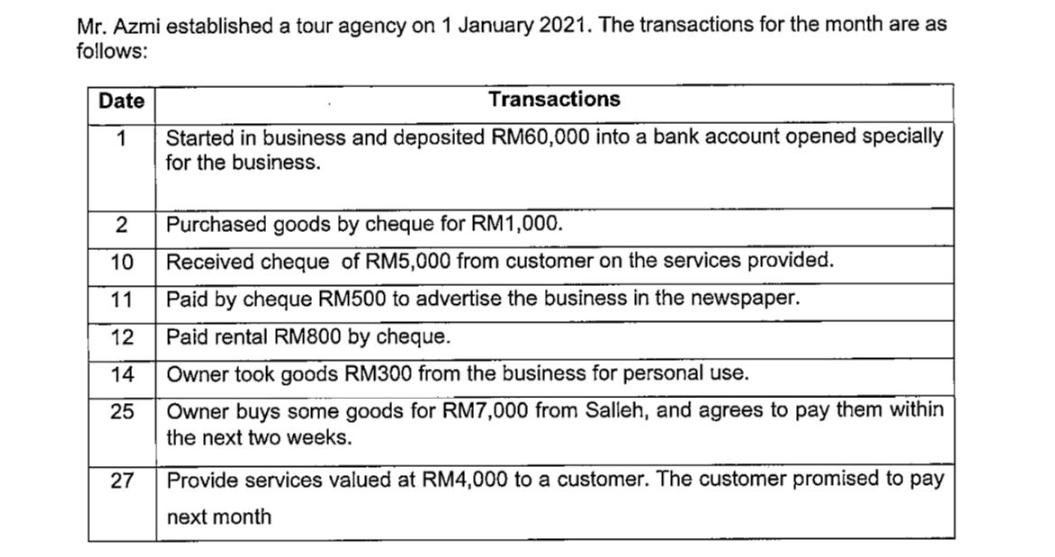

Mr. Azmi established a tour agency on 1 January 2021. The transactions for the month are as follows: Date 1 2 10 11 1214

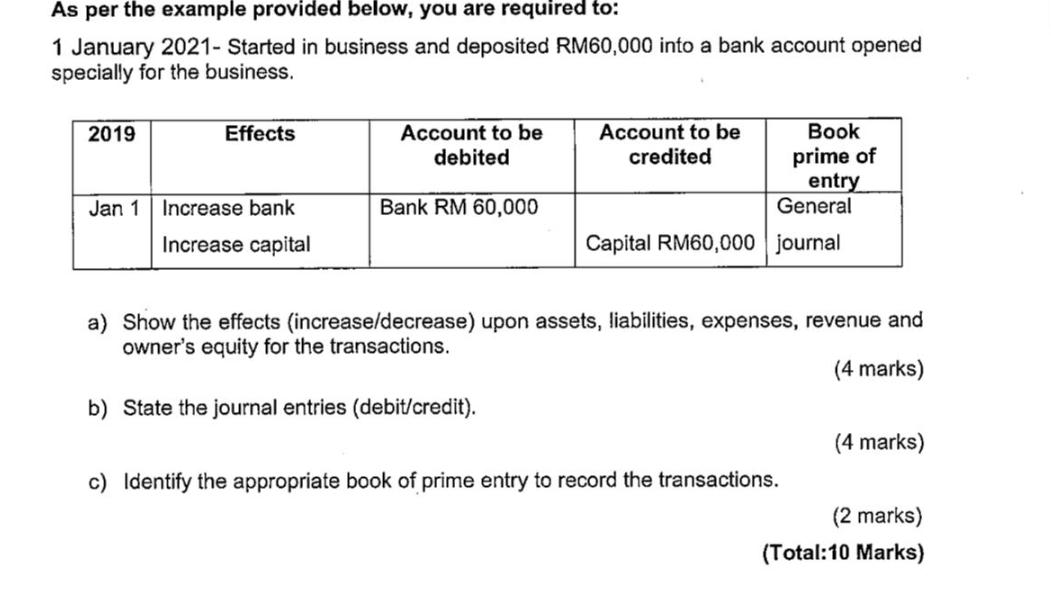

Mr. Azmi established a tour agency on 1 January 2021. The transactions for the month are as follows: Date 1 2 10 11 1214 25 27 Transactions Started in business and deposited RM60,000 into a bank account opened specially for the business. Purchased goods by cheque for RM1,000. Received cheque of RM5,000 from customer on the services provided. Paid by cheque RM500 to advertise the business in the newspaper. Paid rental RM800 by cheque. Owner took goods RM300 from the business for personal use. Owner buys some goods for RM7,000 from Salleh, and agrees to pay them within the next two weeks. Provide services valued at RM4,000 to a customer. The customer promised to pay next month As per the example provided below, you are required to: 1 January 2021- Started in business and deposited RM60,000 into a bank account opened specially for the business. 2019 Jan 1 Effects Increase bank Increase capital Account to be debited Bank RM 60,000 Book prime of entry General Capital RM60,000 journal Account to be credited a) Show the effects (increase/decrease) upon assets, liabilities, expenses, revenue and owner's equity for the transactions. (4 marks) b) State the journal entries (debit/credit). c) Identify the appropriate book of prime entry to record the transactions. (4 marks) (2 marks) (Total:10 Marks)

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Effects on assets liabilities expenses revenue and owners equity for the transactions 1 Started in business and deposited RM60000 into a bank account Assets Increase in Bank account by RM60...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started