Question

Joy Bhd has been an established public listed company since 2015 that involved in manufacturing and distributing of aromatherapy products such as therapeutic grade essential

Joy Bhd has been an established public listed company since 2015 that involved in manufacturing and distributing of aromatherapy products such as therapeutic grade essential oils, aromatherapy diffusers, aroma sticks, etc. Over the years, the company has made a few investments by acquiring some companies as subsidiaries and associates to strengthen its position in the market. The acquisitions of the subsidiaries and associates were as follows:

Investment in Rose Bhd

On 1 July 2018, Joy Bhd acquired 240 million ordinary shares of Rose Bhd at RM300 million when the retained profits and other equity components of Rose Bhd were RM109 million and RM45 million, respectively.

Subsequently, on 1 July 2019, Joy Bhd acquired another 30% of the ordinary shares of Rose Bhd for RM500 million and 20% of the preference shares of the company for RM70 million when the reserves of Rose Bhd were as follows:

Retained profit RM245 million

Asset revaluation reserve RM120 million

Other components of equity RM52 million

At the acquisition date, the fair value of the land and building of Rose Bhd was RM2.4 million and RM5.5 million more than their respective carrying value. No adjustment has been made in Rose Bhd accounts to incorporate these values. The remaining useful life of the building as at the date of acquisition was 25 years. As at that date, the fair value of the ordinary share of Rose Bhd was RM 2.10 each.

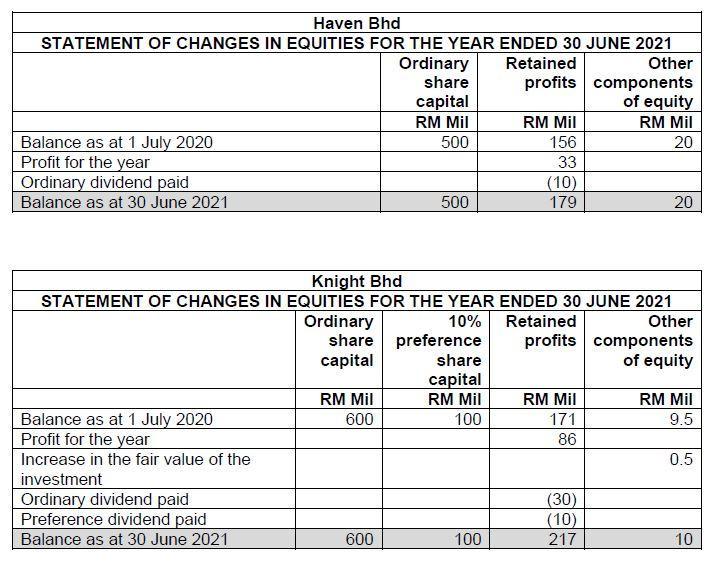

Investment in Haven Bhd

On 1 July 2020, Rose Bhd acquired 70% of the ordinary shares of Haven Bhd at RM420 million cash. The fair value of the ordinary shares of Haven Bhd as at that date was RM1.70 each. As at the acquisition date, Rose Bhd recognized an internally generated brand in Haven Bhd and valued it at RM15 million. It was determined that the brand has 10 years of useful life.

At the same date, Joy Bhd also acquired 10% of the ordinary shares of Haven Bhd at RM75 million. The acquisition was settled through issuance of 10 million units of ordinary shares of Joy Bhd at RM7.50 per share. This acquisition has not been recorded in any Joy Bhd's account as at 30 June 2021.

Investment in Knight Bhd

Joy Bhd acquired 40% of the ordinary shares of Knight Bhd on 1 January 2021 at RM300 million. In May 2021, Joy Bhd sold goods costing RM10 million to Knight Bhd at an invoice price of RM12 million. Three-quarters of the goods were still in Knight Bhd's store on 30 June 2021.

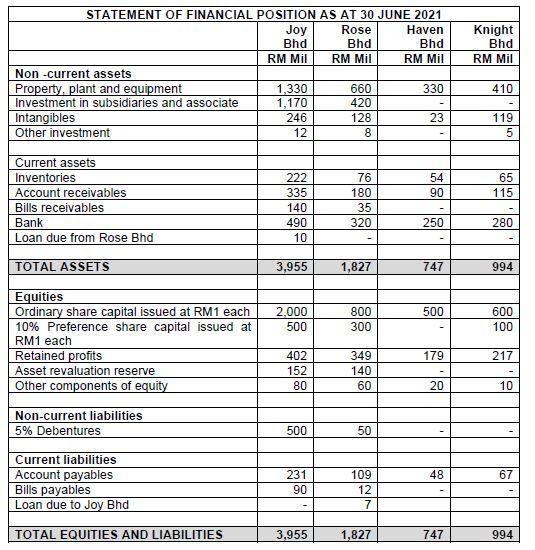

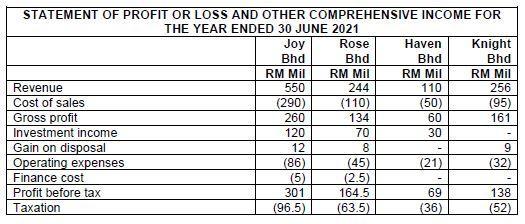

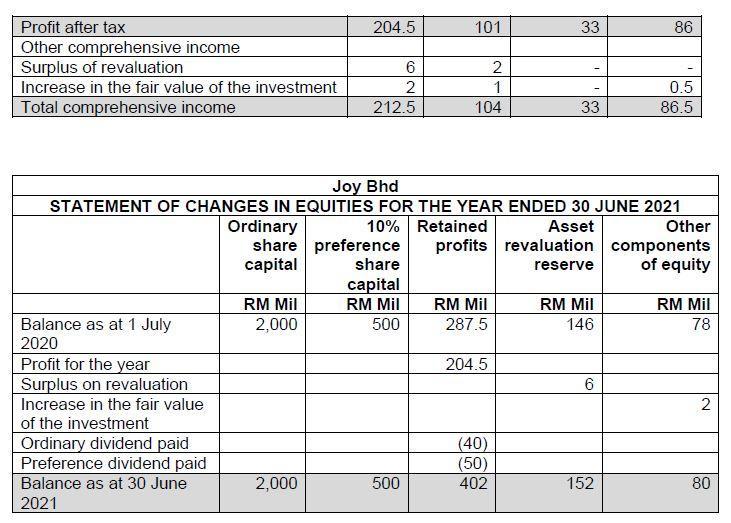

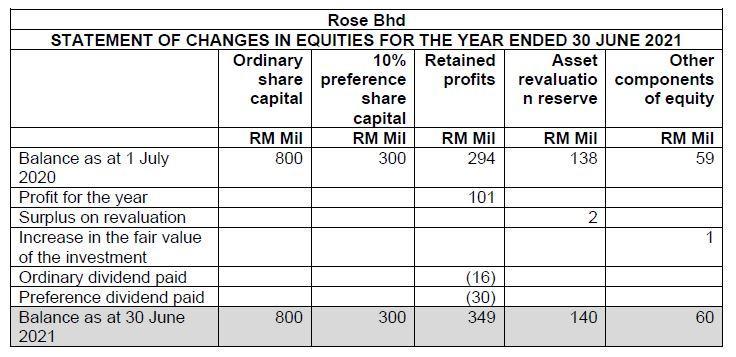

The following are the financial statements of Joy Bhd and its group for the financial year ended 30 June 2021:

Additional information:

1. During the year ended 30 June 2021, Rose Bhd sold to Joy Bhd goods worth RM25 million. Rose Bhd priced its sales to Joy Bhd at cost plus 25%. Half of the invoiced amount was still due from Joy Bhd on 30 June 2021. At the end of the year, RM5 million of these goods remained unsold. There was also an unrealised profit of RM2 million in the opening inventory of Joy Bhd. The opening inventory was also purchased from Rose Bhd.

2. On 1 January 2021, Haven Bhd sold a plant to Rose Bhd for RM12 million when the carrying value of the plant was RM9.5 million. The remaining life of the plant was 5 years on that date.

3. On 28 June 2021, Rose Bhd sent a cheque to Joy Bhd of RM3 million as part of the settlement on the loan due to Joy Bhd. This was only received by Joy Bhd on 3 July 2021.

4. Bills receivables of RM8 million in Joy Bhd were issued in favour of Rose Bhd. Joy Bhd had discounted RM2 million of these bills as at year-end.

5. The surplus on revaluation in Joy Bhd and Rose Bhd was related to subsequent revaluations of some properties in the current year.

6. The increase in the fair value of investments was related to changes in the fair value of financial assets measured at fair value through other comprehensive income on 30 June 2021. The reserves have been included as part of other components of equity.

7. On 1 April 2021, Joy Bhd issued RM20 million 5% Redeemable Preference shares of RM1 each for cash. The interest on these shares was still accrued at year end and no record were made by Joy Bhd as at 30 June 2021.

8. The ordinary shares and 10% preference shares’ dividends are declared and paid on 28 June 2021.

9. The impairment test revealed that the goodwill in Rose Bhd had been impaired by 10% as at 30 June 2021.

10. The group's policy is to measure the non-controlling interest at its fair value.

11. Depreciation for property, plant and equipment is recognised in the statement of profit or loss to write off the cost or revaluation amount of each asset over its estimated useful life. Depreciation on property, plant and equipment is using the straight line method calculated on a yearly basis with no residual value, where full-year depreciation is charged in the year of purchase and none in the year of disposal.

12. Profits are assumed to accrue evenly throughout 2018 to 2021.

Required:

a) Calculate the goodwill/bargain purchase on the acquisition of Rose Bhd as at 1 July 2019.

b) Calculate gain or loss on the 'virtual sale' of ordinary shares of Rose Bhd as at 1 July 2019.

c) Calculate the goodwill/ bargain purchase on the acquisition of Haven Bhd as at 1 July 2020.

d) Calculate the goodwill/ bargain purchase on the acquisition of Knight Bhd's ordinary shares as of 1 January 2021.

e) Prepare Consolidated Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2021 for Joy Bhd's Group.

f) Prepare Consolidated Statement of Changes in Equities for the year ended 30 June 2021 for Joy Bhd's Group.

g) Prepare Consolidated Statement of Financial Position as at 30 June 2021 for Joy Bhd's Group.

STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2021 Joy Bhd Knight Bhd Rose Haven Bhd Bhd RM Mil RM Mil RM Mil RM Mil Non -current assets Property, plant and equipment Investment in subsidiaries and associate 1,330 1,170 660 330 410 420 Intangibles Other investment 246 128 23 119 12 Current assets Inventories 222 76 54 65 Account receivables 335 180 90 115 Bills receivables Bank 140 35 490 320 250 280 Loan due from Rose Bhd 10 TOTAL ASSETS 3,955 1,827 747 994 Equities Ordinary share capital issued at RM1 each 10% Preference share capital issued at RM1 each Retained profits Asset revaluation reserve Other components of equity 2,000 800 500 600 500 300 100 402 349 179 217 152 140 80 60 20 10 Non-current liabilities 5% Debentures 500 50 Current liabilities Account payables Bills payables Loan due to Joy Bhd 231 109 48 67 90 12 7 TOTAL EQUITIES AND LIABILITIES 3,955 1,827 747 994

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started