Answered step by step

Verified Expert Solution

Question

1 Approved Answer

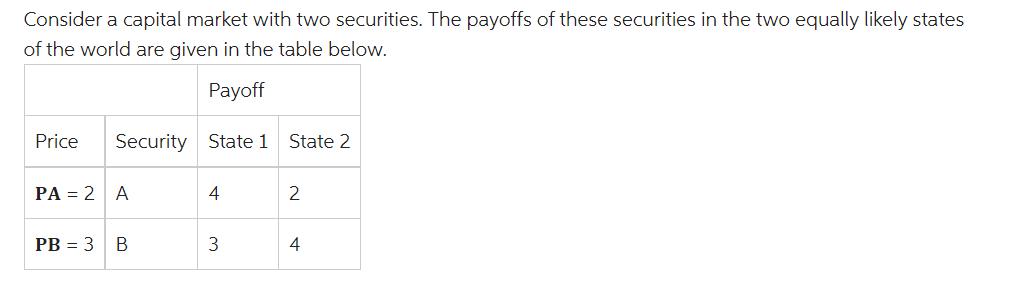

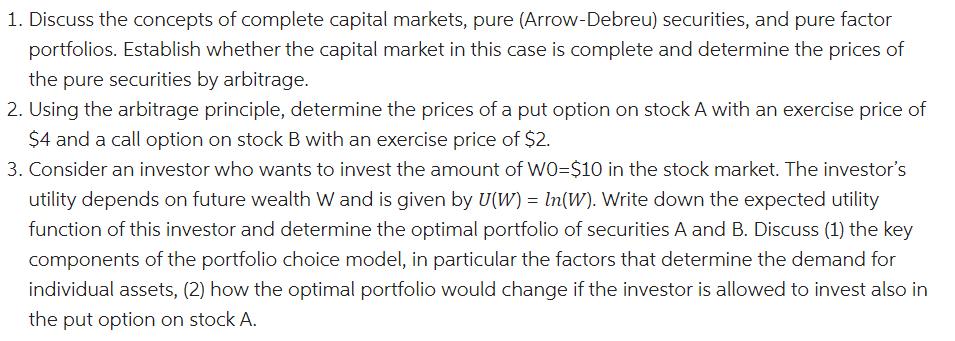

Consider a capital market with two securities. The payoffs of these securities in the two equally likely states of the world are given in

Consider a capital market with two securities. The payoffs of these securities in the two equally likely states of the world are given in the table below. Payoff Security State 1 State 2 Price PA = 2 A PB = 3 B 4 3 2 4 1. Discuss the concepts of complete capital markets, pure (Arrow-Debreu) securities, and pure factor portfolios. Establish whether the capital market in this case is complete and determine the prices of the pure securities by arbitrage. 2. Using the arbitrage principle, determine the prices of a put option on stock A with an exercise price of $4 and a call option on stock B with an exercise price of $2. 3. Consider an investor who wants to invest the amount of WO-$10 in the stock market. The investor's utility depends on future wealth W and is given by U(W) = In(W). Write down the expected utility function of this investor and determine the optimal portfolio of securities A and B. Discuss (1) the key components of the portfolio choice model, in particular the factors that determine the demand for individual assets, (2) how the optimal portfolio would change if the investor is allowed to invest also in the put option on stock A.

Step by Step Solution

★★★★★

3.61 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Concepts of Complete Capital Markets Pure ArrowDebreu Securities and Pure Factor Portfolios Complete Capital Markets A full set of tradable securities exists in a complete capital market and investors ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started