Question

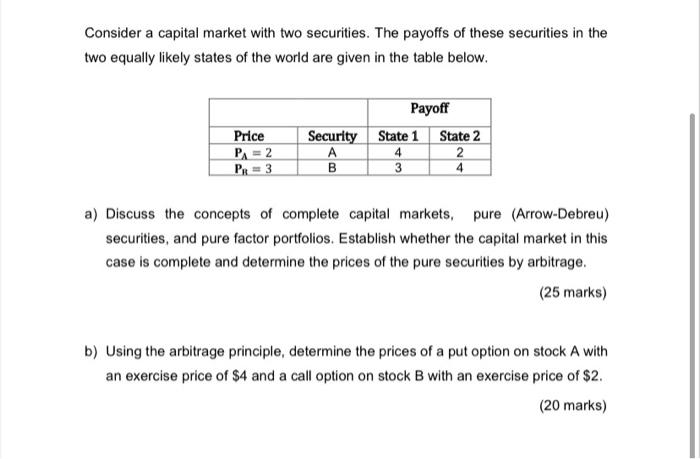

Consider a capital market with two securities. The payoffs of these securities in the two equally likely states of the world are given in

Consider a capital market with two securities. The payoffs of these securities in the two equally likely states of the world are given in the table below. Price P = 2 PR = 3 Security A B Payoff State 1 4 3 State 2 2 4 a) Discuss the concepts of complete capital markets, pure (Arrow-Debreu) securities, and pure factor portfolios. Establish whether the capital market in this case is complete and determine the prices of the pure securities by arbitrage. (25 marks) b) Using the arbitrage principle, determine the prices of a put option on stock A with an exercise price of $4 and a call option on stock B with an exercise price of $2. (20 marks)

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer i Economics focuses on the behaviour and interactions of economic agents and how economies wo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Theory and Corporate Policy

Authors: Thomas E. Copeland, J. Fred Weston, Kuldeep Shastri

4th edition

321127218, 978-0321179548, 321179544, 978-0321127211

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App