Answered step by step

Verified Expert Solution

Question

1 Approved Answer

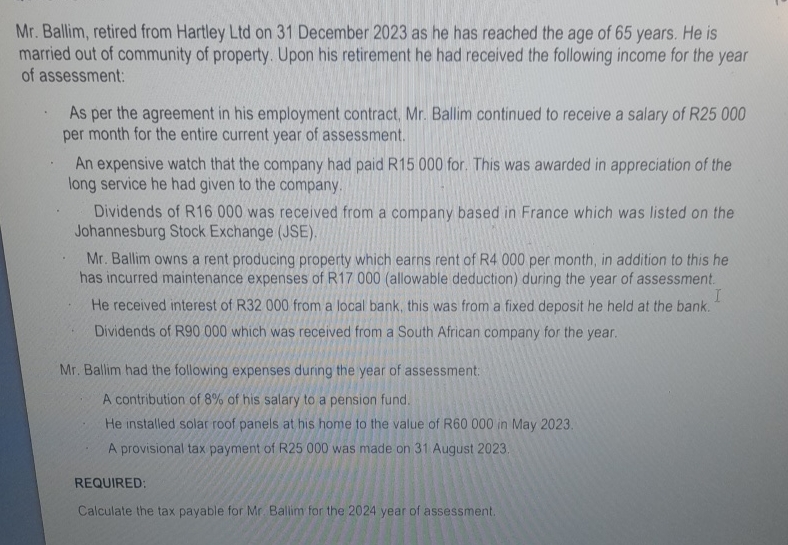

Mr . Ballim, retired from Hartley Ltd on 3 1 December 2 0 2 3 as he has reached the age of 6 5 years.

Mr Ballim, retired from Hartley Ltd on December as he has reached the age of years. He is married out of community of property. Upon his retirement he had received the following income for the year of assessment:

As per the agreement in his employment contract, Mr Ballim continued to receive a salary of R per month for the entire current year of assessment.

An expensive watch that the company had paid R for. This was awarded in appreciation of the long service he had given to the company.

Dividends of R was received from a company based in France which was listed on the Johannesburg Stock Exchange JSE

Mr Ballim owns a rent producing property which earns rent of per month, in addition to this he has incurred maintenance expenses of Rallowable deduction during the year of assessment.

He received interest of R from a local bank, this was from a fixed deposit he held at the bank.

Dividends of which was received from a South African company for the year.

Mr Ballim had the following expenses during the year of assessment:

A contribution of of his salary to a pension fund.

He installed solar roof panels at his home to the value of in May

A provisional tax payment of was made on August

REQUIRED:

Calculate the tax payable for Mr Ballim for the year of assessment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started