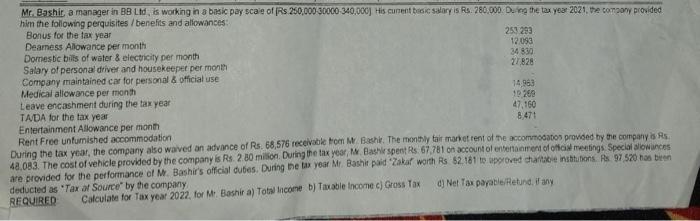

Mr. Bashir a manager in B8 Lid, is working in a basic pay scale of Rs 250,000 30000 340.000J His current salary is Rs. 280.000. During the tax year 2021, the company provided him the following perquisites / benefits and allowances Bonus for the tax year 251 293 Dearess Allowance per month 12.092 Domestic bits of water & electricity per month 34 830 Salary of personal driver and housekeeper per month 27.828 Company maintained car for personal & Official use Medical allowance per month 14.960 1 209 Leave encashment during the tax year TADA for the tax year 47.160 8.471 Entertainment Allowance per month Rent Free untumished accommodation During the tax year, the company also waved on advance of Rs. 68,576 receivable from Bash. The monthly for market rent of the accommodation provided hy the company is Rs. 42,083. The cost of vehicle provided by the company is Rs 280 milion. During the tax year, M. Base spent Rs 67.781 on account of entertainment of of meetings Special lowances are provided for the performance of M. Bashir's official cubes. During me to your Mr. Bashit paid Zakar worth Rs 62.181 to approved that in the Sons Rs 97.520 has been deducted as "Tax ax Source" by the company d) Net Tax payable/Retund, if any REQUIRED Calculate for Tax year 2022. for M Bashir a) Total income b) Taxable income c) Gross Tax Mr. Bashir a manager in B8 Lid, is working in a basic pay scale of Rs 250,000 30000 340.000J His current salary is Rs. 280.000. During the tax year 2021, the company provided him the following perquisites / benefits and allowances Bonus for the tax year 251 293 Dearess Allowance per month 12.092 Domestic bits of water & electricity per month 34 830 Salary of personal driver and housekeeper per month 27.828 Company maintained car for personal & Official use Medical allowance per month 14.960 1 209 Leave encashment during the tax year TADA for the tax year 47.160 8.471 Entertainment Allowance per month Rent Free untumished accommodation During the tax year, the company also waved on advance of Rs. 68,576 receivable from Bash. The monthly for market rent of the accommodation provided hy the company is Rs. 42,083. The cost of vehicle provided by the company is Rs 280 milion. During the tax year, M. Base spent Rs 67.781 on account of entertainment of of meetings Special lowances are provided for the performance of M. Bashir's official cubes. During me to your Mr. Bashit paid Zakar worth Rs 62.181 to approved that in the Sons Rs 97.520 has been deducted as "Tax ax Source" by the company d) Net Tax payable/Retund, if any REQUIRED Calculate for Tax year 2022. for M Bashir a) Total income b) Taxable income c) Gross Tax