Question

Mr. Benson is a salesman where he earns his primary source of income. For 2020, his employment income was $78,000. During 2020, he made contributions

Mr. Benson is a salesman where he earns his primary source of income. For 2020, his employment income was $78,000. During 2020, he made contributions to his employers defined contribution RPP of $2,000. His employer made a matching contribution of $2,000, as well as a $1,200 contribution to a deferred profit-sharing plan.

Also during 2020, Benson had the following additional income:

Interest income $3,400

Eligible dividends $1,900

Royalties from a book written by Liam $6,500

Taxable capital gains $38,000

Losses for the year included the following:

Rental loss $10,400

Allowable capital losses $9,000

2018 net capital loss $32,000

Benson has custody of his 7-year-old son from a former marriage and receives $14,400 in child support payments each year. He also receives $9,000 in annual spousal support. During 2020, Benson incurred deductible child care costs of $4,000.

Benson is also required to pay a total of $2,500 per month in spousal support payments to another former spouse.

At the end of 2020, Benson had $23,000 in unused RRSP deduction room and $21,000 in undeducted RRSP contributions. He did not claim an RRSP deduction in 2020.

REQUIRED: *Show supporting calculations and explanations

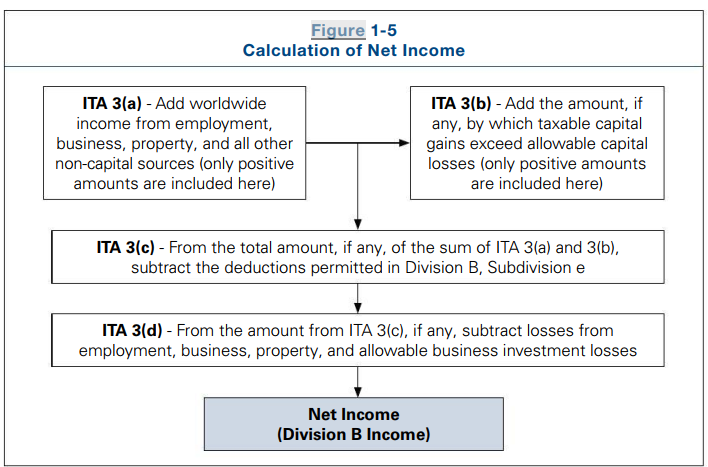

A) Calculate Bensons 2020 Net Income for Tax Purposes. (Refer to ITA 3 Below)

B) Calculate Bensons 2020 Earned Income.

C) Calculate Bensons 2021 RRSP Deduction Limit and How much should Benson contribute to his RRSP in 2021 if he wants to claim the maximum deduction?

Figure 1-5 Calculation of Net Income ITA 3(a) - Add worldwide income from employment, business, property, and all other non-capital sources (only positive amounts are included here) ITA 3(b) - Add the amount, if any, by which taxable capital gains exceed allowable capital losses (only positive amounts are included here) ITA 3(c) - From the total amount, if any, of the sum of ITA 3(a) and 3(b), subtract the deductions permitted in Division B, Subdivision e ITA 3(d) - From the amount from ITA 3(c), if any, subtract losses from employment, business, property, and allowable business investment losses Net Income (Division B Income)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started