Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr Bigg, the President of Big Capital Enterprises, has assembled his top advisers to evaluate an investment opportunity. The advisers expect the company to

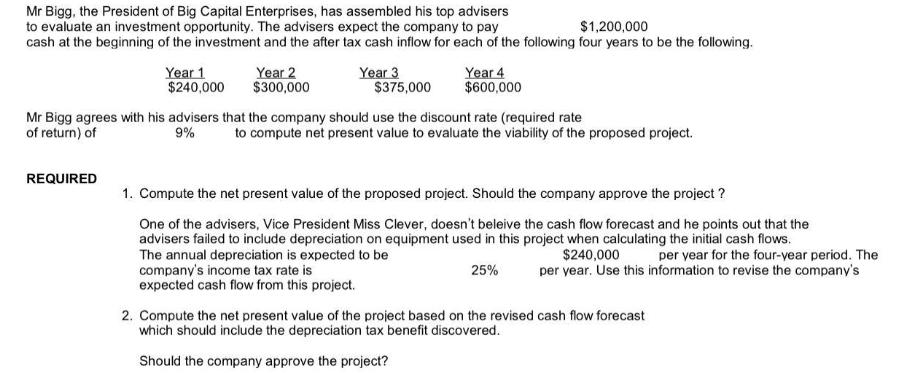

Mr Bigg, the President of Big Capital Enterprises, has assembled his top advisers to evaluate an investment opportunity. The advisers expect the company to pay cash at the beginning of the investment and the after tax cash inflow for each of the following four years to be the following. $1,200,000 Year 1 $240,000 REQUIRED Year 2 $300,000 Year 3 $375,000 Mr Bigg agrees with his advisers that the company should use the discount rate (required rate of return) of 9% Year 4 $600,000 company's income tax rate is expected cash flow from this project. to compute net present value to evaluate the viability of the proposed project. 1. Compute the net present value of the proposed project. Should the company approve the project? One of the advisers, Vice President Miss Clever, doesn't beleive the cash flow forecast and he points out that the advisers failed to include depreciation on equipment used in this project when calculating the initial cash flows. The annual depreciation is expected to be $240,000 per year for the four-year period. The per year. Use this information to revise the company's 25% 2. Compute the net present value of the project based on the revised cash flow forecast which should include the depreciation tax benefit discovered. Should the company approve the project?

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

year 1 2 3 4 Computation of Netpresent NPV Valve inflow Discounting ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started