Question

Mr. Blah and Mrs. Bleh, are friends and they met at university when they were studying Business Law at Universty. They share a passion for

Mr. Blah and Mrs. Bleh, are friends and they met at university when they were studying Business Law at Universty. They share a passion for virtual reality and virtual games. After completing their studies, they decided to start up a new business based on Mr. Blah's idea regarding a virtual reality without glasses. Mr. Blah's idea consists of a very powerful projector with a lot of speakers of different sizes and overall software that changes the video and the involving sound taking into account upon user's viewing. There is also a very incipient augmented virtual reality.

Mrs. Bleh, jointly with Mr. Blah, raised the necessary fund for kicking off the project. Mrs. Bleh's family and friends let her 100.000 euro meanwhile, Mr. Blah's family and friends let him 20.000 euro.

The first prototype had a cost of 110.000 euros and it took nearly 1 year of working. During this first year, Mrs. Bleh and Mr. Bla did not have a salary and they have been involved in this project, with other classmates, to whom they paid occasionally. Most of the funds have been applied to pay components and software developers.

Mrs. Bleh has contacted a Japanese company which is very interested to buy the new projector. The Japanese company's director has come to Barcelona to have his own experience with the prototype and finally, he has ordered 6 projectors.

Fact 2.

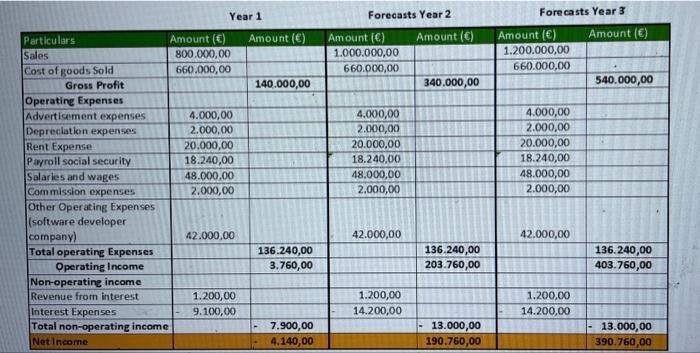

Mrs. Bleh's father recommended founding a new company and at the same time agreed on the delivery of another 6 projectors, this time the customer is a French company. To run the new job and update the software, they need 200,000 euros, but they can no longer squeeze their family and friends. Ms. Bleh has met two adventure capital funds that have informed Ms. Bleh of their interest in investing in their company but have asked her for a profit and loss forecast, at least for the next 2 years. She sent them the following predictions:

Questions.

What kind of company should you suggest them?

What should the share capital be, who should be the shareholders and what percentage?

Can you suggest how to raise the funds needed for this new delivery?

If Mr. Blah, Ms. Bleh and Adventure Capital Fund reach an agreement, suggest what type of agreement they should enter into.

If you need to increase the share capital, you should propose all the formalities and requirements that they should complete. Remember that this is a Spanish company. The absence of any formality or requirement will be considered a non-response.

Given the forecasts, could the Adventure Capital Fund claim any liability against Ms. Bleh in the case the company does not fulfill the forecasts?

Do you think the forecasts make sense or are correct?

Particulars Sales Cost of goods Sold Gross Profit Operating Expenses Advertisement expenses Depreciation expenses Rent Expense Payroll social security Salaries and wages Commission expenses Other Operating Expenses (software developer company) Total operating Expenses Operating Income Non-operating income Revenue from interest Interest Expenses Total non-operating income Net Income Year 1 Amount () 800.000,00 660.000,00 4.000,00 2.000,00 20.000,00 18.240,00 48.000,00 2.000,00 42.000,00 1.200,00 9.100,00 Amount (C) 140.000,00 136.240,00 3.760,00 7.900,00 4.140,00 Forecasts Year 2 Amount () 1.000.000,00 660.000,00 4,000,00 2.000,00 20.000,00 18.240,00 48,000,00 2.000,00 42.000,00 1.200,00 14.200,00 Amount () 340.000,00 136.240,00 203.760,00 - 13.000,00 190.760,00 Forecasts Year 3 Amount (C) 1.200.000,00 660.000,00 4.000,00 2.000,00 20.000,00 18.240,00 48.000,00 2.000,00 42.000,00 1.200,00 14.200,00 Amount () 540.000,00 136.240,00 403.760,00 13.000,00 390.760,00

Step by Step Solution

3.57 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

1 I would suggest them a private limited company 2 The share capital should be 150000 Euros The shar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started