Answered step by step

Verified Expert Solution

Question

1 Approved Answer

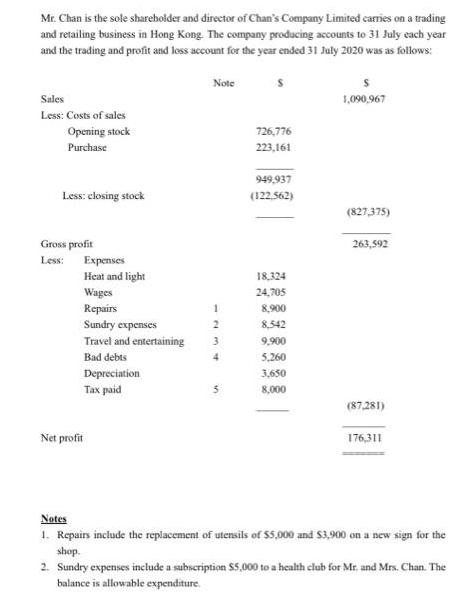

Mr. Chan is the sole sharebolder and director of Chan's Company Limited carries on a trading and retailing business in Hong Kong. The company

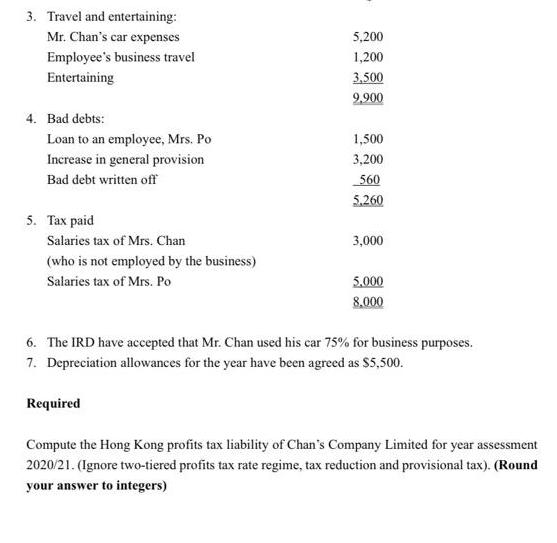

Mr. Chan is the sole sharebolder and director of Chan's Company Limited carries on a trading and retailing business in Hong Kong. The company producing accounts to 31 July each year and the trading and proft and less account for the year ended 31 July 2020 was as follows: Note Sales 1,090,967 Less: Costs of sales Opening stock Purchase 726,776 223,161 949,937 Less: closing stock (122,562) (827,375) Gross profit 263,592 Less: Expenses Heat and light 18,324 Wages Repairs Sundry expenses 24,705 8,900 8,542 Travel and entertaining 3 9,900 Bad debts 5,260 Depreciation 3,650 Tax paid 8,000 (87.281) Net profit 176,311 Notes 1. Repairs include the replacement of utensils of $5,000 and $3,900 on a new sign for the shop. 2. Sundry expenses include a subscription S5,000 to a health club for Mr. and Mrs. Chan. The balance is allowable expenditure. 3. Travel and entertaining: Mr. Chan's car expenses 5,200 Employee's business travel 1,200 Entertaining 3,500 9,900 4. Bad debts: Loan to an employee, Mrs. Po 1,500 Increase in general provision 3,200 Bad debt written off 560 5.260 5. Tax paid Salaries tax of Mrs. Chan 3,000 (who is not employed by the business) Salaries tax of Mrs. Po 5.000 8,000 6. The IRD have accepted that Mr. Chan used his car 75% for business purposes. 7. Depreciation allowances for the year have been agreed as $5,500. Required Compute the Hong Kong profits tax liability of Chan's Company Limited for year assessment 2020/21. (Ignore two-tiered profits tax rate regime, tax reduction and provisional tax). (Round your answer to integers)

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Mr Xs net asseable profit and profit tax computations for YA ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started