On 1 March 2018, YY Ltd acquired 85% of the ordinary share capital of ZZ Ltd. There

Question:

On 1 March 2018, YY Ltd acquired 85% of the ordinary share capital of ZZ Ltd. There are no preference shares. Both companies prepare financial statements to 31 October each year. Transactions between the two companies during the year to 31 October 2018 were as follows:

(a) On 31 January 2018, YY Ltd sold goods costing ?2,000 to ZZ Ltd for ?3,500. All of these goods had been sold by ZZ Ltd by the end of the accounting year.

(b) On 30 September 2018, YY Ltd sold goods costing ?4,000 to ZZ Ltd for ?7,000. None of these goods had been sold by ZZ Ltd by the end of the accounting year.

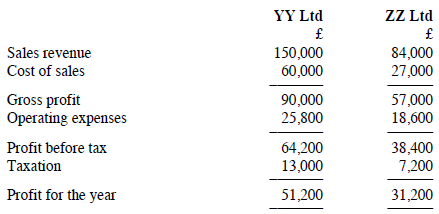

There was a goodwill impairment loss of ?10,000 during the period from 1 March 2018 to 31 October 2018. The statements of comprehensive income of the two companies for the year to 31 October 2018 are as follows:

All income and expenses accrued evenly through the year.

Required:?

Prepare a consolidated statement of comprehensive income for the year to 31 October ?2018.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

International Financial Reporting A Practical Guide

ISBN: 978-1292200743

6th edition

Authors: Alan Melville