A company (which is not a member of a group) has the following results for the 14

Question:

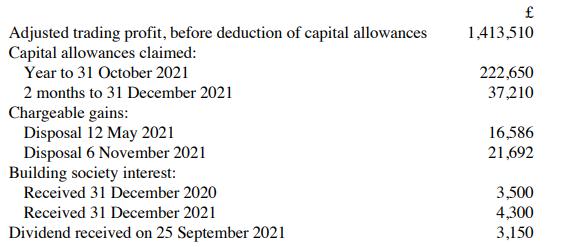

A company (which is not a member of a group) has the following results for the 14 months to 31 December 2021:

Accrued building society interest was £3,000 on 31 October 2020, £4,000 on 31 October 2021 and £nil on 31 December 2021.

Compute the company's total corporation tax liability for the 14-month period and state the date (or dates) on which this tax is due to be paid.

Transcribed Image Text:

Adjusted trading profit, before deduction of capital allowances Capital allowances claimed: Year to 31 October 2021 2 months to 31 December 2021 Chargeable gains: Disposal 12 May 2021 Disposal 6 November 2021 Building society interest: Received 31 December 2020 Received 31 December 2021 Dividend received on 25 September 2021 1,413,510 222,650 37,210 16,586 21,692 3,500 4,300 3,150

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

To calculate the corporation tax liability for the 14month period well need to combine all the profits net of any allowances along with any chargeable ...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

A company has the following results for the 14 months to 31 December 2020: Adjusted trading profit, before deduction of capital allowances 1,413,510 Capital allowances claimed: Year to 31 October...

-

A company has the following results for the 14 months to 31 December 2020: Adjusted trading profit, before deduction of capital allowances 1,413,510 Capital allowances claimed: Year to 31 October...

-

A company (which is not a member of a group) has the following results for the year to 31 March 2022: The company intends to make Gift Aid donations of 30,000 every six months, starting on 30...

-

Exporting files into binary files is done in O Logical files O Physical backup O Physical full backup O Physical partial backup L

-

How does a natural-draft wet cooling tower work?

-

Create a plan for the personal development conversation. What are your strengths and where do you need improvement? What kinds of assignments or projects might help you develop skills you need?...

-

Imagine that you work for Puma and are tasked with producing an IMC campaign with a goal of increasing market share by three percent. First, you decide to use traditional and online advertising and...

-

Following are condensed balance sheets and statements of operations for Elias Hospital for the years ended December 31, 2013 and 2012 ( amounts in thousands of dollars). Use the preceding information...

-

39/40 Fun Company incurred direct materials cost of $750,000 during the year. Manufacturing overhead applied was $700,000 and is applied based on direct labor costs. The predetermined overhead rate...

-

Use Venn diagrams to evaluate the immediate inferences in Part II of this exercise. Identify any that commit the existential fallacy. In part 1. No sculptures by Rodin are boring creations....

-

A company has the following results for the three years to 31 March 2022: Assuming that the trading loss is carried forward and that maximum loss relief is taken as soon as possible, calculate the...

-

State the date (or dates) on which a "large" company would be required to settle its corporation tax liability for each of the following accounting periods: Assume in each case that the company's tax...

-

The price of wheat per bushel at time t (in months) is approximated by f (t) = 4 + .001t + .01e -t . What is the percentage rate of change of f (t) at t = 0? t = 1? t = 2?

-

Maintenance costs at Red Dot Manufacturing over the past six months are listed in the following table. ( Click the icon to view the maintenance costs. ) Using the high - low method, what is the total...

-

PURPOSE: Understand Markov chains as a means to model/predict probabilistic processes in a simple case. a. Toss a coin 32 times and record the outcome (as a string of H and T). b. Compute the...

-

2. 1. The following are considered Financial Statements as per the Generally Accepted Accounting Principles (GAAP), except: a.) Profit & Loss Statement b.) Cash Flow Statement c.) Statement of...

-

In what ways do you feel prepared to use your communication skill after completing the assignment? If you don't feel prepared, share why.

-

Budgeted Activity Activity Cost Activity Base Casting $238,560 Machine hours Assembly 158,620 Direct labor hours Inspecting 24,090 Number of inspections Setup 52,540 Number of setups 43,200 Number of...

-

For specified limits for the maximum and minimum temperatures, the ideal cycle with the lowest thermal efficiency is (a) Carnot (b) Stirling (c) Ericsson (d) Otto (e) All are the same

-

What is beacon marketing? What are digital wallets?

-

Susan is granted a 20 -year lease on a property, paying a premium of 76, 000. Explain how tax relief will be given in relation to this premium if: (a) she uses the property for trading purposes, or...

-

In tax year 2017-18, a landlord receives a premium of 36,000 when granting a 25-year lease to a tenant. How much of this premium is chargeable to income tax?

-

Sandra's entire income is derived from the letting of proper ty. Her income and expenditure in tax years 2015-16 through to 2017-18 are as follows: 2015-16 49,320 78,510 Total rental income Total...

-

A proposed $2.5 M investment in new equipment at a 100 MG/y M&Ms factory will save the plant $800,000/y in energy costs. Assuming an annual interest rate of 5%/y (compounded annually), and an...

-

Brief Exercise 10-7 Coronado Company obtained land by issuing 2,250 shares of its $14 par value common stock. The land was recently appraised at $103,240. The common stock is actively traded at $44...

-

The following schedule reconciles Cele Co.'s pretax GAAP income Pretax GAAP income Nondeductible expense for fines Tax deductible depreciation in excess of GAAP depreciation expens Taxable rental...

Study smarter with the SolutionInn App