State the date (or dates) on which a large company would be required to settle its corporation

Question:

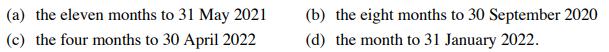

State the date (or dates) on which a "large" company would be required to settle its corporation tax liability for each of the following accounting periods:

Assume in each case that the company's tax liability for the period exceeds £10,000 and that the company was also large in the previous 12 months.

Transcribed Image Text:

(a) the eleven months to 31 May 2021 (c) the four months to 30 April 2022 (b) the eight months to 30 September 2020 (d) the month to 31 January 2022.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (1 review)

In each case the company must pay corporation tax by instalments and the final instalment is due thr...View the full answer

Answered By

Ayush Mishra

I am a certified online tutor, with more than 3 years of experience in online tutoring. My tutoring subjects include: Physics, Mathematics and Mechanical engineering. I have also been awarded as best tutor for year 2019 in my previous organisation. Being a Mechanical Engineer, I love to tell the application of the concepts of science and mathematics in the real world. This help students to develop interest and makes learning fun and easy. This in turn, automatically improves their grades in the subject. I teach students to get prepared for college entry level exam. I also use to teach undergraduate students and guide them through their career aim.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Carol Harris, Ph.D, CPA, is a single taxpayer and she lives at 674 Yankee Street, Durham, NC 27409. Her Social Security number is 793-52-4335. Carol is an Associate Professor of Accounting at a local...

-

Natureview Farm It was a crisp Vermont morning in February 2000. Christine Walker, vice president of marketing for Natureview Farm, Inc., a small yogurt manufacturer, paused to collect her thoughts...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Your geothermal heat pump is used to heat your house in the winter. The heat pump is operated as a vapor-compression cycle. The design is such that there must be a 10 degree temperature difference...

-

A stream of warm air with a dry-bulb temperature of 40C and a wet-bulb temperature of 32C is mixed adiabatically with a stream of saturated cool air at 18C. The dry air mass flow rates of the warm...

-

What might be done to sustain it or refresh and extend it?

-

When designing in-store signage, retailers often develop yellow signs and shelf tags with bold lettering to catch the attention of consumers. The use of visuals in this manner represents the _____...

-

In a production facility, 1.2-in-thick, 2-ft = 2-ft square brass plates (r = 532.5 lbm/ft3 and cp = 0.091 Btu/lbm ¢ °F) that are initially at a uniform temperature of 75°F are heated by...

-

On July 1, Harding Construction purchases a bulldozer for $228,000. The equipment has a 8-year life with a residual value of $16,000. Harding uses straight-line depreciation a. Calculate the...

-

write a title Understanding the roots of modern educational practices can provide valuable insights into their effectiveness and potential for improvement. One such root influencing contemporary...

-

A company (which is not a member of a group) has the following results for the year to 31 March 2022: The company intends to make Gift Aid donations of 30,000 every six months, starting on 30...

-

A company calculates its corporation tax liability for the year to 31 August 2020 as 120,000 and pays this amount on 1 June 2021. The company's corporation tax return is submitted during August 2021...

-

What types of problems does inflation cause when financial statements are analyzed? (Appendix)

-

Your client who is currently using only Facebook and Instagram wants to try LinkedIn. What would you do first ? and why ?

-

Exro Technologies Corp. (Exro) is an upstart Canadian company that specializes in the manufacture of electric motors and batteries for electric bikes. Exro uses a job costing system and during...

-

How do neurobiological mechanisms, such as the stress response system and emotional regulation pathways, influence the dynamics of conflict escalation and resolution?

-

What is the consideration to invest in the company which has recorded revenue growth over the past 5 years but the Debt to Equity ratio also increase significantly to 5.72?

-

Builder Products, Incorporated, uses the weighted-average method in its process costing system. It manufactures a caulking compound that goes through three processing stages prior to completion....

-

Repeat Problem 9-182 using helium as the working fluid.

-

An educational researcher devised a wooden toy assembly project to test learning in 6-year-olds. The time in seconds to assemble the project was noted, and the toy was disassembled out of the childs...

-

Pauline (born May 1937) marries Adrian (born March 1935) on 17 October 2017 . Their income for 2017-18 is as follows: During 2017-18, Adrian pays maintenance of 4 ,000 to his former wife, as required...

-

Matthew (who was born on 1 May 1934) dies on 23 December 2017. His only income in tax year 2017 -18 is a retirement pension of 2 9,260. H e made a Gift Aid donation of 200 in July 2017. His wife has...

-

In 2017-18, Raj has dividend income of 58,400. He has no other income. He makes a qualifying Gift Aid donation of 440 during the year. Show his 2017-18 income tax computation.

-

(1 point) Bill makes annual deposits of $1900 to an an IRA earning 5% compounded annually for 14 years. At the end of the 14 years Bil retires. a) What was the value of his IRA at the end of 14...

-

Which of the following concerning short-term financing methods is NOT CORRECT? Short-term bank loans typically do not require assets as collateral. Firms generally have little control over the level...

-

Kingbird Corporation is preparing its December 31, 2017, balance sheet. The following items may be reported as either a current or long-term liability. 1. On December 15, 2017, Kingbird declared a...

Study smarter with the SolutionInn App