Pauline (born May 1937) marries Adrian (born March 1935) on 17 October 2017 . Their income for

Question:

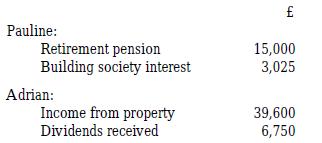

Pauline (born May 1937) marries Adrian (born March 1935) on 17 October 2017 . Their income for 2017-18 is as follows:

During 2017-18, Adrian pays maintenance of £4 ,000 to his former wife, as required by a court order. She has not remarried.

Show Pauline's and Adrian's income tax computations for 2017-18.

Transcribed Image Text:

Pauline: Retirement pension Building society interest Adrian: Income from property Dividends received 43 15,000 3,025 39,600 6,750

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

Without information on the specific tax laws and regulations that apply to the tax year 201718 its not possible to provide an exact income tax computa...View the full answer

Answered By

Nazrin Ziad

I am a post graduate in Zoology with specialization in Entomology.I also have a Bachelor degree in Education.I posess more than 10 years of teaching as well as tutoring experience.I have done a project on histopathological analysis on alcohol treated liver of Albino Mice.

I can deal with every field under Biology from basic to advanced level.I can also guide you for your project works related to biological subjects other than tutoring.You can also seek my help for cracking competitive exams with biology as one of the subjects.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Pauline (born August 1974) married Adrian (born March 1975) on 17 October 2022. Their income for 2022-23 is as follows: Pauline: Share of partnership profit Building society interest Adrian: Income...

-

Pauline (born August 1973) married Adrian (born March 1974) on 17 October 2021. Their income for 2021-22 is as follows: During 2021-22, Pauline paid interest of 450 on a loan which she used to buy a...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Evaluate the limit of the sequence or state that it does not exist. an || u8 n!

-

The following are the more stable anomers of the pyranose forms of D-glucose, D-mannose, and D-galactose:

-

An accounting professor at the University of California at Berkley was quoted in The Wall Street Journal (December 17, 1990) as saying, The most important items on the financial statements are trends...

-

C12.14. Cana firmhavea highPIE ratioyeta lowP/Bratio? Howwould youcharacterize the growth expectations forthis firm?

-

Stocks A and B have the following historical returns: a. Calculate the average rate of return for each stock during the 5-year period.b. Assume that someone held a portfolio consisting of 50% of...

-

Your Company sells exercise bikes for $675 each. The following cost formula relates to last year's operations: Y = $147,500 + $157X. Your Company sold 475 bikes last year, what was its net income...

-

Geoffrey's income for 2017-18 consists of a salary of 114,600 and dividends received of 4,400. He makes qualifying Gift Aid donations of 7,200 during the year . He is not a Scottish taxpayer....

-

Matthew (who was born on 1 May 1934) dies on 23 December 2017. His only income in tax year 2017 -18 is a retirement pension of 2 9,260. H e made a Gift Aid donation of 200 in July 2017. His wife has...

-

Suppose that X has the normal distribution with mean and variance 2. Express E(X3) in terms of and 2.

-

According to the College Board website, the scores on the math part of the SAT (SAT-M) in a certain year had a mean of 507 and a standard deviation of 111. Assume that SAT scores follow a normal...

-

Pay and incentive programs are being used both for knowledge workers and in non-knowledge worker occupations. In every industry, from restaurants to construction and low-tech manufacturing, companies...

-

Closet International invested in an equipment in 2019 with an initial cost of $598,000. It falls under asset class 8 with a CCA rate of 20%. The equipment was sold in 2021 for $260,000. Calculate the...

-

Question 4 (30 Marks) A 12-ply Kevlar/Epoxy composite beam with layup [0/90 / 0 1s is loaded in 3-point bending, as shown in Figure Q4. The beam has a length, L of 100mm, a width, b of 25mm and a...

-

Scenario: You have been working in a community service sector for two years. However, you always find evaluating your own performance challenging. Your Supervisor has also identified that you do not...

-

(i) Show that the class A* (= ) defined in Exercise 15 contains the class defined by = {B ( (; either B = ! for some A ( A, or B ( N for some N ( A with (N) = 0}. (That is is taken from A by...

-

C- Consider the following scenario:- A supermarket needs to develop the following software to encourage regular customers. For this, the customer needs to supply his/her residence address, telephone...

-

Klarke plc acquired a subsidiary, Cameroon Ltd, on 1 October 2017. The statements of financial position of Klarke plc and Cameroon Ltd as at 30 September 2018 are as follows: Additional data: (i) The...

-

PP Ltd acquired 65% of the ordinary share capital of QQ Ltd on 1 January 2017. There are no preference shares. The statements of comprehensive income of the two companies for the year to 31 December...

-

FF Ltd acquired 80% of the ordinary share capital of GG Ltd on 1 April 2014. On that date, the retained earnings of GG Ltd were ?18,260. There are no preference shares. The statements of...

-

Imagine you are an Investor in the Stock Market. Identify three companies in the Korean Stock Market (KOSPI) where you would like to invest. Explain your answer

-

Domino is 4 0 years old and is married out of community of property with the exclusion of the accrual system to Dolly ( 3 5 ) . They have one child, Domonique, who is 1 1 years old. Domino resigned...

-

YOU ARE CREATING AN INVESTMENT POLICY STATEMENT FOR JANE DOE General: 60 years old, 3 grown children that are living on their own and supporting themselves. She is in a very low tax rate so we don't...

Study smarter with the SolutionInn App