PP Ltd acquired 65% of the ordinary share capital of QQ Ltd on 1 January 2017. There

Question:

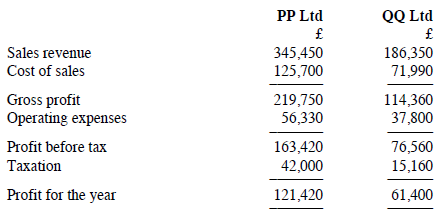

PP Ltd acquired 65% of the ordinary share capital of QQ Ltd on 1 January 2017. There are no preference shares. The statements of comprehensive income of the two companies for the year to 31 December 2017 are as follows:

Required:

Prepare a consolidated statement of comprehensive income for the year to 31 December 2017.

Transcribed Image Text:

PP Ltd QQ Ltd Sales revenue Cost of sales 345,450 125,700 186,350 71,990 Gross profit Operating expenses 219,750 56,330 114,360 37,800 Profit before tax 163,420 42,000 76,560 15,160 Тахаtion Profit for the year 121,420 61,400

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (10 reviews)

PP Ltd Consolidated statement of comprehensive income For the year to 31 December 2017 Sa...View the full answer

Answered By

Bright Student

sfadfsdfdsa fdsafdsafsadsfsdafffffffffffdsafdfasdafsdffdfsdfdsfsafsdfdfasf

0.00

0 Reviews

16+ Question Solved

Related Book For

International Financial Reporting A Practical Guide

ISBN: 978-1292200743

6th edition

Authors: Alan Melville

Question Posted:

Students also viewed these Business questions

-

On 31 December 2017, A3 Ltd paid ?550,000 to acquire 80% of the ordinary share capital of A4 Ltd. The statements of financial position of the two companies just after this transaction were as...

-

FF Ltd acquired 80% of the ordinary share capital of GG Ltd on 1 April 2014. On that date, the retained earnings of GG Ltd were ?18,260. There are no preference shares. The statements of...

-

On 1 March 2018, YY Ltd acquired 85% of the ordinary share capital of ZZ Ltd. There are no preference shares. Both companies prepare financial statements to 31 October each year. Transactions between...

-

We have titrated natural water in which the primary buffering agent is carbonate species and understood how to predict the titration curve using the equilibrium constants of those weak acids. Plot...

-

Examine the structure of cyclosporin A (page 503). a. By drawing a dashed line at each peptide bond, deduce how many amino acid units are present in cyclosporin A. b. Three of the units are...

-

Using the break-even formula, determine the number of hours required to break even: annual fixed costs $62,000; charter revenue per hour $275; and operating costs per hour $189. a. 225 c. 500 b. 328...

-

7.1 Why do firms need to give credit, with the consequent risk of non-payment?

-

Pen Ltd. acquired an 85% interest in Silk Corp. on December 31, Year 1, for $646,000. On that date, Silk had common shares of $500,000 and retained earnings of $100,000. The imputed acquisition...

-

PROBLEM 2 [40 points) Unearned Fees; Brenda Wells, Capital; Brenda Wells, Drawing; Professional Few Set up Taccounts for Cash; Accounts Receivable; Supplies; Accounts Payable; (Revenues); and...

-

Assume that you are the chairman of the Department of Accountancy at Central Manitoba University. One of the accounting professors in your department, Dr. Smith, has been uniformly regarded by...

-

Klarke plc acquired a subsidiary, Cameroon Ltd, on 1 October 2017. The statements of financial position of Klarke plc and Cameroon Ltd as at 30 September 2018 are as follows: Additional data: (i) The...

-

The Managing Director of Wraymand plc has asked you to prepare the statement of comprehensive income for the group. The company has one subsidiary undertaking, Blonk Ltd. The statements of...

-

What data pattern would suggest the use of a Winters' exponential smoothing model?

-

The Tip Calculator app does not need a Button to perform its calculations. Reimplement this app to use property listeners to perform the calculations whenever the user modifies the bill amount or...

-

A particle, carrying a positive charge of \(4 \mathrm{nC}\), located at \((5 \mathrm{~cm}, 0)\) on the \(x\)-axis experiences an attractive force of magnitude 115.2 \(\mathrm{N}\) due to an unknown...

-

A large-sized chemical company is considering investing in a project that costs `5,00,000. The estimated salvage value is zero; tax rate is 35 per cent. The company uses straight line method of...

-

From the following budgeted and actual figures, calculate and present the variances in respect of profit on sales and cost of sales. Budget: Sales, 2,000 units @ 15 each Cost of sales @ 12 each...

-

(a) From the following data of a manufacturing unit, find out (i) sales to break-even and (ii) sales to earn a profit of 8,000. (b) The following information is available for companies A and B. (i)...

-

List the sequences of the mRNA molecules transcribed from the following template DNA sequences: a. T G A A C T A C G G T A C C A T A C b. G C A C T A A A G A T C

-

Derive Eq. (18.33) from Eq. (18.32).

-

A company has the following results for the four years to 31 March 2023: Calculate the total repayment of corporation tax (with interest) to which the company is entitled, assuming that: (a) all...

-

A company's taxable total profits for the year to 31 March 2022 are 400,000. In the year to 31 March 2023, the company incurs a trading loss of 700,000 but has other taxable income and gains...

-

A company has the following results for its three most recent accounting periods: Assuming that all possible claims are made to relieve the trading loss against total profits, calculate the company's...

-

A single taxpayer who makes $34,024 per year in gross employment income has an 17 year old son who has a mental infirmity (but is not eligible to claim the disability tax credit). He pays $3,219 per...

-

The trial balance of Oriole Company at the end of its fiscal year, August 31, 2017, includes these accounts: Beginning Inventory $18,870; Purchases $224,790; Sales Revenue $204,200; Freight-In...

-

Question 9 5 pts Depreciation expense $4,000 Add $4,000 to operating Subtract $4,000 to operating Question 10 5 pts Issued bonds for $6,000 o Operating O Investing Financing

Study smarter with the SolutionInn App