A company has the following results for its three most recent accounting periods: Assuming that all possible

Question:

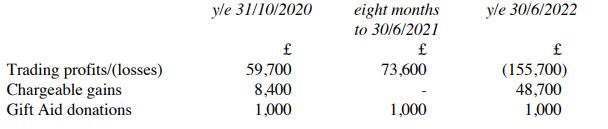

A company has the following results for its three most recent accounting periods:

Assuming that all possible claims are made to relieve the trading loss against total profits, calculate the company's taxable total profits for each of the three periods.

Transcribed Image Text:

Trading profits/(losses) Chargeable gains Gift Aid donations yle 31/10/2020 59,700 8,400 1,000 eight months to 30/6/2021 73,600 1,000 yle 30/6/2022 (155,700) 48,700 1,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (4 reviews)

Trading income Chargeable gains Less Trade loss relief a Less Trade loss relief b ...View the full answer

Answered By

Nazrin Ziad

I am a post graduate in Zoology with specialization in Entomology.I also have a Bachelor degree in Education.I posess more than 10 years of teaching as well as tutoring experience.I have done a project on histopathological analysis on alcohol treated liver of Albino Mice.

I can deal with every field under Biology from basic to advanced level.I can also guide you for your project works related to biological subjects other than tutoring.You can also seek my help for cracking competitive exams with biology as one of the subjects.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

A 1199 kg mass car travels with a constant speed of v = 50 km/hour towards a hill that has a semicircular cross section of radius, R = 70 m in a region near the top of the hill as shown in the...

-

A company has the following results for the four years to 31 March 2023: Calculate the total repayment of corporation tax (with interest) to which the company is entitled, assuming that: (a) all...

-

A company has the following results for the year to 31 October 2021: Assuming that a claim is made to relieve the trading loss against total profits of the lossmaking accounting period, calculate the...

-

Joe must decide how much ice-cream to stock in his ice-cream truck that he drives around Grand Blanc, MI. Ice cream sells for $9.3 per lb (pound) and costs $3.2 per lb. At the end of the day any...

-

A wet cooling tower is to cool 60 kg/s of water from 40 to 26°C. Atmospheric air enters the tower at 1 atm with dry- and wet-bulb temperatures of 22 and 16°C, respectively, and leaves at...

-

What are the functional and dysfunctional elements of the culture? What can you begin to do to change the culture? AppendixLO1

-

Using the steps in the AIDA model, explain why a potential consumer in question 1 who views rag & bones advertising may not be ready to go out and purchase a new pair of jeans.

-

Hiatt Company sells automatic can openers under a 75-day warranty for defective merchandise. Based on past experience, Hiatt estimates that 3% of the units sold will become defective during the...

-

Which of the subsequent assertions is untrue? A. Corporate governance contributes to the operation of a sufficient and suitable system of controls inside a firm, allowing for the protection of...

-

A major credit card company (call it MasterDebt) receives checks from all different regions in the country on a daily basis. Once these checks are mailed, the time a check spends in the mail (called...

-

A company's taxable total profits for the year to 31 March 2022 are 400,000. In the year to 31 March 2023, the company incurs a trading loss of 700,000 but has other taxable income and gains...

-

Which of the following statements is true? (a) Capital losses may be carried forward and relieved against future trading profits. (b) Trading losses may be carried forward for relief against future...

-

Air Spares is a wholesaler that stocks engine components and test equipment for the commercial aircraft industry. A new customer has placed an order for 10 high-bypass turbine engines, which increase...

-

Given the following differential equation, dydx = sin ( x + y ) Find the following: ( a ) The substitution u = ( b ) The transformed differential equation dudx = ( c ) The implicit solution, given...

-

Consider the following type declarations TYPE Alinteger; A2 pointer to float; A3 pointer to integer; T1 structure (x: integer; } T2 structure (x: A1; next pointer to integer; } b float; } a :...

-

https://www.viddler.com/embed/82b62f65 Questions: How do companies decide where to locate their facilities? Why has just-in-time inventory control become a dominant production process used in the...

-

Adjusting Entries for Interest At December 31 of Year 1, Portland Corporation had two notes payable outstanding (notes 1 and 2). At December 31 of Year 2, Portland also had two notes payable...

-

We want to get an idea of the actual mass of 235U involved in powering a nuclear power plant. Assume that a single fission event releases 200 MeV of thermal energy. A 1,000 MWe electric power plant...

-

In an ideal Otto cycle, air is compressed from 1.20 kg/m3 and 2.2 to 0.26 L, and the net work output of the cycle is 440 kJ/kg. The mean effective pressure (MEP) for this cycle is (a) 612 kPa (b) 599...

-

suppose a nickel-contaminated soil 15 cm deep contained 800 mg/kg Ni, Vegetation was planted to remove the nickel by phytoremediation. The above-ground plant parts average 1% Ni on a dry-weight bas...

-

An interest in possession trust with one life tenant has the following income in 2017-18: (a) Compute the trustees' income tax liability for 2017-18. (b) How much income does the life tenan t receive...

-

For each of the following savers, identify the further ISA investments that may be made during tax year 2017-18: (a) Alexander saves 500 in a cash ISA on 26 April 2017. (b) Bianca saves 6,000 in a...

-

In 2017-18, Alfred had business profits of 15,8 70 and received net debenture interest of 1,520. He acquired the debentures on 1 July 2017 and accrued interest (gross) on 5 April 2018 was 950....

-

Maddox Resources has credit sales of $ 1 8 0 , 0 0 0 yearly with credit terms of net 3 0 days, which is also the average collection period. Maddox does not offer a discount for early payment, so its...

-

Selk Steel Co., which began operations on January 4, 2017, had the following subsequent transactions and events in its long-term investments. 2017 Jan. 5 Selk purchased 50,000 shares (25% of total)...

-

Equipment with a book value of $84,000 and an original cost of $166,000 was sold at a loss of $36,000. Paid $100,000 cash for a new truck. Sold land costing $330,000 for $415,000 cash, yielding a...

Study smarter with the SolutionInn App