Question

Mr. Chan purchased a property at $8,500,000 four years ago. He borrowed 55% from a bank through mortgage at a rate of 3.6% p.a.

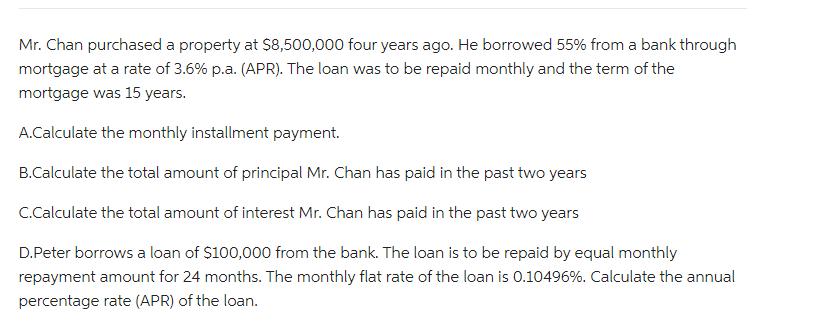

Mr. Chan purchased a property at $8,500,000 four years ago. He borrowed 55% from a bank through mortgage at a rate of 3.6% p.a. (APR). The loan was to be repaid monthly and the term of the mortgage was 15 years. A.Calculate the monthly installment payment. B.Calculate the total amount of principal Mr. Chan has paid in the past two years C.Calculate the total amount of interest Mr. Chan has paid in the past two years D.Peter borrows a loan of $100,000 from the bank. The loan is to be repaid by equal monthly repayment amount for 24 months. The monthly flat rate of the loan is 0.10496%. Calculate the annual percentage rate (APR) of the loan.

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Engineering Economic Analysis

Authors: Donald Newnan, Ted Eschanbach, Jerome Lavelle

9th Edition

978-0195168075, 9780195168075

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App