Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Chandler, the production supervisor, bursts into your office, carrying the company's prior year performance report and thundering, There is villainy here, sir! And

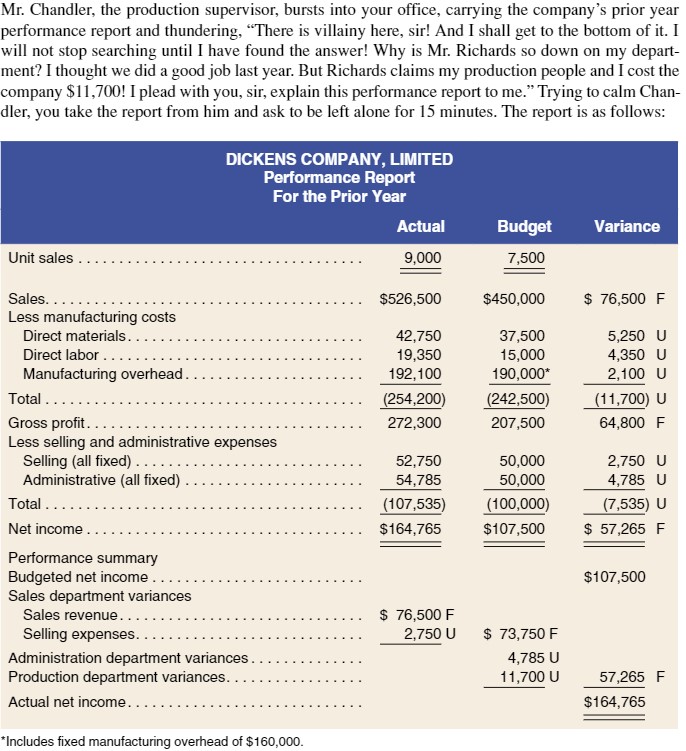

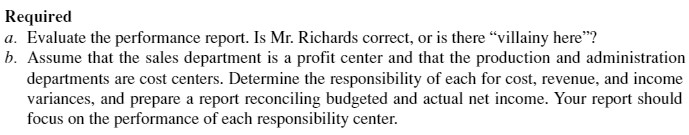

Mr. Chandler, the production supervisor, bursts into your office, carrying the company's prior year performance report and thundering, "There is villainy here, sir! And I shall get to the bottom of it. I will not stop searching until I have found the answer! Why is Mr. Richards so down on my depart- ment? I thought we did a good job last year. But Richards claims my production people and I cost the company $11,700! I plead with you, sir, explain this performance report to me." Trying to calm Chan- dler, you take the report from him and ask to be left alone for 15 minutes. The report is as follows: DICKENS COMPANY, LIMITED Performance Report For the Prior Year Actual Budget Variance Unit sales.. 9,000 7,500 Sales... $526,500 $450,000 $ 76,500 F Less manufacturing costs Direct materials.. 42,750 37,500 5,250 U Direct labor .... 19,350 15,000 4,350 U Manufacturing overhead. 192,100 190,000* 2,100 U Total..... (254,200) (242,500) (11,700) U Gross profit.... 272,300 207,500 64,800 F Less selling and administrative expenses Selling (all fixed) ..... 52,750 50,000 2,750 U Administrative (all fixed). 54,785 50,000 4,785 U Total.... (107,535) (100,000) (7,535) U Net income.. $164,765 $107,500 $ 57,265 F Performance summary Budgeted net income. Sales department variances Sales revenue.. $107,500 Selling expenses. Administration department variances. Production department variances.. Actual net income..... *Includes fixed manufacturing overhead of $160,000. $ 76,500 F 2,750 U $ 73,750 F 4,785 U 11,700 U 57,265 F $164,765 Required a. Evaluate the performance report. Is Mr. Richards correct, or is there "villainy here"? b. Assume that the sales department is a profit center and that the production and administration departments are cost centers. Determine the responsibility of each for cost, revenue, and income variances, and prepare a report reconciling budgeted and actual net income. Your report should focus on the performance of each responsibility center.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started