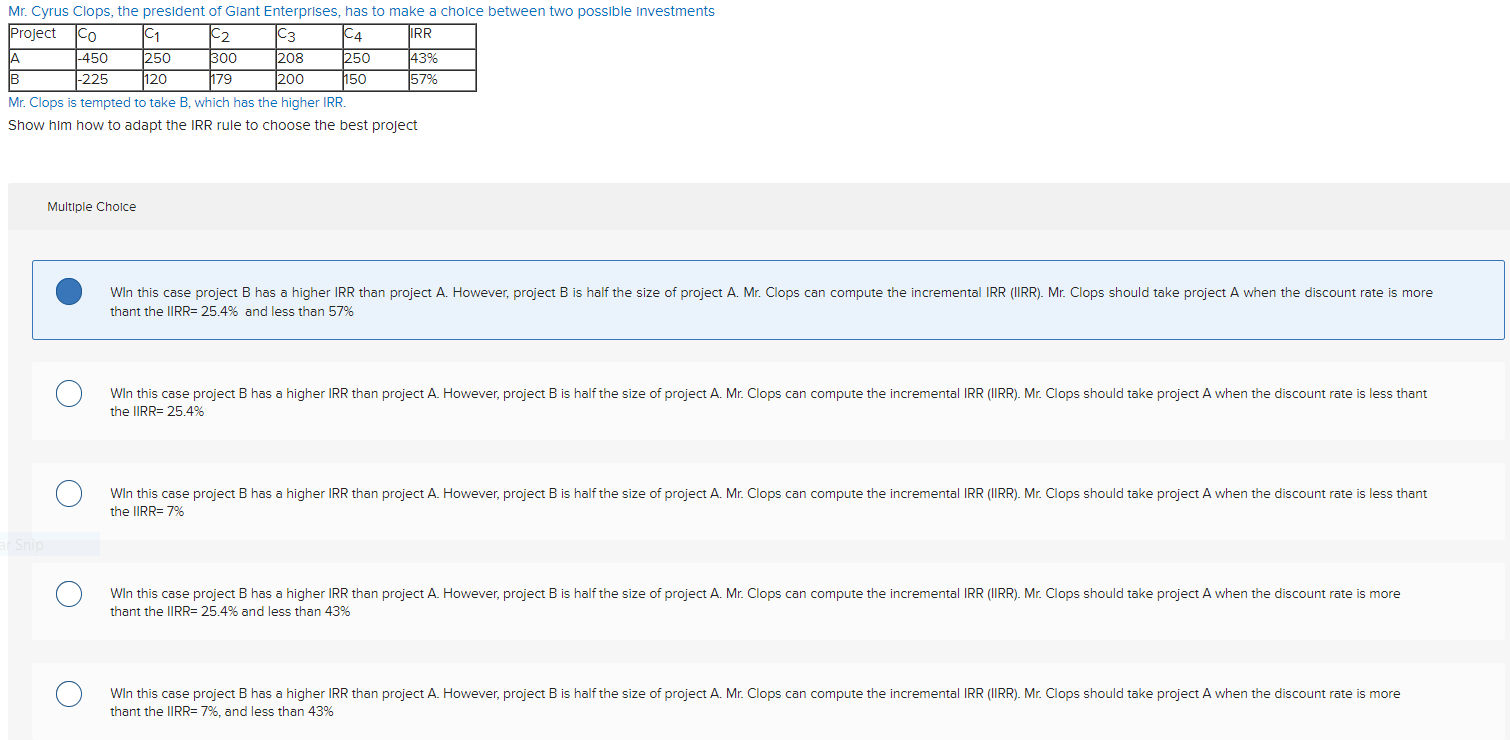

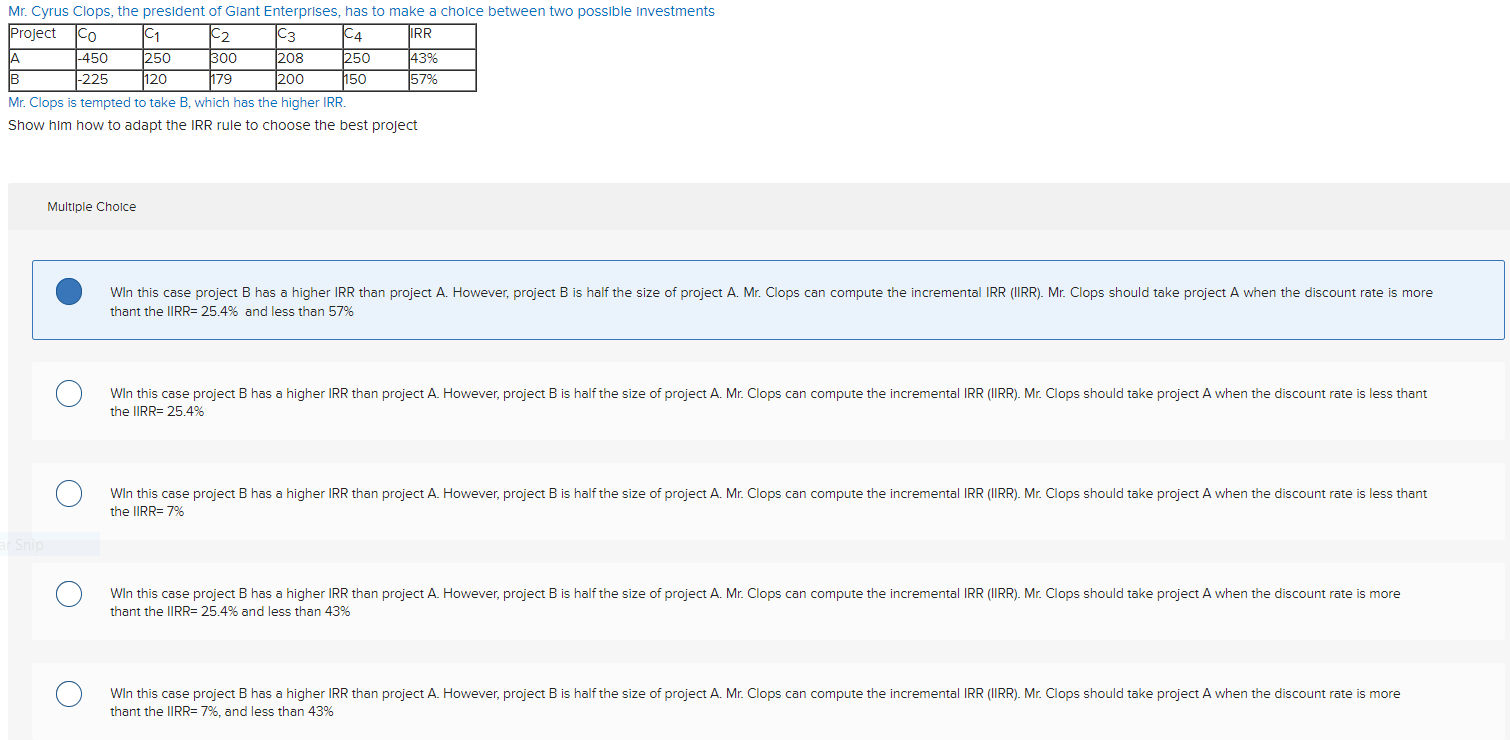

Mr. Cyrus Clops, the president of Giant Enterprises, has to make a choice between two possible investments Project Co C1 C2 C3 C4 IRR IA -450 250 300 208 250 43% B -225 120 1179 200 1150 57% Mr. Clops is tempted to take B, which has the higher IRR. Show him how to adapt the IRR rule to choose the best project Multiple Choice Win this case project B has a higher IRR than project A. However, project B is half the size of project A. Mr. Clops can compute the incremental IRR (IIRR). Mr. Clops should take project A when the discount rate is more thant the IRR= 25.4% and less than 57% Win this case project B has a higher IRR than project A. However, project B is half the size of project A. Mr. Clops can compute the incremental IRR (IIRR). Mr. Clops should take project A when the discount rate is less thant the IRR= 25.4% Win this case project B has a higher IRR than project A. However, project B is half the size of project A. Mr. Clops can compute the incremental IRR (IIRR). Mr. Clops should take project A when the discount rate is less thant the IIRR= 7% Win this case project B has a higher IRR than project A. However, project B is half the size of project A. Mr. Clops can compute the incremental IRR (IRR). Mr. Clops should take project A when the discount rate is more thant the IIRR= 25.4% and less than 43% O Win this case project B has a higher IRR than project A. However, project B is half the size of project A. Mr. Clops can compute the incremental IRR (IRR). Mr. Clops should take project A when the discount rate is more thant the IRR= 7%, and less than 43% Mr. Cyrus Clops, the president of Giant Enterprises, has to make a choice between two possible investments Project Co C1 C2 C3 C4 IRR IA -450 250 300 208 250 43% B -225 120 1179 200 1150 57% Mr. Clops is tempted to take B, which has the higher IRR. Show him how to adapt the IRR rule to choose the best project Multiple Choice Win this case project B has a higher IRR than project A. However, project B is half the size of project A. Mr. Clops can compute the incremental IRR (IIRR). Mr. Clops should take project A when the discount rate is more thant the IRR= 25.4% and less than 57% Win this case project B has a higher IRR than project A. However, project B is half the size of project A. Mr. Clops can compute the incremental IRR (IIRR). Mr. Clops should take project A when the discount rate is less thant the IRR= 25.4% Win this case project B has a higher IRR than project A. However, project B is half the size of project A. Mr. Clops can compute the incremental IRR (IIRR). Mr. Clops should take project A when the discount rate is less thant the IIRR= 7% Win this case project B has a higher IRR than project A. However, project B is half the size of project A. Mr. Clops can compute the incremental IRR (IRR). Mr. Clops should take project A when the discount rate is more thant the IIRR= 25.4% and less than 43% O Win this case project B has a higher IRR than project A. However, project B is half the size of project A. Mr. Clops can compute the incremental IRR (IRR). Mr. Clops should take project A when the discount rate is more thant the IRR= 7%, and less than 43%