Question

Mr Faizal, the newly appointed accountant of Woody Bhd, found difficulty in preparing the statement of cash flows for the company. He was also struggling

Mr Faizal, the newly appointed accountant of Woody Bhd, found difficulty in preparing the statement of cash flows for the company. He was also struggling in understanding the importance of the statement of cash flows to investors, creditors and lenders. He seeks for Mr Nizaam s advice. In preparing the statement of cash flows, Mr Nizaam and his team discovered the following transactions for Woody Bhd. During the year, the company had sold an obsolete equipment, with a cost of RM70,000 and an accumulated depreciation of RM40,000, for cash at a loss of RM5,000. The company had also purchased a new equipment costing RM140,000 to replace the obsolete equipment. 60% of the payment for the purchase of equipment was made by cash, and the remaining balance was by note payable. All sales and purchases of goods were made on credit. All other proceeds and payments were made by cash, unless stated otherwise.

Required:

Prepare the statement of cash flows for Zoulman Bhd for the year ended 31 December 2019 using: the indirect method?

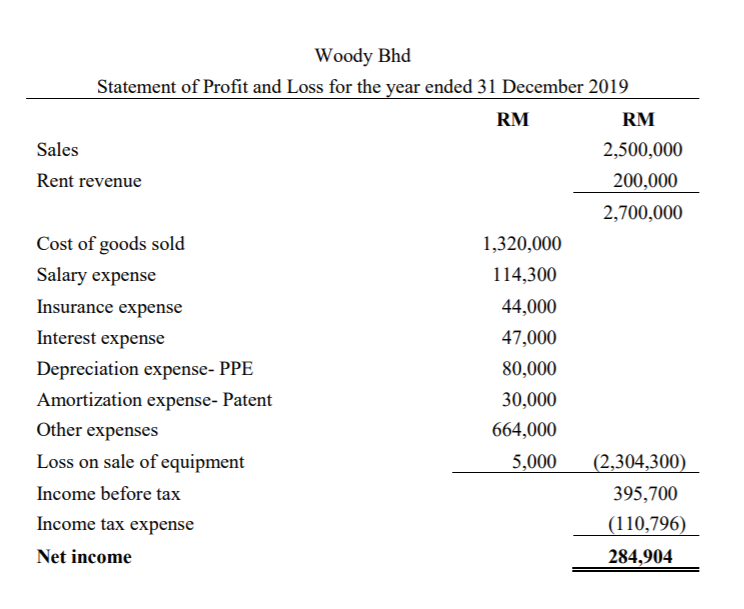

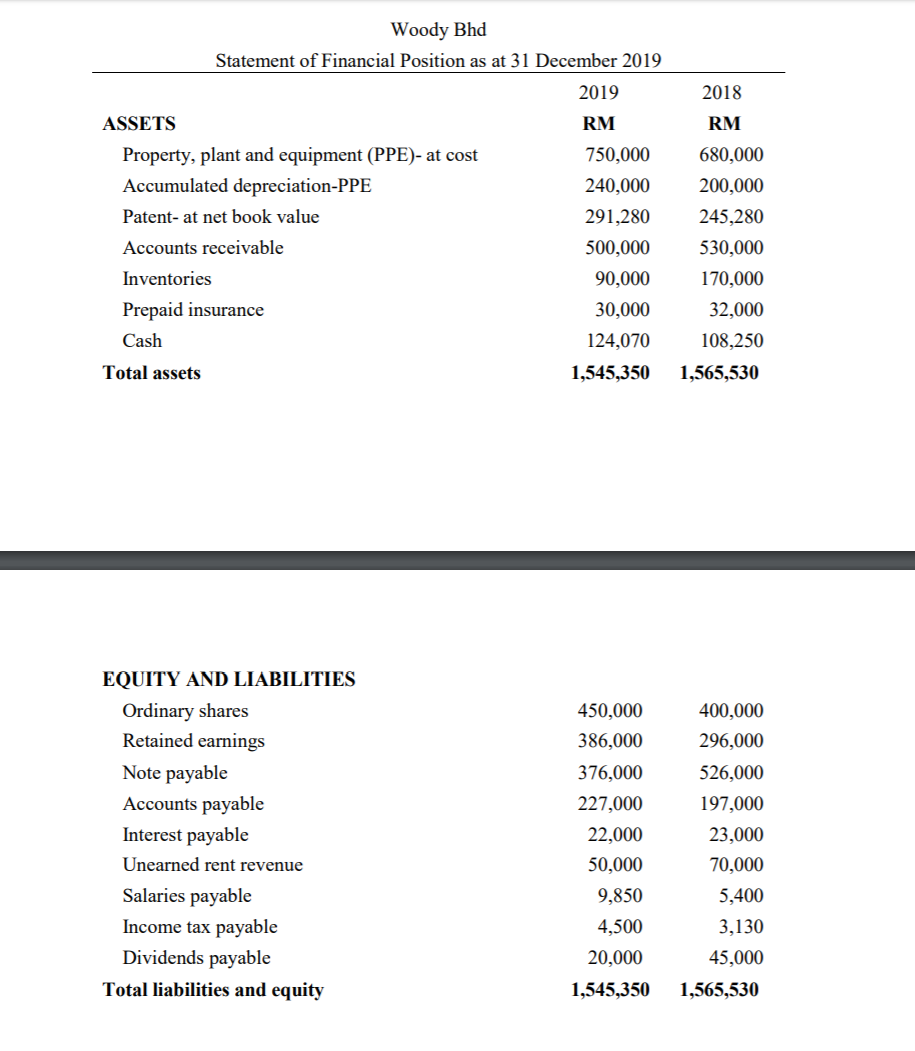

Woody Bhd Statement of Profit and Loss for the year ended 31 December 2019 RM RM Sales 2,500,000 Rent revenue 200,000 2,700,000 Cost of goods sold 1,320,000 Salary expense 114,300 Insurance expense 44,000 Interest expense 47,000 Depreciation expense- PPE 80,000 Amortization expense- Patent 30,000 Other expenses 664,000 Loss on sale of equipment 5,000 (2,304,300) Income before tax 395,700 Income tax expense (110,796) Net income 284,904 Woody Bhd Statement of Financial Position as at 31 December 2019 2019 2018 RM RM ASSETS Property, plant and equipment (PPE)- at cost Accumulated depreciation-PPE Patent- at net book value Accounts receivable Inventories Prepaid insurance Cash 750,000 240,000 291,280 500,000 90,000 30,000 124,070 1,545,350 680,000 200,000 245,280 530,000 170,000 32,000 108,250 1,565,530 Total assets EQUITY AND LIABILITIES Ordinary shares Retained earnings Note payable Accounts payable Interest payable Unearned rent revenue Salaries payable Income tax payable Dividends payable Total liabilities and equity 450,000 386,000 376,000 227,000 22,000 50,000 9,850 4,500 20,000 1,545,350 400,000 296,000 526,000 197,000 23,000 70,000 5,400 3,130 45,000 1,565,530Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started