Answered step by step

Verified Expert Solution

Question

1 Approved Answer

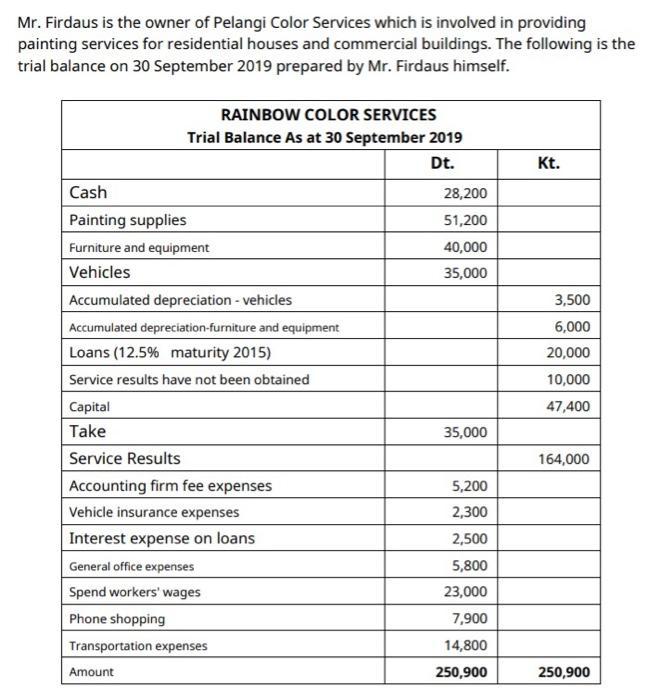

Mr. Firdaus is the owner of Pelangi Color Services which is involved in providing painting services for residential houses and commercial buildings. The following

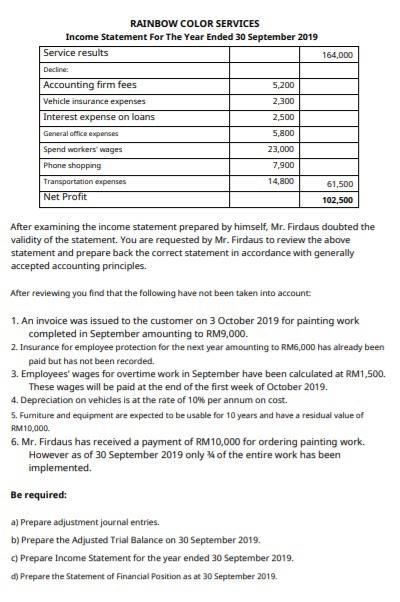

Mr. Firdaus is the owner of Pelangi Color Services which is involved in providing painting services for residential houses and commercial buildings. The following is the trial balance on 30 September 2019 prepared by Mr. Firdaus himself. RAINBOW COLOR SERVICES Trial Balance As at 30 September 2019 Dt. Kt. Cash Painting supplies Furniture and equipment Vehicles Accumulated depreciation - vehicles Accumulated depreciation-furniture and equipment Loans (12.5% maturity 2015) Service results have not been obtained Capital Take Service Results Accounting firm fee expenses Vehicle insurance expenses Interest expense on loans General office expenses Spend workers' wages Phone shopping Transportation expenses Amount 28,200 51,200 40,000 35,000 35,000 5,200 2,300 2,500 5,800 23,000 7,900 14,800 250,900 3,500 6,000 20,000 10,000 47,400 164,000 250,900 RAINBOW COLOR SERVICES Income Statement For The Year Ended 30 September 2019 Service results Decline: Accounting firm fees 5,200 Vehicle insurance expenses 2,300 Interest expense on loans 2,500 General office expenses 5,800 Spend workers wages 23,000 Phone shopping 7,900 14,800 61,500 Transportation expenses Net Profit 102,500 After examining the income statement prepared by himself, Mr. Firdaus doubted the validity of the statement. You are requested by Mr. Firdaus to review the above statement and prepare back the correct statement in accordance with generally accepted accounting principles. After reviewing you find that the following have not been taken into account 1. An invoice was issued to the customer on 3 October 2019 for painting work completed in September amounting to RM9,000. 2. Insurance for employee protection for the next year amounting to RM6,000 has already been paid but has not been recorded. 3. Employees' wages for overtime work in September have been calculated at RM1,500. These wages will be paid at the end of the first week of October 2019. 4. Depreciation on vehicles is at the rate of 10% per annum on cost. 5. Furniture and equipment are expected to be usable for 10 years and have a residual value of RM10,000. 6. Mr. Firdaus has received a payment of RM10,000 for ordering painting work. However as of 30 September 2019 only % of the entire work has been implemented. Be required: a) Prepare adjustment journal entries. b) Prepare the Adjusted Trial Balance on 30 September 2019. c) Prepare Income Statement for the year ended 30 September 2019. d) Prepare the Statement of Financial Position as at 30 September 2019. 164,000

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SNO Accounts Debit Credit 1 Accounts receivable 9000 Services fees revenue 9000 2 Prepaid insurance 6000 Cash 6000 3 Wages and salaries expense 1500 W...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started