Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Fox, a single taxpayer, recognized a $64,000 long-term capital gain, a $14,300 short-term capital gain, and a $12,900 long-term capital loss. Required: Compute Mr.

Mr. Fox, a single taxpayer, recognized a $64,000 long-term capital gain, a $14,300 short-term capital gain, and a $12,900 long-term capital loss.

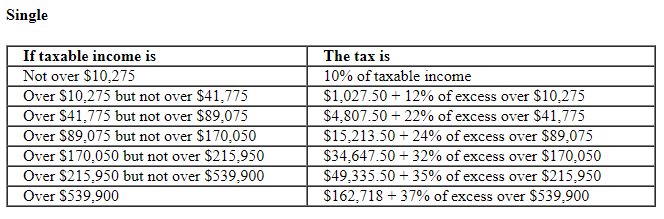

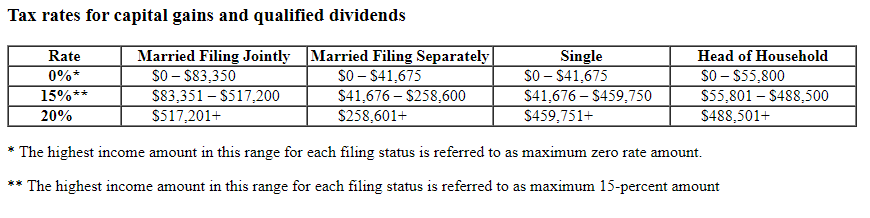

Required: Compute Mr. Foxs income tax and Medicare contribution tax if his taxable income before consideration of his capital transactions is $451,000. Use Individual tax rate schedules and Tax rates for capital gains and qualified dividends. Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.

PLEASE SOLVE FOR:

PLEASE SOLVE FOR:

|

Single Tax rates for capital gains and qualified dividends * The highest income amount in this range for each filing status is referred to as maximum zero rate amount. ** The highest income amount in this range for each filing status is referred to as maximum 15 -percent amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started