Question

Mr. Fox, a single taxpayer, recognized a $64,000 long-term capital gain, a $14,300 short-term capital gain, and a $12,900 long-term capital loss. Required: Compute

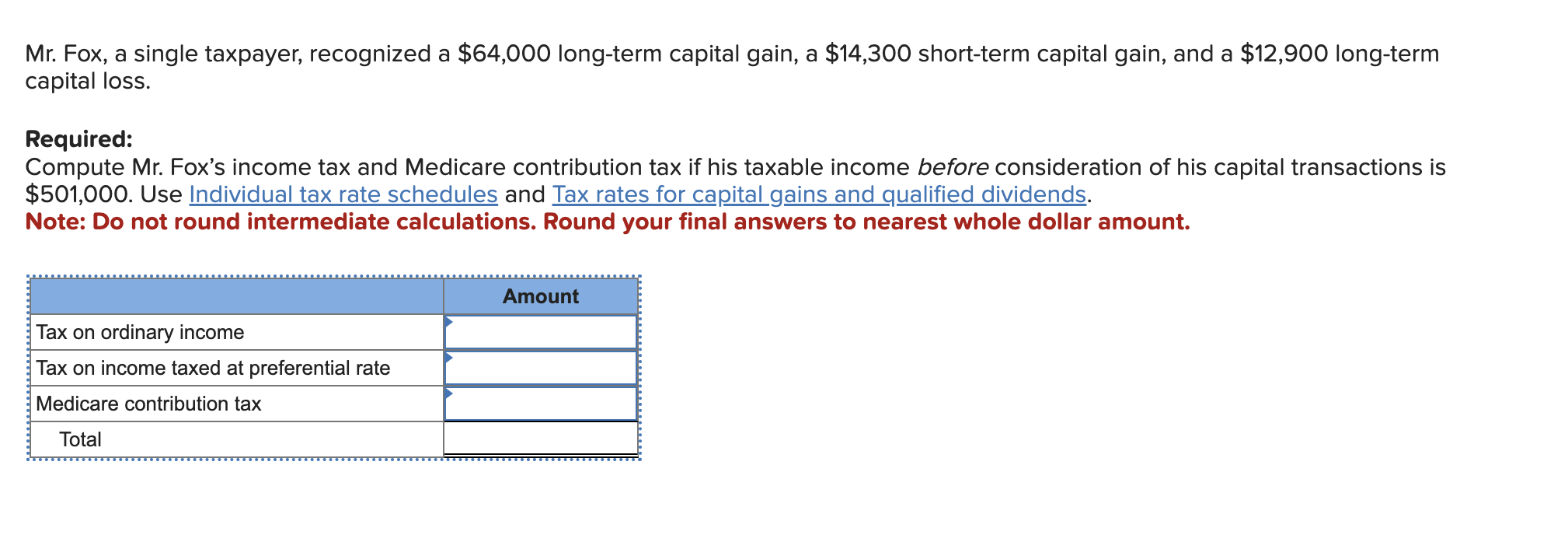

Mr. Fox, a single taxpayer, recognized a $64,000 long-term capital gain, a $14,300 short-term capital gain, and a $12,900 long-term capital loss. Required: Compute Mr. Fox's income tax and Medicare contribution tax if his taxable income before consideration of his capital transactions is $501,000. Use Individual tax rate schedules and Tax rates for capital gains and qualified dividends. Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar amount. Tax on ordinary income Tax on income taxed at preferential rate Medicare contribution tax Total Amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Mr Foxs Capital Gains and Losses First lets calculate the net capital gain Net longterm capit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Taxation For Business And Investment Planning 2019 Edition

Authors: Sally Jones, Shelley C. Rhoades Catanach, Sandra R Callaghan

22nd Edition

9781259917097, 1259917096, 978-1260161472

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App