Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Gates bought an interest in zinc ore assets for $45,000. It was estimated that the recoverable amount of zinc ore was 22,000 lbs.

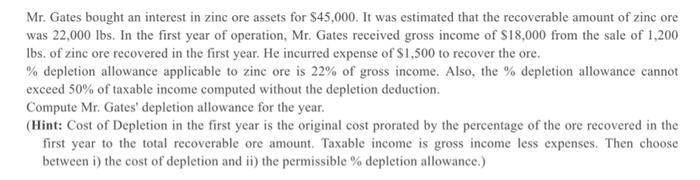

Mr. Gates bought an interest in zinc ore assets for $45,000. It was estimated that the recoverable amount of zinc ore was 22,000 lbs. In the first year of operation, Mr. Gates received gross income of $18,000 from the sale of 1,200 lbs. of zinc ore recovered in the first year. He incurred expense of $1,500 to recover the ore. % depletion allowance applicable to zinc ore is 22% of gross income. Also, the % depletion allowance cannot exceed 50% of taxable income computed without the depletion deduction. Compute Mr. Gates' depletion allowance for the year. (Hint: Cost of Depletion in the first year is the original cost prorated by the percentage of the ore recovered in the first year to the total recoverable ore amount. Taxable income is gross income less expenses. Then choose between i) the cost of depletion and ii) the permissible % depletion allowance.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER Solution the As the question is related to Depletion Allowance for the year Cast of Deple...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started