Question

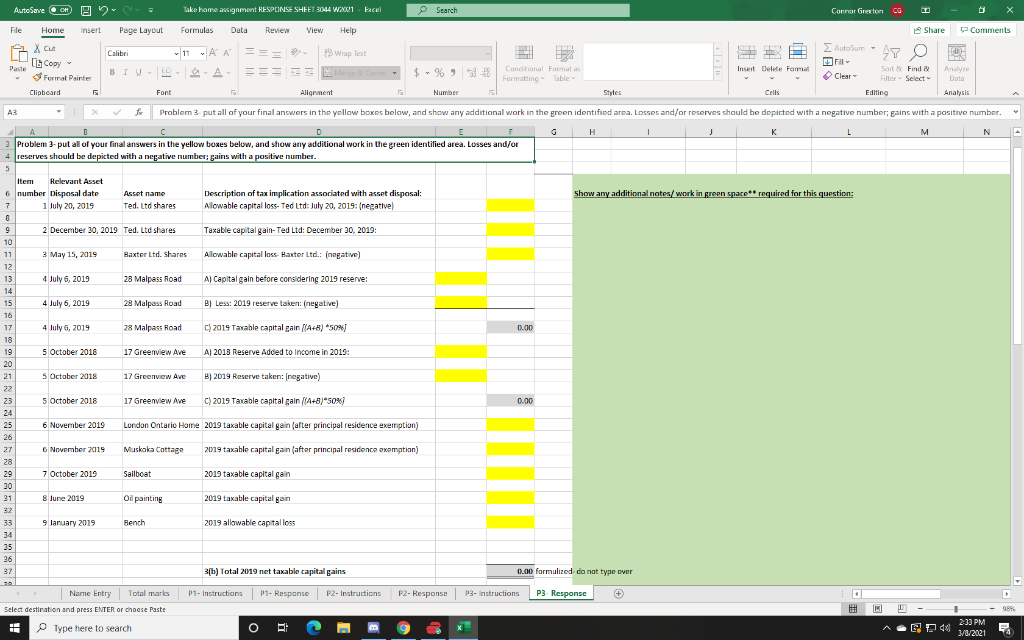

Mr. Geoffrey Guo had a variety of transactions during the 2019 year. Determine the total taxable capital gains included in Mr. Guo's division B income.

Mr. Geoffrey Guo had a variety of transactions during the 2019 year. Determine the total taxable capital gains included in Mr. Guo's division B income. The transactions included:

1. On January 1, 2019, Geoffrey purchased 2100 shares of Ted Ltd. at $25 per share and 500 shares at $30 per share on February 5, 2019. He sold 250 of these shares on July 20, 2019 at $23 per share.

2. On September 30, 2019, he purchased an additional 850 shares of Ted. Ltd. at $29 per share. On December 30, 2019, he sold 280 Ted Ltd. shares at $65 per share.

3. Geoffrey owns 3300 shares of Baxter Ltd. with an adjusted cost base of $14 per share. On May 15, 2019, he sells all 3300 Baxter Ltd. shares at $7 per share. On May 20, 2019, he acquires 1290 shares of Baxter Ltd. at a cost of $4 per share and is still holding these shares at the end of the year.

4. On July 6, 2019, Geoffrey sells a capital property (28 Malpass Road) with an adjusted cost base of $130000 for proceeds of disposition of $370000. In 2019, he receives $80,000 in cash, along with the purchaser's note for the balance of the proceeds. The note is to be repaid in full ($290000) in five years. Assume that Geoffrey deducts the maximum capital gains reserve.

5. In October, 2018, Geoffrey sold a different capital property (17 Greenview Ave) with an adjusted cost base of $115000 for proceeds of disposition of $210000. In 2018, he received $75,000 in cash, along with the purchaser's note for the balance of the proceeds. The note is to be repaid at the rate of $2,500 per year beginning in 2019. He receives the 2019 payment of $2,500 in full. Assume that Geoffrey deducts the maximum capital gains reserve in both 2018 and 2019.

6. Geoffrey purchased his first home in London, Ontario in 2008 at a cost of $51000. In 2012, he also purchased a cottage in Muskoka for $100000. In November, 2019, both properties are sold, the house for $195000 and the cottage for $180000. Both of these properties can qualify as a principal residence for him. He will designate the principal residence exemption in such a way that will minimize the taxable capital gains that he must report on the sale of these two properties.

7. Geoffrey owned a personal sailboat with an adjusted cost base of $30000. He sold it for $72000 in October 2019.

8. Geoffrey personally owned an oil painting that he purchased many years ago for $350. He sold it for $8000 in June 2019.

9. Geoffrey kept a bench on the front porch of his home which cost him $1700 several years ago. He sold it for $200 in January 2019.

Required: Determine the total net taxable capital gains included in paragraph 3(b) of Mr. Guo's divison B income. Respond on "P3- Response" tab. Final answers for each line item should be typed into the yellow boxes. Please show all your backup work in the designated green space for full marks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started