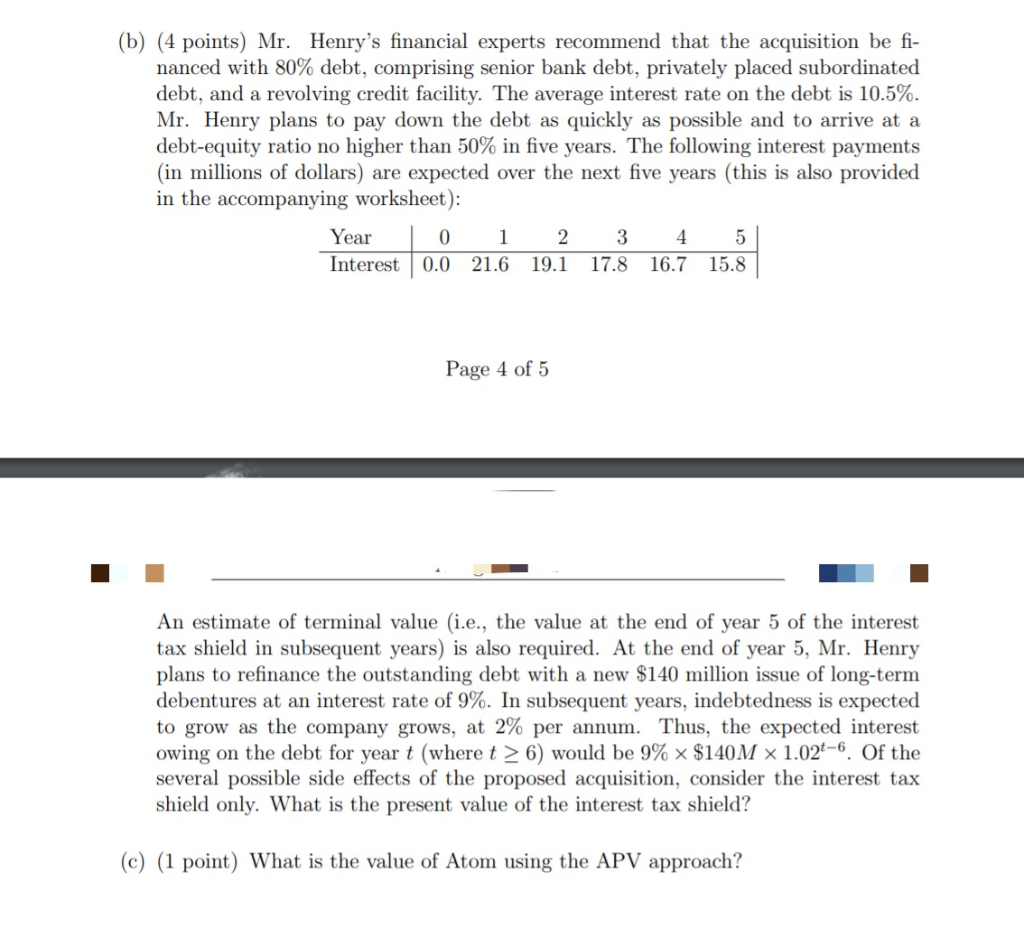

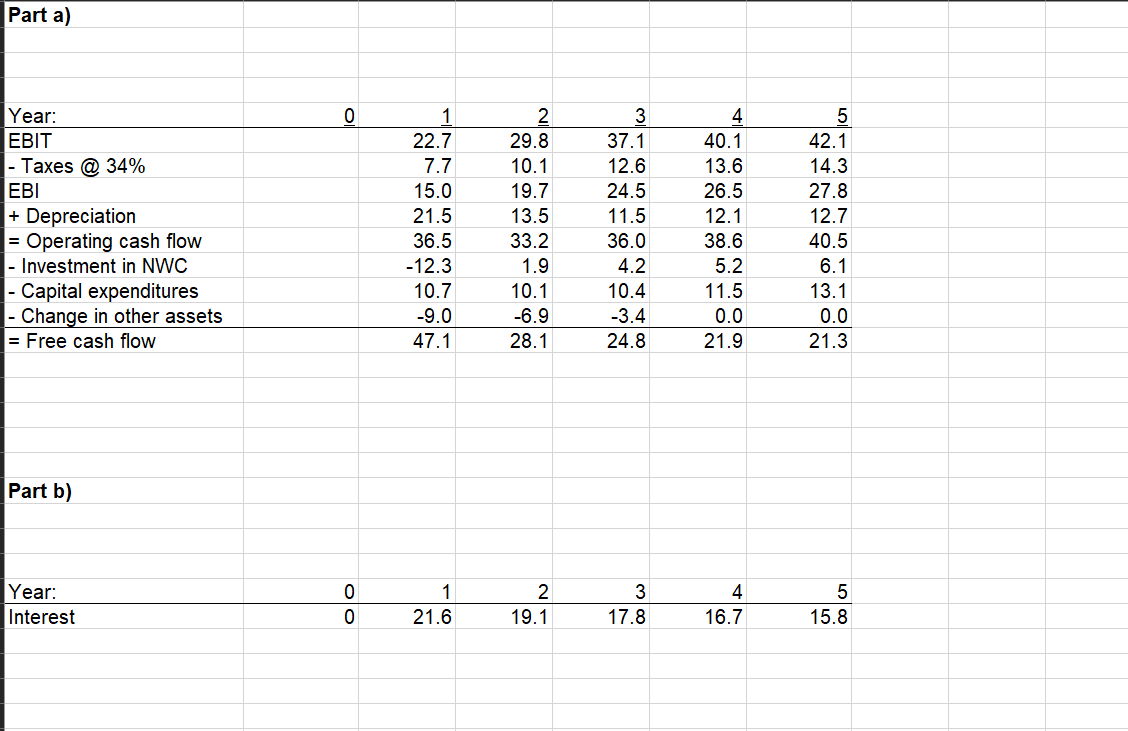

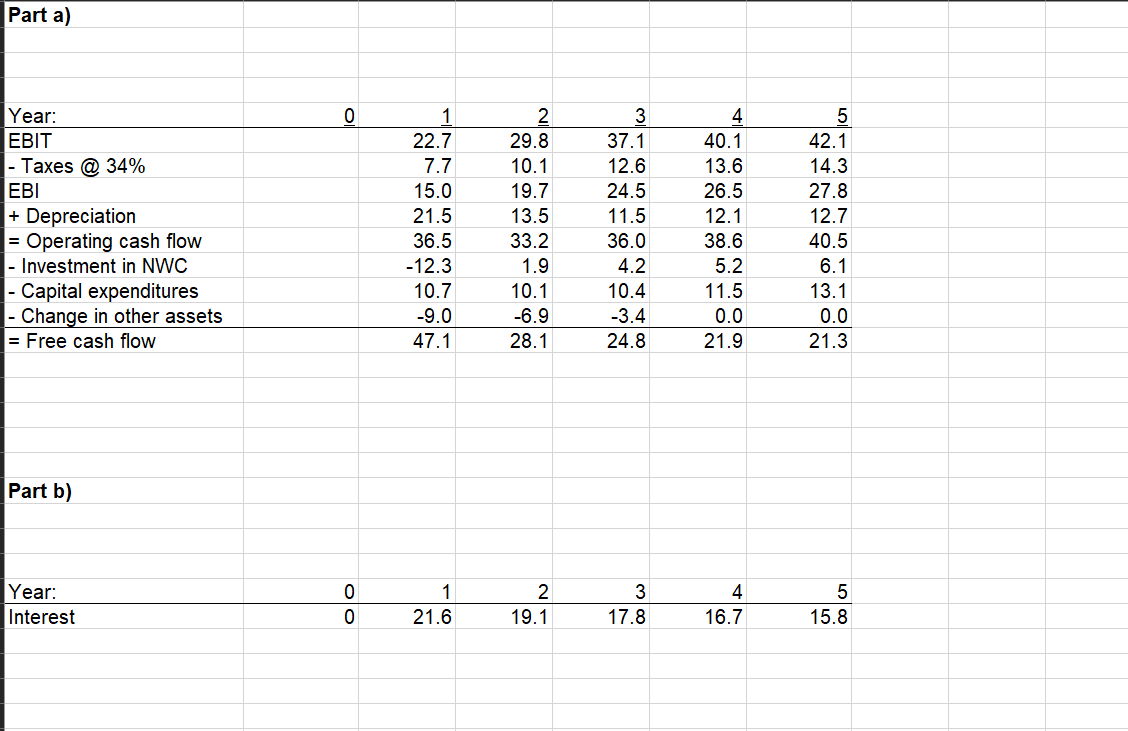

Mr. Henry, president of IDEX Industries, is considering the acquisition of Atom Filters, a division of TL Corporation. Atom is a mature business that has underperformed in its industry for the past six years and TL Corporation is resolved to sell Atom. Mr. Henry has targeted a number of specific opportunities for value creation if IDEX acquires Atom: Atom's product line will be rationalized and some components will be outsourced to improve the company's operating margin by three percentage points. The same changes will reduce inventory and boost payables, producing onetime reductions in net working capital. Some of Atom's nonproductive assets will be sold. Distribution will be streamlined and new sales initiatives introduced to raise Atom's sales growth from 2% to 3% annually to the industry average of 5%. Some taxes will be saved, mostly through the interest tax shields associated with borrowing. Mr. Henry seeks to determine the value of Atom Filters using APV. (a) (4 points) The following table provide projections of the free cash flows (in millions of dollars) to the business (this is also provided in the accompanying worksheet): Year 0 1 2 3 4 5 EBIT 22.7 29.8 37.1 40.1 42.1 - Taxes @ 34% 7.7 10.1 12.6 13.6 14.3 = EBI 15.0 19.7 24.5 26.5 27.8 + Depreciation 21.5 13.5 11.5 12.1 12.7 = Operating cash flow 36.5 33.2 36.0 38.6 40.5 - Investment in NWC -12.3 1.9 4.2 5.2 6.1 - Capital Expenditures 10.7 10.1 10.4 11.5 13.1 - Change in other assets -9.0 -6.9 -3.4 0.0 0.0 = Free cash flow 47.1 28.1 24.8 21.9 21.3 Mr. Henry estimates the terminal value of Atom at the end of year 5 using the following information: free cash flows for year 6 and after are expected to grow at 2% per year in perpetuity. Mr. Henry observes that another company comparable to Atom, with no debt in its capital structure, has an estimated cost of equity of 13.5%. What is the value of the business if it were financed entirely with equity? (b) (4 points) Mr. Henry's financial experts recommend that the acquisition be fi- nanced with 80% debt, comprising senior bank debt, privately placed subordinated debt, and a revolving credit facility. The average interest rate on the debt is 10.5%. Mr. Henry plans to pay down the debt as quickly as possible and to arrive at a debt-equity ratio no higher than 50% in five years. The following interest payments (in millions of dollars) are expected over the next five years (this is also provided in the accompanying worksheet): Year 0 1 2 3 4 5 Interest 0.0 21.6 19.1 17.8 16.7 15.8 Page 4 of 5 An estimate of terminal value (i.e., the value at the end of year 5 of the interest tax shield in subsequent years) is also required. At the end of year 5, Mr. Henry plans to refinance the outstanding debt with a new $140 million issue of long-term debentures at an interest rate of 9%. In subsequent years, indebtedness is expected to grow as the company grows, at 2% per annum. Thus, the expected interest owing on the debt for year t (where t > 6) would be 9% $140M 1.02-6. Of the several possible side effects of the proposed acquisition, consider the interest tax shield only. What is the present value of the interest tax shield? (c) (1 point) What is the value of Atom using the APV approach? Parta) Year: EBIT - Taxes @ 34% EBI + Depreciation = Operating cash flow - Investment in NWC - Capital expenditures - Change in other assets = Free cash flow 22.7 7.7 15.0 21.5 36.5 -12.3 10.7 -9.0 47.1 29.8 10.1 19.7 13.5 33.2 1.9 10.1 -6.9 28.1 37.1 12.6 24.5 11.5 36.0 4.2 10.4 -3.4 24.8 40.1 13.6 26.5 12.1 38.6 5.2 11.5 0.0 21.9 42.1 14.3 27.8 12.7 40.5 6.1 13.1 0.0 21.3 Part b) Year: Interest - 0 1 21.0 2 19.1 3 17.8 4 16.1 158 5 Mr. Henry, president of IDEX Industries, is considering the acquisition of Atom Filters, a division of TL Corporation. Atom is a mature business that has underperformed in its industry for the past six years and TL Corporation is resolved to sell Atom. Mr. Henry has targeted a number of specific opportunities for value creation if IDEX acquires Atom: Atom's product line will be rationalized and some components will be outsourced to improve the company's operating margin by three percentage points. The same changes will reduce inventory and boost payables, producing onetime reductions in net working capital. Some of Atom's nonproductive assets will be sold. Distribution will be streamlined and new sales initiatives introduced to raise Atom's sales growth from 2% to 3% annually to the industry average of 5%. Some taxes will be saved, mostly through the interest tax shields associated with borrowing. Mr. Henry seeks to determine the value of Atom Filters using APV. (a) (4 points) The following table provide projections of the free cash flows (in millions of dollars) to the business (this is also provided in the accompanying worksheet): Year 0 1 2 3 4 5 EBIT 22.7 29.8 37.1 40.1 42.1 - Taxes @ 34% 7.7 10.1 12.6 13.6 14.3 = EBI 15.0 19.7 24.5 26.5 27.8 + Depreciation 21.5 13.5 11.5 12.1 12.7 = Operating cash flow 36.5 33.2 36.0 38.6 40.5 - Investment in NWC -12.3 1.9 4.2 5.2 6.1 - Capital Expenditures 10.7 10.1 10.4 11.5 13.1 - Change in other assets -9.0 -6.9 -3.4 0.0 0.0 = Free cash flow 47.1 28.1 24.8 21.9 21.3 Mr. Henry estimates the terminal value of Atom at the end of year 5 using the following information: free cash flows for year 6 and after are expected to grow at 2% per year in perpetuity. Mr. Henry observes that another company comparable to Atom, with no debt in its capital structure, has an estimated cost of equity of 13.5%. What is the value of the business if it were financed entirely with equity? (b) (4 points) Mr. Henry's financial experts recommend that the acquisition be fi- nanced with 80% debt, comprising senior bank debt, privately placed subordinated debt, and a revolving credit facility. The average interest rate on the debt is 10.5%. Mr. Henry plans to pay down the debt as quickly as possible and to arrive at a debt-equity ratio no higher than 50% in five years. The following interest payments (in millions of dollars) are expected over the next five years (this is also provided in the accompanying worksheet): Year 0 1 2 3 4 5 Interest 0.0 21.6 19.1 17.8 16.7 15.8 Page 4 of 5 An estimate of terminal value (i.e., the value at the end of year 5 of the interest tax shield in subsequent years) is also required. At the end of year 5, Mr. Henry plans to refinance the outstanding debt with a new $140 million issue of long-term debentures at an interest rate of 9%. In subsequent years, indebtedness is expected to grow as the company grows, at 2% per annum. Thus, the expected interest owing on the debt for year t (where t > 6) would be 9% $140M 1.02-6. Of the several possible side effects of the proposed acquisition, consider the interest tax shield only. What is the present value of the interest tax shield? (c) (1 point) What is the value of Atom using the APV approach? Parta) Year: EBIT - Taxes @ 34% EBI + Depreciation = Operating cash flow - Investment in NWC - Capital expenditures - Change in other assets = Free cash flow 22.7 7.7 15.0 21.5 36.5 -12.3 10.7 -9.0 47.1 29.8 10.1 19.7 13.5 33.2 1.9 10.1 -6.9 28.1 37.1 12.6 24.5 11.5 36.0 4.2 10.4 -3.4 24.8 40.1 13.6 26.5 12.1 38.6 5.2 11.5 0.0 21.9 42.1 14.3 27.8 12.7 40.5 6.1 13.1 0.0 21.3 Part b) Year: Interest - 0 1 21.0 2 19.1 3 17.8 4 16.1 158 5