Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. John Wanjala Batista is an employee of Ujuzi Company Limited. He has furnished the following particulars of income for the year 31st December

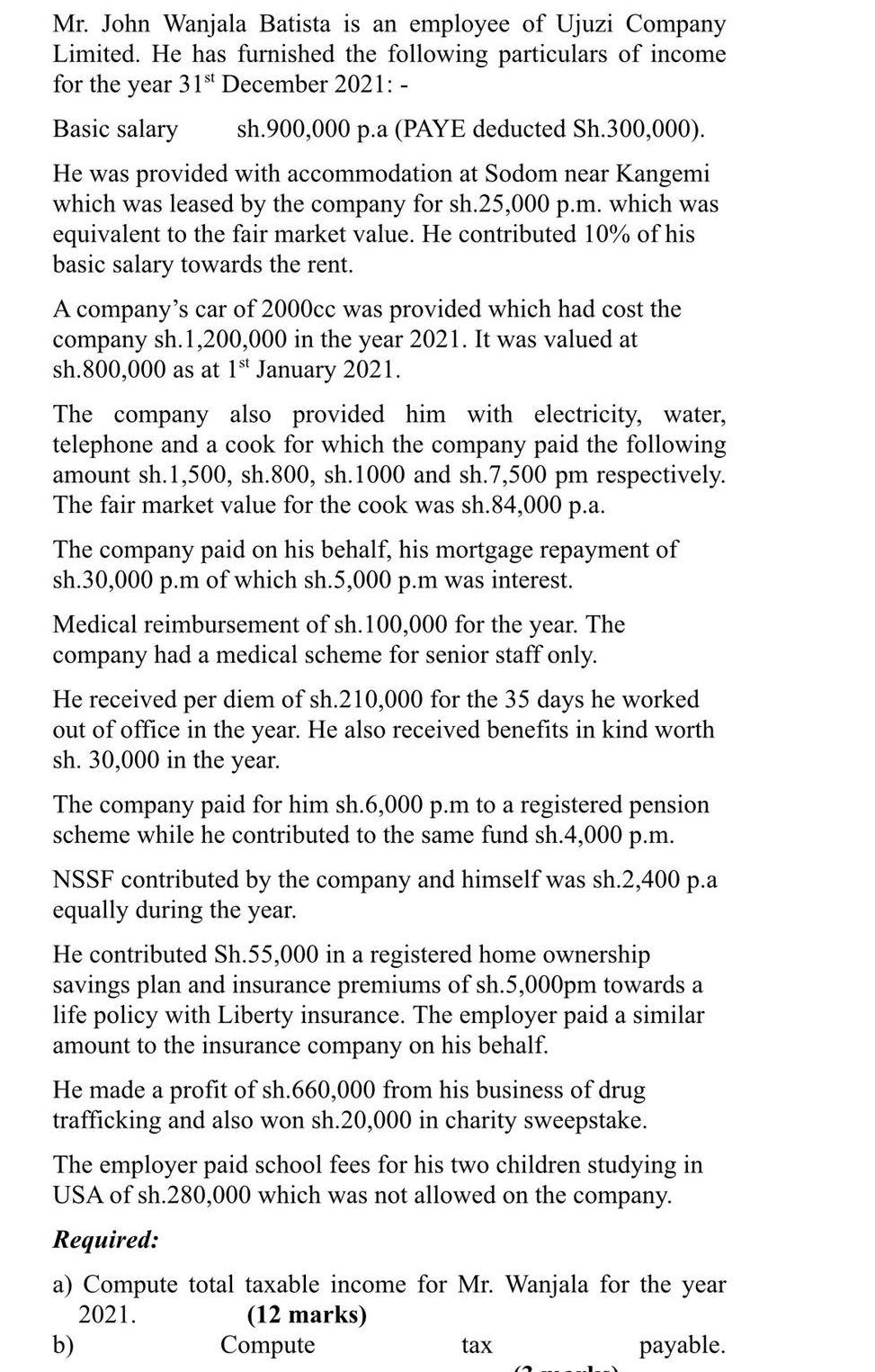

Mr. John Wanjala Batista is an employee of Ujuzi Company Limited. He has furnished the following particulars of income for the year 31st December 2021: - Basic salary sh.900,000 p.a (PAYE deducted Sh.300,000). He was provided with accommodation at Sodom near Kangemi which was leased by the company for sh.25,000 p.m. which was equivalent to the fair market value. He contributed 10% of his basic salary towards the rent. A company's car of 2000cc was provided which had cost the company sh.1,200,000 in the year 2021. It was valued at sh.800,000 as at 1st January 2021. The company also provi him with electricit water, telephone and a cook for which the company paid the following amount sh. 1,500, sh.800, sh.1000 and sh.7,500 pm respectively. The fair market value for the cook was sh.84,000 p.a. The company paid on his behalf, his mortgage repayment of sh.30,000 p.m of which sh.5,000 p.m was interest. Medical reimbursement of sh.100,000 for the year. The company had a medical scheme for senior staff only. He received per diem of sh.210,000 for the 35 days he worked out of office in the year. He also received benefits in kind worth sh. 30,000 in the year. The company paid for him sh.6,000 p.m to a registered pension scheme while he contributed to the same fund sh.4,000 p.m. NSSF contributed by the company and himself was sh.2,400 p.a equally during the year. He contributed Sh.55,000 in a registered home ownership savings plan and insurance premiums of sh.5,000pm towards a life policy with Liberty insurance. The employer paid a similar amount to the insurance company on his behalf. He made a profit of sh.660,000 from his business of drug trafficking and also won sh.20,000 in charity sweepstake. The employer paid school fees for his two children studying in USA of sh.280,000 which was not allowed on the company. Required: a) Compute total taxable income for Mr. Wanjala for the year 2021. (12 marks) b) payable. Compute tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Mr Wanjalas total taxable income for the year 2021 is Sh1560000 This is calcul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started