Answered step by step

Verified Expert Solution

Question

1 Approved Answer

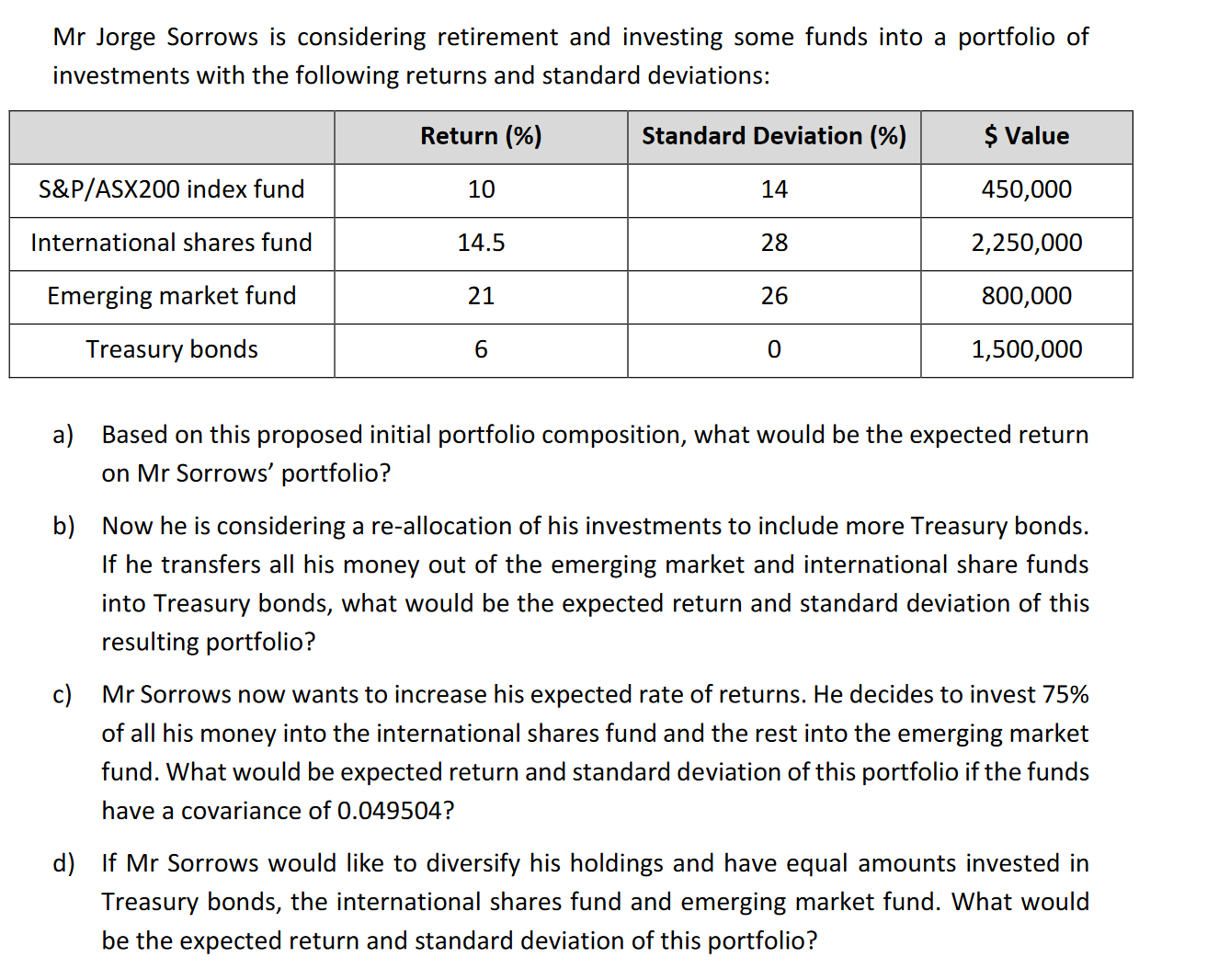

Mr Jorge Sorrows is considering retirement and investing some funds into a portfolio of investments with the following returns and standard deviations: a) Based on

Mr Jorge Sorrows is considering retirement and investing some funds into a portfolio of investments with the following returns and standard deviations: a) Based on this proposed initial portfolio composition, what would be the expected return on Mr Sorrows' portfolio? b) Now he is considering a re-allocation of his investments to include more Treasury bonds. If he transfers all his money out of the emerging market and international share funds into Treasury bonds, what would be the expected return and standard deviation of this resulting portfolio? c) Mr Sorrows now wants to increase his expected rate of returns. He decides to invest \75 of all his money into the international shares fund and the rest into the emerging market fund. What would be expected return and standard deviation of this portfolio if the funds have a covariance of 0.049504 ? d) If Mr Sorrows would like to diversify his holdings and have equal amounts invested in Treasury bonds, the international shares fund and emerging market fund. What would be the expected return and standard deviation of this portfolio

Mr Jorge Sorrows is considering retirement and investing some funds into a portfolio of investments with the following returns and standard deviations: a) Based on this proposed initial portfolio composition, what would be the expected return on Mr Sorrows' portfolio? b) Now he is considering a re-allocation of his investments to include more Treasury bonds. If he transfers all his money out of the emerging market and international share funds into Treasury bonds, what would be the expected return and standard deviation of this resulting portfolio? c) Mr Sorrows now wants to increase his expected rate of returns. He decides to invest \75 of all his money into the international shares fund and the rest into the emerging market fund. What would be expected return and standard deviation of this portfolio if the funds have a covariance of 0.049504 ? d) If Mr Sorrows would like to diversify his holdings and have equal amounts invested in Treasury bonds, the international shares fund and emerging market fund. What would be the expected return and standard deviation of this portfolio Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started