Answered step by step

Verified Expert Solution

Question

1 Approved Answer

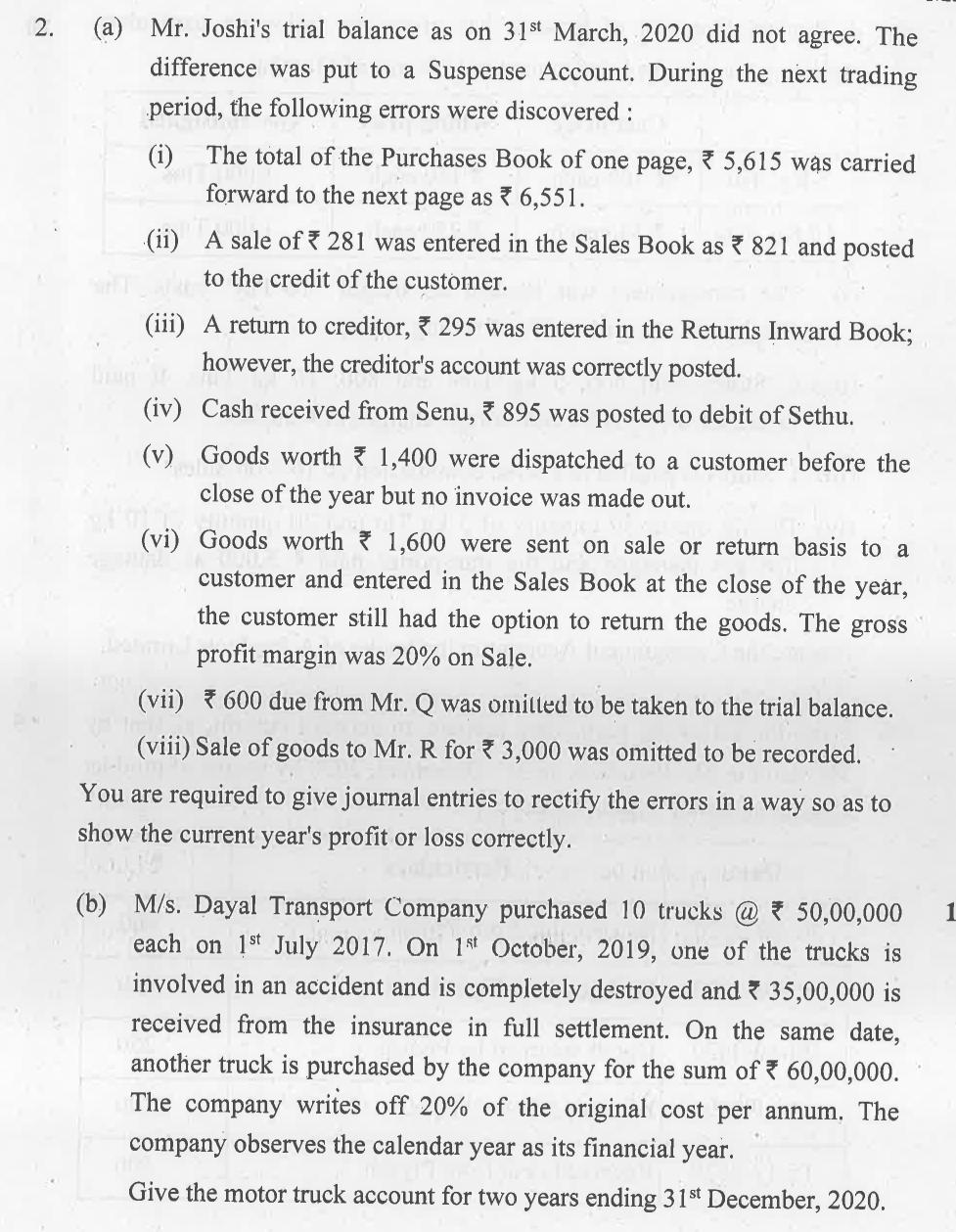

Mr. Joshi's trial balance as on 31st March, 2020 did not agree. The difference was put to a Suspense Account. During the next trading

Mr. Joshi's trial balance as on 31st March, 2020 did not agree. The difference was put to a Suspense Account. During the next trading period, the following errors were discovered: (i) U (b) The total of the Purchases Book of one page, 5,615 was carried forward to the next page as 6,551. (vi) Goods worth 1,600 were sent on sale or return basis to a customer and entered in the Sales Book at the close of the year, the customer still had the option to return the goods. The gross Aram profit margin was 20% on Sale. (vii) 600 due from Mr. Q was omitted to be taken to the trial balance. (viii) Sale of goods to Mr. R for 3,000 was omitted to be recorded. You are required to give journal entries to rectify the errors in a way so as to show the current year's profit or loss correctly. P (ii) A sale of 281 was entered in the Sales Book as 821 and posted to the credit of the customer. (iii) A return to creditor, 295 was entered in the Returns Inward Book; however, the creditor's account was correctly posted. (iv) Cash received from Senu, 895 was posted to debit of Sethu. (v) Goods worth 1,400 were dispatched to a customer before the close of the year but no invoice was made out. M/s. Dayal Transport Company purchased 10 trucks @50,00,000 each on 1st July 2017. On 1st October, 2019, one of the trucks is involved in an accident and is completely destroyed and 35,00,000 is received from the insurance in full settlement. On the same date, another truck is purchased by the company for the sum of 60,00,000. The company writes off 20% of the original cost per annum. The company observes the calendar year as its financial year. Give the motor truck account for two years ending 31st December, 2020. 1

Step by Step Solution

★★★★★

3.38 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started