Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Kaushik is a amanufacturer fromVadodara and his aggregate turnover during the financial year 2020-21 was Rs. 12800000. Mr. Kaushik wants to take registration under

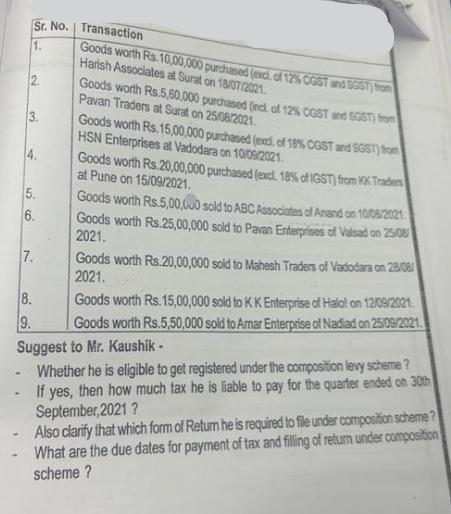

Mr. Kaushik is a amanufacturer fromVadodara and his aggregate turnover during the financial year 2020-21 was Rs. 12800000. Mr. Kaushik wants to take registration under composition scheme of GST in 2021-22. Further, details of transactions entered by him from july 1, 2021 to september 30, 2021 are as under

2. Sr. No. Transaction 1. ci 56 7. 8. 9. Goods worth Rs.10,00,000 purchased (excl. of 12% CGST and SGST) from Harish Associates at Surat on 18/07/2021. Goods worth Rs.5,60,000 purchased (incl. of 12% CGST and SGST) from Pavan Traders at Surat on 25/08/2021. Goods worth Rs.15,00,000 purchased (excl. of 18% CGST and SGST) from HSN Enterprises at Vadodara on 10/09/2021. Goods worth Rs.20,00,000 purchased (excl. 18% of IGST) from KK Traders at Pune on 15/09/2021. Goods worth Rs.5,00,000 sold to ABC Associates of Anand on 10/08/2021. Goods worth Rs.25,00,000 sold to Pavan Enterprises of Valsad on 25/08 2021. Goods worth Rs.20,00,000 sold to Mahesh Traders of Vadodara on 28/08/ 2021. Goods worth Rs.15,00,000 sold to KK Enterprise of Halol on 12/09/2021. Goods worth Rs.5,50,000 sold to Amar Enterprise of Nadiad on 25/09/2021. Suggest to Mr. Kaushik - Whether he is eligible to get registered under the composition levy scheme? If yes, then how much tax he is liable to pay for the quarter ended on 30th September,2021? - Also clarify that which form of Return he is required to file under composition scheme? What are the due dates for payment of tax and filling of return under composition scheme?

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided lets analyze Mr Kaushiks eligibility for registration under the co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started