Answered step by step

Verified Expert Solution

Question

1 Approved Answer

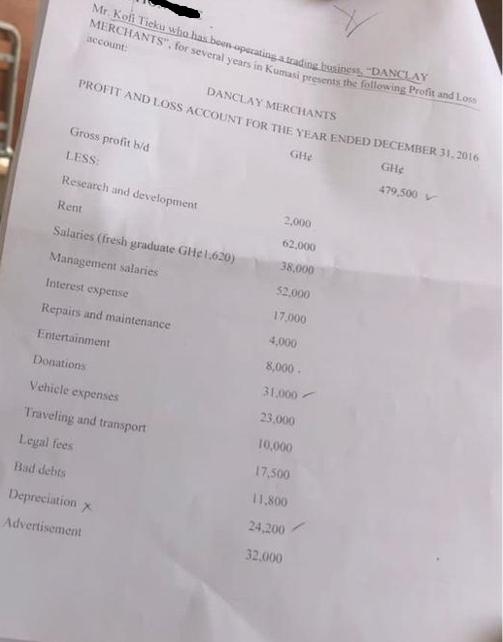

Mr. Kofi Tieku who has been operating a trading business, DANCLAY MERCHANTS, for several years in Kumasi presents the following Profit and Loss account:

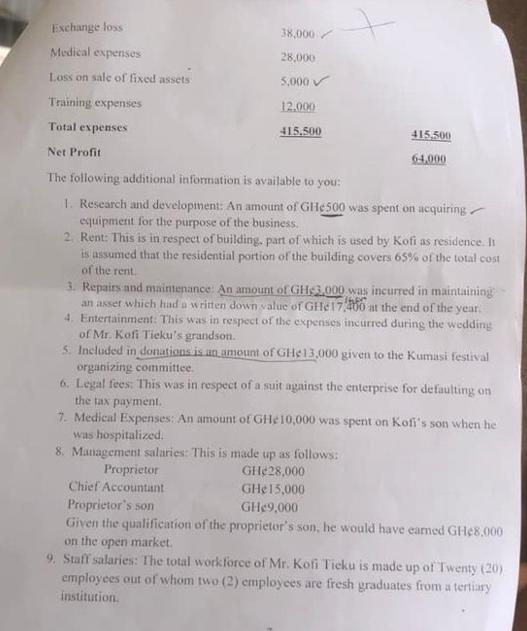

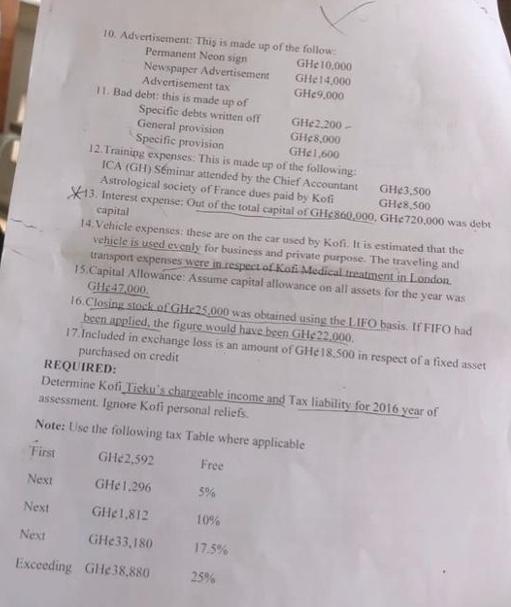

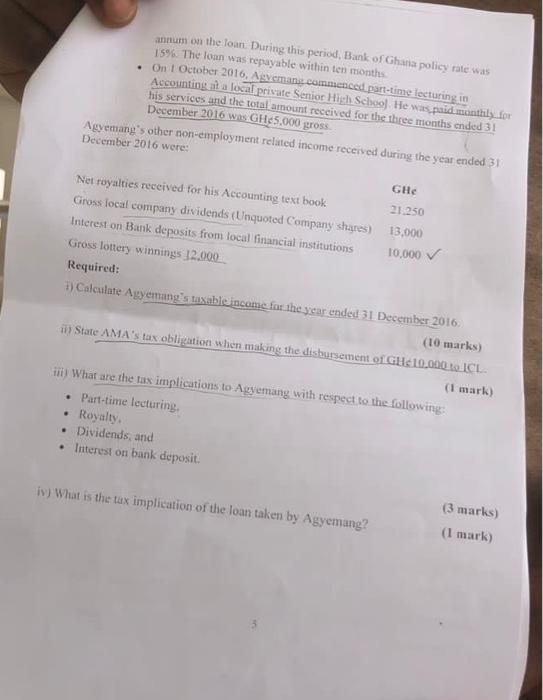

Mr. Kofi Tieku who has been operating a trading business, "DANCLAY MERCHANTS", for several years in Kumasi presents the following Profit and Loss account: DANCLAY MERCHANTS PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED DECEMBER 31, 2016 GH 479,500 Gross profit b/d LESS: Research and development Rent Salaries (fresh graduate GH1,620) Management salaries Legal fees Bad debts Interest expense Repairs and maintenance Entertainment Donations Vehicle expenses Traveling and transport Depreciation x Advertisement GHe 2,000 62,000 38,000 $2,000 17,000 4,000 8,000. 31,000 23,000 10,000 17,500 11,800 24,200 32,000 Exchange loss Medical expenses Loss on sale of fixed assets 38,000 28,000 5,000 12.000 415.500 Training expenses Total expenses Net Profit The following additional information is available to you: 1. Research and development: An amount of GHe 500 was spent on acquiring equipment for the purpose of the business. 2. Rent: This is in respect of building, part of which is used by Kofi as residence. It is assumed that the residential portion of the building covers 65% of the total cost of the rent 3. Repairs and maintenance: An amount of GHg3,000 was incurred in maintaining an asset which had a written down value of GHe 17.00 at the end of the year. 4. Entertainment: This was in respect of the expenses incurred during the wedding of Mr. Kofi Tieku's grandson. 5. Included in donations is an amount of GHe 13,000 given to the Kumasi festival organizing committee. 6. Legal fees: This was in respect of a suit against the enterprise for defaulting on the tax payment. 7. Medical Expenses: An amount of GHe 10,000 was spent on Kofi's son when he was hospitalized. 8. Management salaries: This is made up as follows: GH 28,000 Proprietor Chief Accountant 415.500 64,000 GH$15,000 GH9,000 Proprietor's son Given the qualification of the proprietor's son, he would have earned GHe8,000 on the open market. 9. Staff salaries: The total workforce of Mr. Kofi Ticku is made up of Twenty (20) employees out of whom two (2) employees are fresh graduates from a tertiary institution. 10. Advertisement: This is made up of the follow: GHe10,000 Permanent Neon sign Newspaper Advertisement GH:14,000 Advertisement tax GH9,000 11. Bad debt: this is made up of Specific debts written off General provision Specific provision Next Next Next GH2.200- GH8,000 GH1,600 12. Training expenses. This is made up of the following: ICA (GH) Seminar attended by the Chief Accountant Astrological society of France dues paid by Kofi GH3,500 GH8,500 13. Interest expense: Out of the total capital of GHc860,000, GHe720,000 was debt capital 14. Vehicle expenses: these are on the car used by Kofi. It is estimated that the vehicle is used evenly for business and private purpose. The traveling and transport expenses were in respect of Kofi Medical treatment in London. 15.Capital Allowance: Assume capital allowance on all assets for the year was GH:47,000. 16.Closing stock of GHe25,000 was obtained using the LIFO basis. If FIFO had been applied, the figure would have been GH22.000. 17. Included in exchange loss is an amount of GHe 18.500 in respect of a fixed asset purchased on credit REQUIRED: Determine Kofi Ticku's chargeable income and Tax liability for 2016 year of assessment. Ignore Kofi personal reliefs. Note: Use the following tax Table where applicable First GH22,592 Free GH1.296 5% GH1,812 10% GHe33,180 17.5% Exceeding GHe 38,880 25% annum on the loan. During this period, Bank of Ghana policy rate was 15%. The loan was repayable within ten months. . On 1 October 2016, Agyemang commenced part-time lecturing in Accounting at a local private Senior High School. He was paid monthly for his services and the total amount received for the three months ended 31 December 2016 was GHe5,000 gross. Agyemang's other non-employment related income received during the year ended 31 December 2016 were: Net royalties received for his Accounting text book Gross local company dividends (Unquoted Company shares) Interest on Bank deposits from local financial institutions Gross lottery winnings 12,000 . Required: i) Calculate Agyemang's taxable income for the year ended 31 December 2016. GH 21.250 13,000 10,000 (10 marks) in State AMA's tax obligation when making the disbursement of GHe 10,000 to ICL (1 mark) iii) What are the tax implications to Agyemang with respect to the following: Part-time lecturing. Royalty, Dividends, and Interest on bank deposit. iv) What is the tax implication of the loan taken by Agyemang? (3 marks) (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Kofi Tiekus Chargeable Income and Tax Liability for 2016 Adjustments to Profit and Loss Account a Research and Development Deduct the capital expendit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started