Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Lee runs his own accounting firm. His wife works as an administrative manager in an unrelated firm. Both of them are 39 years

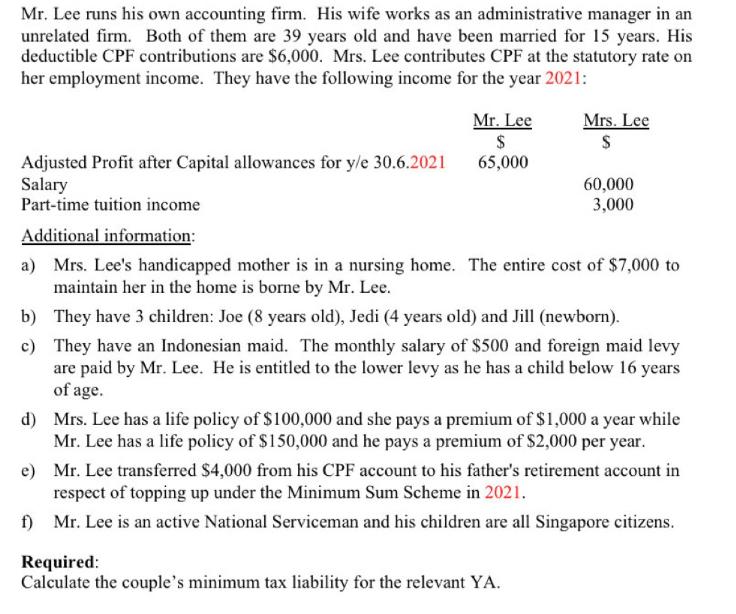

Mr. Lee runs his own accounting firm. His wife works as an administrative manager in an unrelated firm. Both of them are 39 years old and have been married for 15 years. His deductible CPF contributions are $6,000. Mrs. Lee contributes CPF at the statutory rate on her employment income. They have the following income for the year 2021: Mr. Lee $ 65,000 b) c) Adjusted Profit after Capital allowances for y/e 30.6.2021 Salary Part-time tuition income Additional information: a) Mrs. Lee's handicapped mother is in a nursing home. The entire cost of $7,000 to maintain her in the home is borne by Mr. Lee. Mrs. Lee S 60,000 3,000 They have 3 children: Joe (8 years old), Jedi (4 years old) and Jill (newborn). They have an Indonesian maid. The monthly salary of $500 and foreign maid levy are paid by Mr. Lee. He is entitled to the lower levy as he has a child below 16 years of age. d) Mrs. Lee has a life policy of $100,000 and she pays a premium of $1,000 a year while Mr. Lee has a life policy of $150,000 and he pays a premium of $2,000 per year. Required: Calculate the couple's minimum tax liability for the relevant YA. e) Mr. Lee transferred $4,000 from his CPF account to his father's retirement account in respect of topping up under the Minimum Sum Scheme in 2021. f) Mr. Lee is an active National Serviceman and his children are all Singapore citizens.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the couples minimum tax liability we need to consider their income sources deductions and applicable tax rates Here are the calculations ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started