Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Foo, a non-active NS man, derived the following income in 2021: Employment income from SIA: Salary of $80,000 and bonus of $12,000. Interest:

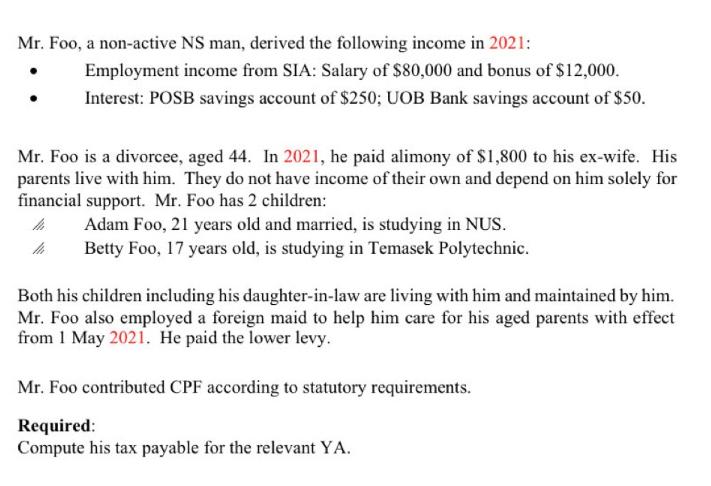

Mr. Foo, a non-active NS man, derived the following income in 2021: Employment income from SIA: Salary of $80,000 and bonus of $12,000. Interest: POSB savings account of $250; UOB Bank savings account of $50. Mr. Foo is a divorcee, aged 44. In 2021, he paid alimony of $1,800 to his ex-wife. His parents live with him. They do not have income of their own and depend on him solely for financial support. Mr. Foo has 2 children: Adam Foo, 21 years old and married, is studying in NUS. Betty Foo, 17 years old, is studying in Temasek Polytechnic. M Both his children including his daughter-in-law are living with him and maintained by him. Mr. Foo also employed a foreign maid to help him care for his aged parents with effect from 1 May 2021. He paid the lower levy. Mr. Foo contributed CPF according to statutory requirements. Required: Compute his tax payable for the relevant YA.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To compute Mr Foos tax payable for the year 2021 we need to calculate his total income and deduct hi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started