Question

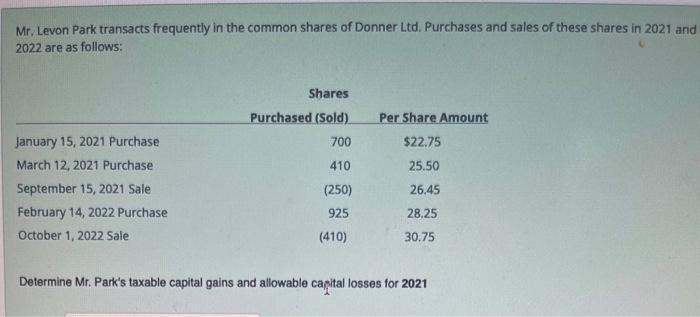

Mr. Levon Park transacts frequently in the common shares of Donner Ltd. Purchases and sales of these shares in 2021 and 2022 are as

Mr. Levon Park transacts frequently in the common shares of Donner Ltd. Purchases and sales of these shares in 2021 and 2022 are as follows: January 15, 2021 Purchase March 12, 2021 Purchase September 15, 2021 Sale February 14, 2022 Purchase October 1, 2022 Sale Shares Purchased (Sold) 700 410 (250) 925 (410) Per Share Amount $22.75 25.50 26.45 28.25 30.75 Determine Mr. Park's taxable capital gains and allowable capital losses for 2021

Step by Step Solution

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Mr Levon Parks taxable capital gains and allowable capital losses for 2021 we need to c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Volume 2

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy

13th Canadian Edition

1119740444, 9781119740445

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App