Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Lion, who is in the 37 percent tax bracket, is the sole shareholder of Toto,Inc., which manufactures greeting cards. Totos average annual net profit

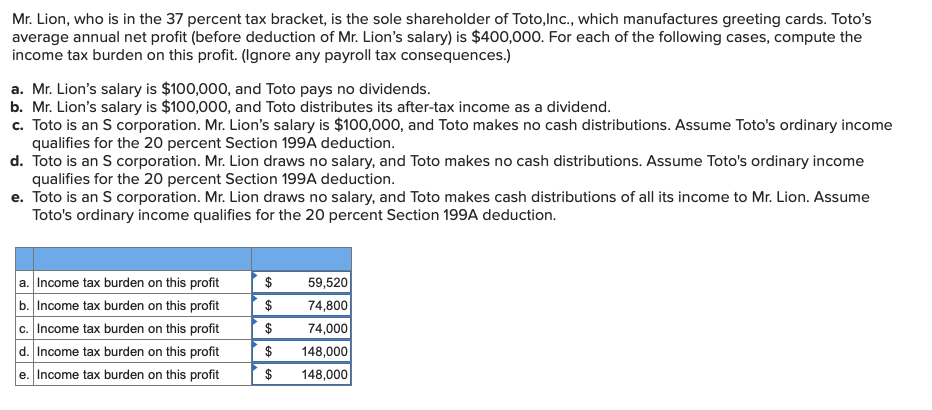

Mr. Lion, who is in the 37 percent tax bracket, is the sole shareholder of Toto,Inc., which manufactures greeting cards. Totos average annual net profit (before deduction of Mr. Lions salary) is $400,000. For each of the following cases, compute the income tax burden on this profit. (Ignore any payroll tax consequences.)

- Mr. Lions salary is $100,000, and Toto pays no dividends.

- Mr. Lions salary is $100,000, and Toto distributes its after-tax income as a dividend.

- Toto is an S corporation. Mr. Lions salary is $100,000, and Toto makes no cash distributions. Assume Toto's ordinary income qualifies for the 20 percent Section 199A deduction.

- Toto is an S corporation. Mr. Lion draws no salary, and Toto makes no cash distributions. Assume Toto's ordinary income qualifies for the 20 percent Section 199A deduction.

- Toto is an S corporation. Mr. Lion draws no salary, and Toto makes cash distributions of all its income to Mr. Lion. Assume Toto's ordinary income qualifies for the 20 percent Section 199A deduction.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started