Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Lloyd is 50 years old, married, has three teenage drivers, and owns a home. To manage risk and protect his wealth, he has the

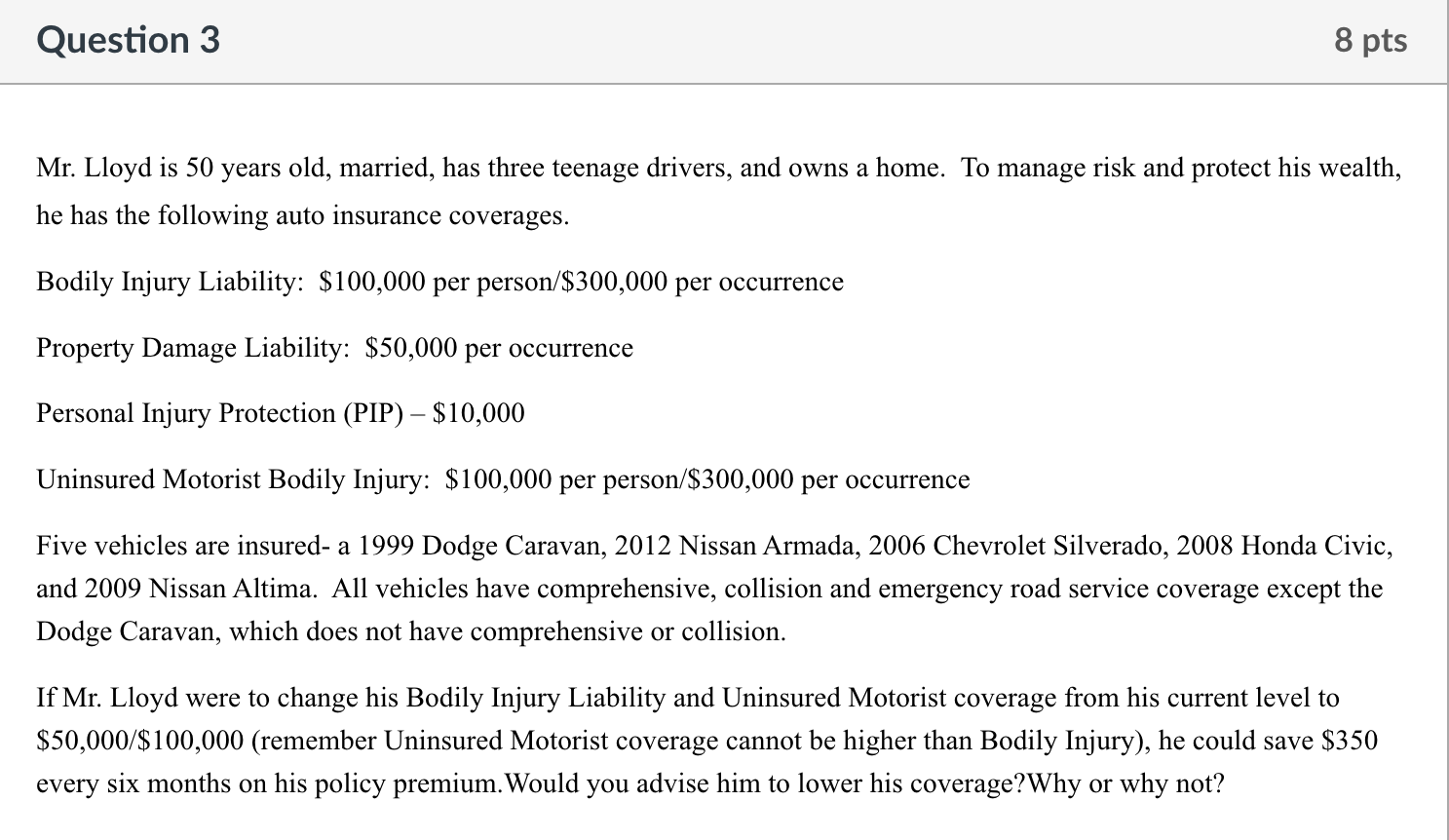

Mr. Lloyd is 50 years old, married, has three teenage drivers, and owns a home. To manage risk and protect his wealth, he has the following auto insurance coverages. Bodily Injury Liability: $100,000 per person $300,000 per occurrence Property Damage Liability: $50,000 per occurrence Personal Injury Protection (PIP) - \$10,000 Uninsured Motorist Bodily Injury: $100,000 per person $300,000 per occurrence Five vehicles are insured- a 1999 Dodge Caravan, 2012 Nissan Armada, 2006 Chevrolet Silverado, 2008 Honda Civic, and 2009 Nissan Altima. All vehicles have comprehensive, collision and emergency road service coverage except the Dodge Caravan, which does not have comprehensive or collision. If Mr. Lloyd were to change his Bodily Injury Liability and Uninsured Motorist coverage from his current level to $50,000/$100,000 (remember Uninsured Motorist coverage cannot be higher than Bodily Injury), he could save $350 every six months on his policy premium. Would you advise him to lower his coverage?Why or why not

Mr. Lloyd is 50 years old, married, has three teenage drivers, and owns a home. To manage risk and protect his wealth, he has the following auto insurance coverages. Bodily Injury Liability: $100,000 per person $300,000 per occurrence Property Damage Liability: $50,000 per occurrence Personal Injury Protection (PIP) - \$10,000 Uninsured Motorist Bodily Injury: $100,000 per person $300,000 per occurrence Five vehicles are insured- a 1999 Dodge Caravan, 2012 Nissan Armada, 2006 Chevrolet Silverado, 2008 Honda Civic, and 2009 Nissan Altima. All vehicles have comprehensive, collision and emergency road service coverage except the Dodge Caravan, which does not have comprehensive or collision. If Mr. Lloyd were to change his Bodily Injury Liability and Uninsured Motorist coverage from his current level to $50,000/$100,000 (remember Uninsured Motorist coverage cannot be higher than Bodily Injury), he could save $350 every six months on his policy premium. Would you advise him to lower his coverage?Why or why not Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started